Bitcoin price remained in a consolidation phase even as the amount held on exchanges continued to decline.

Bitcoin (BTC) was seen trading at $62,540 on Oct. 8, slightly below this week’s high of $64,500. It remains in a correction after falling 15% from its highest point this year.

Bitcoin still has some potential catalysts that could push its price higher in the coming months. Data from CoinGlass shows that Bitcoin reserves on exchanges have continued to fall, reaching a year-to-date low of 2.34 million.

Bitcoin balances on exchanges | Source: CoinGlass

Bitcoin balances on exchanges | Source: CoinGlass

It is estimated that Bitcoins worth over $31 billion have been removed from exchanges since February. Most of these coins have moved to self-custody wallets, while others have been transferred to exchange-traded funds.

Flows from exchanges to wallets are often a sign that most holders are bullish. Some prominent companies, such as MicroStrategy, Marathon Digital, Block, and Tesla, are among the most bullish in the industry.

MicroStrategy has accumulated over 252,000 worth of Bitcoins while Marathon holds 26,842 coins. Tesla and Block, formerly known as Square, hold 9,720 and 8,211 coins, respectively.

You might also like: Spot Bitcoin ETF inflows surge nine fold, Ethereum ETFs stall

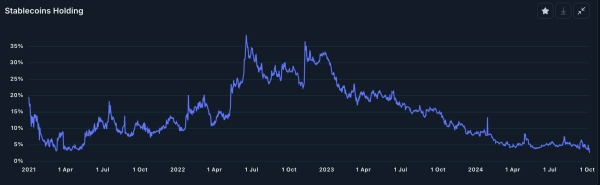

Additional data from Nansen shows that smart money holdings of stablecoins have dropped to their lowest level in years.

The figure peaked at 38.5% in May 2022 when Terra collapsed and rebounded to 35.7% in November of the same year after FTX collapsed. It has been in a strong downtrend since then, suggesting that smart money is mostly bullish on cryptocurrencies.

Stablecoin holdings by smart money | Source: Nansen

Stablecoin holdings by smart money | Source: Nansen

Bitcoin has found support at the 200 EMA

Bitcoin price chart by TradingView

Bitcoin price chart by TradingView

On the daily chart, Bitcoin has remained within the descending black channel that connects the highest and lowest swings since March. This channel can be viewed as a falling broadening wedge, a popular bullish sign.

It has also found support at the 200-day Exponential Moving Average, which is a positive sign. However, Bitcoin has formed a small evening star candlestick pattern, characterized by a small red body and a long upper shadow.

Therefore, Bitcoin will need to rise above the upper side of the shadow pattern at $64,500. After that, bulls will need to push it above the descending trendline and then the all-time high of $73,800 to continue the uptrend.

The alternative scenario is where Bitcoin drops below the 200-day EMA at $60,000. If this happens, it will increase the chances of a drop to the lower side of the wedge at $52,000.

You might also like: Bitcoin price could retest all-time high soon; analyst predicts

Source