Synopsis

Bitcoin and other cryptocurrencies experienced a dip as traders secured profits. Investors are closely monitoring US inflation data. Market participants are focusing on CPI and PPI data. Institutions continue to show long-term confidence in Bitcoin. XRP bucked the trend, gaining value. Despite the pullback, activity in the crypto space remains high. Bitcoin’s market capitalization stands at $2.035 trillion.

Bitcoin and other major cryptocurrencies traded lower on Tuesday as traders booked profits after recent highs, while global macroeconomic signals and upcoming inflation data kept sentiment cautious.

As of 11:27 AM IST, Bitcoin was down 1.4% at $102,393, while Ethereum slipped 1.8% to $2,449.

The global cryptocurrency market capitalization fell 1.7% to $3.28 trillion, with major altcoins like BNB, Solana, Dogecoin, Cardano, Tron, Sui, Chainlink, Avalanche, and Shiba Inu down as much as 7%. XRP, however, bucked the trend, gaining 4.12% to $2.48.

Crypto Tracker![]() TOP COIN SETSAI Tracker29.48% BuyNFT & Metaverse Tracker25.90% BuyBTC 50 :: ETH 5023.59% BuyWeb3 Tracker21.72% BuyCrypto Blue Chip – 516.17% BuyTOP COINS (₹) XRP212 (4.48%)BuyTether85 (0.2%)BuyBNB55,073 (-1.08%)BuyBitcoin8,702,896 (-1.53%)BuyEthereum208,531 (-1.88%)BuyEdul Patel, Co-founder and CEO of Mudrex, said, “Bitcoin is trading near $102,200 after rebounding from key support at $100,000. Investors turned to profit booking at higher levels as macroeconomic factors like the strengthening dollar index and the US-China trade deal made equities more attractive.”

TOP COIN SETSAI Tracker29.48% BuyNFT & Metaverse Tracker25.90% BuyBTC 50 :: ETH 5023.59% BuyWeb3 Tracker21.72% BuyCrypto Blue Chip – 516.17% BuyTOP COINS (₹) XRP212 (4.48%)BuyTether85 (0.2%)BuyBNB55,073 (-1.08%)BuyBitcoin8,702,896 (-1.53%)BuyEthereum208,531 (-1.88%)BuyEdul Patel, Co-founder and CEO of Mudrex, said, “Bitcoin is trading near $102,200 after rebounding from key support at $100,000. Investors turned to profit booking at higher levels as macroeconomic factors like the strengthening dollar index and the US-China trade deal made equities more attractive.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Patel also noted that institutions remain active buyers, with Strategy and Metaplanet together accumulating over 14,600 BTC recently—highlighting continued long-term confidence in the asset.

Live Events

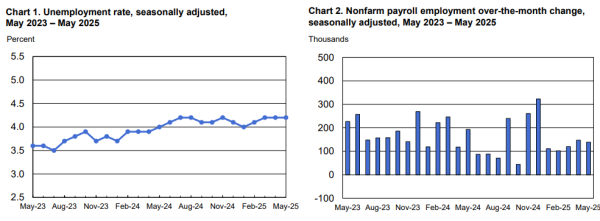

Shivam Thakral, CEO of BuyUcoin, echoed similar sentiments, stating, “Bitcoin witnessed a slight dip due to traders liquidating positions for profit booking. Market participants are now focused on April’s CPI and PPI data, which could influence expectations for future Federal Reserve rate decisions.”

Meanwhile, investors are closely watching the release of the US inflation data later today. “A third consecutive downside surprise in CPI could boost Bitcoin by increasing expectations for rate cuts in 2025,” Patel added.

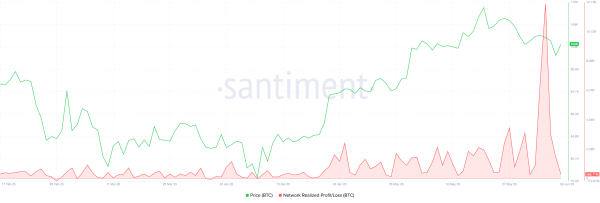

Despite today’s pullback, activity in the crypto space remains high. Bitcoin’s market capitalization now stands at $2.035 trillion, with dominance at 62%, and trading volume up 40.3% to $64.6 billion, according to .

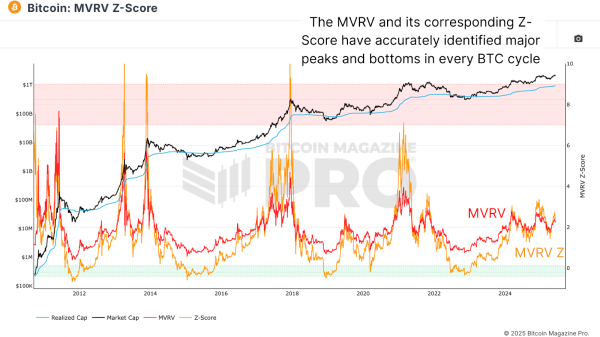

Avinash Shekhar, Co-founder and CEO of Pi42, said the broader rally in crypto—especially Bitcoin’s recent surge past $105,000—reflects “growing investor confidence amid improving global macroeconomic signals.”

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)