Bitcoin shoots up on Trump assassination attempt

![]() Cryptocurrency Jul 15, 2024 Share

Cryptocurrency Jul 15, 2024 Share

Given its tentative role as digital gold, Bitcoin (BTC) also apparently benefitted from a significant uptick in global uncertainty following an assassination attempt on the most likely Republican presidential candidate, Donald Trump, at a rally in Pennsylvania.

Reagan’s landslide 1984 victory following the 1982 shooting also demonstrates that Trump’s chances for November have likely never been better which may have been received favorably by the crypto community.

While vague, Trump has been positioning himself as a strongly pro-crypto candidate since the San Francisco fundraiser in June, as pointed out by Tony Sycamore, an IG market analyst:

Picks for you

How rich is New Mexico's junior senator: Ben Ray Lujan's net worth revealed 33 mins ago How rich is Cody Conrod? Clix’s net worth revealed 2 hours ago How rich is Alaska's senator: Dan Sullivan's net worth revealed 3 hours ago How much is North Dakota senator Kevin Cramer worth; Kevin Cramer's net worth revealed 3 hours ago

He’s certainly positioned himself as pro-crypto and as the odds of his reelection were galvanised by the shooting on the weekend, it’s certainly put a big boost underneath the bid in crypto markets and bitcoin obviously, just an absolute standout.

Trump’s credentials as a cryptocurrency advocate have also been boosted by his speaking engagement at the upcoming Bitcoin conference in Nashville, Tennessee, scheduled for July 27, and his confirmation he will attend even after the assassination attempt.

Germany has finished selling their #Bitcoin.

Global uncertainty is rising after the assassination attempt on Trump.

That's an ideal climate for Bitcoin to go upwards consistently.

Ethereum ETF coming this week.

It's up only again. pic.twitter.com/pEOsGykYpv

— Michaël van de Poppe (@CryptoMichNL) July 15, 2024

Germany sells remaining Bitcoin holdings

Late June brought significant downward pressure to the crypto market as, almost at the same time, the German authorities began moving Bitcoin they seized in January and the failed crypto exchange Mt. Gox announced it would imminently begin repaying its creditors.

The convergence of events triggered a bloodbath for several cryptocurrencies, with BTC itself rapidly dropping from approximately $67,000 to, at one point, below $55,000, causing fears that the coin would collapse to lows not seen since January.

Mid-July, however, brought a notable change as again several bullish events converged.

For starters, by Friday, July 12, the German government had completed the sale of its cryptocurrency, reducing the downward pressure and giving tailwinds to the buying pressure that emerged due to BTC’s comparative cheapness.

Bitcoin price analysis

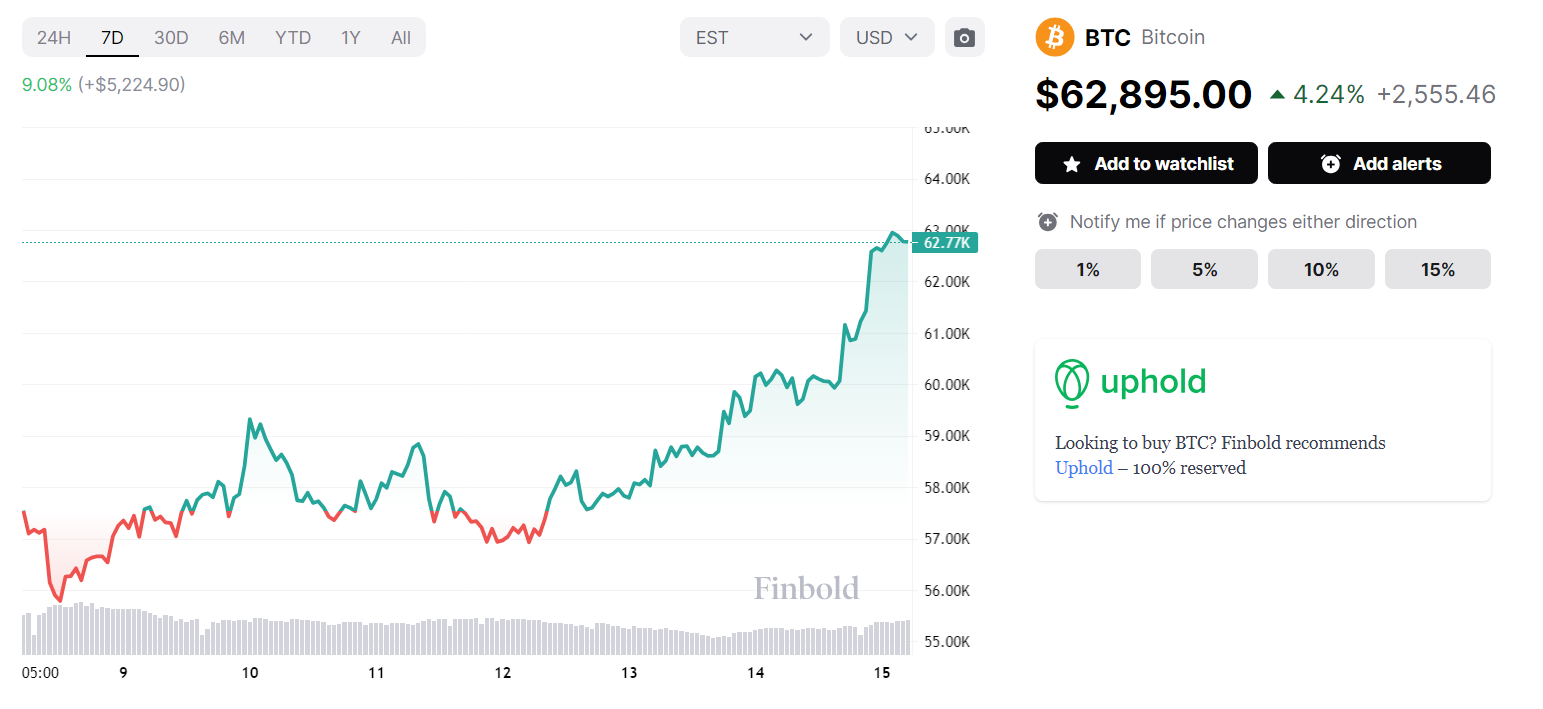

The 7-day price chart, however, demonstrates the significance of both the completion of the German sale and the Trump assassination attempt, given that BTC is up 9.08% in the time frame and Bitcoin price today, at press time, stands at $62,895.

BTC 7-day price chart. Source: Finbold

BTC 7-day price chart. Source: Finbold

Despite the positive developments, Bitcoin’s rally remains somewhat uncertain. On the one hand, trading throughout 2024 has shown that the coin tends to reclaim lower highs following a downturn. It is plausible it will not regain its previously stable range between approximately $65,000 and $67,000.

On the other hand, though the German BTC is, by July 15, out of the picture, Mt. Gox is still set to return nearly $10 billion worth of Bitcoin and Bitcoin Cash (BCH) to its creditors who may or may not choose to sell quickly.

The pressure from the repayments is likely to persist for several months, given that some crypto exchanges, such as Kraken, gave themselves up to three months to forward the cryptocurrency to the relevant users.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.