Since hitting a new all-high time above $111,000, Bitcoin has seen a significant market cool-off resulting in a price correction over the past week. According to data from CoinMarketCap, Bitcoin declined by 4.36% in the past seven days forcing prices below $104,000.

To establish a bullish momentum, prominent crypto analyst with X username Daan Crypto has stated the premier cryptocurrency must decisively close above $106,000 which represents a pivotal price region in the current price structure.

Bitcoin Price Out Of Consolidation Range – Downside Ahead?

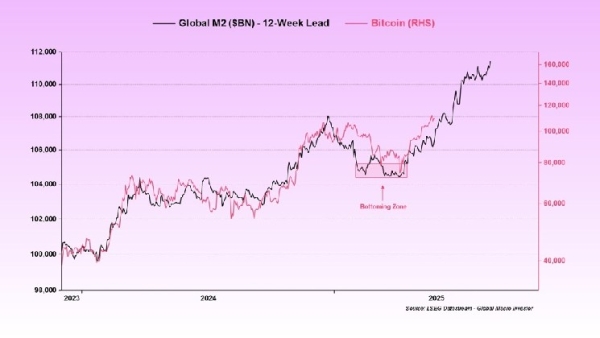

Following the re-start of the crypto bull market in April, Bitcoin has shown a specific price pattern marked by an estimated $10,000 price surge followed by a consolidation within a specific price range for about 7-10 days before another rally occurs.

After its most recent ascent to $111,970 as a new ATH, BTC prices appeared to have settled in range bound movement between $106,000-$112,000 in preparation for another potential upswing. However, recent negative market reaction to factors including macro-economic pressure as reports suggest US-China trade talks have hit a wall have forced prices below the consolidation zone to trade as low as $103,867.

Source: @DaanCrypto on X

Source: @DaanCrypto on X

According to Daan Crypto in an X post on May 30, Bitcoin bulls must reclaim the price range above $106,000 to halt the current decline and establish intentions to maintain the present uptrend.

Notably, a potential rejection at this price level would indicate that Bitcoin might have hit a market top at $111,970 and is due for a further price correction over the incoming weeks. The potential of this bearish development is significantly high especially considering other factors including that the Bitcoin spot ETFs registered a negative net inflow on May 29, marking the first time in over ten trading days.

Certain market analysts have opined on the potential of an overwhelming bearish pressure pinpointing price targets around $100,000-$102,000, while others believe the premier cryptocurrency could set for a major price crash in alignment with the crypto market cycle.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $103,539 reflecting a loss of 2.60% in the past day. Meanwhile, the asset’s daily trading volume is down by 2.24% indicating a slight fall in selling pressure in the market amidst the current decline.

According to data from blockchain analytics firm Sentora, over 1.27 million are presently in a decline due to Bitcoin’s retracement. However, there is strong evidence to back a market rebound should prices retest the $100,000 region.

BTC trading at $103,389 on the daily chart | Source: BTCUSDT chart on Tradingview.com Featured image from Pexels, chart from Tradingview

BTC trading at $103,389 on the daily chart | Source: BTCUSDT chart on Tradingview.com Featured image from Pexels, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Source