Bitcoin is ready for a bullish reversal: ‘This time could be different’

![]() Cryptocurrency Sep 4, 2024 Share

Cryptocurrency Sep 4, 2024 Share

While a majorly negative sentiment currently dominates the down-trending cryptocurrency market, a trading analyst shows optimism for a potential Bitcoin (BTC) bullish reversal.

Notably, the trader CRYPTOMOJO_TA shared an analysis on TradingView on September 3, urging investors to “be ready for the reversal.”

According to him, Bitcoin has failed multiple times to break the key resistance between $69,000 and $70,000. However, the analyst believes “this time could be different,” driving BTC to the so-awaited $100,000 price target.

Picks for you

Here's when the U.S. Dollar could reach 154 Japanese Yen (USD/JPY) 3 hours ago Opportunity? This Solana (SOL) indicator 'calling for $850' target 3 hours ago Why is Michael Saylor not buying Bitcoin lately? 7 hours ago Bitcoin's dip 'may keep dipping' if this trendline is not breached, says analyst 8 hours ago

“Breaking through the critical $69-70k resistance level is essential for the bulls to regain control. Despite multiple failed attempts, there is renewed optimism that this time could be different, as the resistance is showing signs of weakening.”

– CRYPTOMOJO_TA

Bitcoin bullish reversal from a ‘descending broadening wedge’

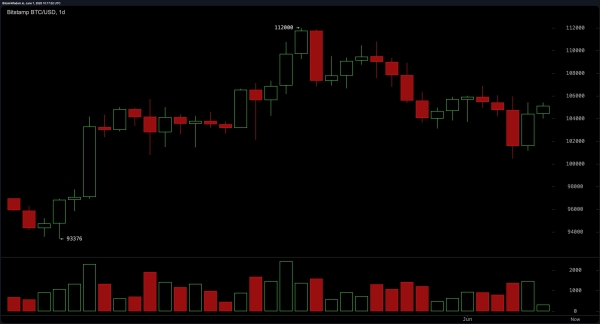

As of this writing, BTC/USDT perpetual contracts on Binance trade at $57,451, with a notable premium from spot. Like the Bitcoin spot daily chart, analysts have identified a descending broadening wedge – a bearish chart pattern.

The descending broadening wedge is made of less volatile lower highs and more volatile lower lows, increasing the range. Bitcoin has kept this pattern for the past six months, since the $73,800 all-time high in March.

BTC/USDT perpetual contract daily chart. Source: TradingView / CRYPTOMOJO_TA

BTC/USDT perpetual contract daily chart. Source: TradingView / CRYPTOMOJO_TA

According to the analyst, Bitcoin must break from this pattern to seek new highs, but he is still warning caution. Essentially, the reversal is still uncertain, and CRYPTOMOJO_TA thinks traders should avoid opening leveraged positions.

“A successful breakout above the Descending Broadening Wedge could propel Bitcoin towards the 100k mark in Q4. However, for now, leverage trading might not be the best approach. If you’re holding Bitcoin, it’s time to sit back and relax—the next bull run could be just around the corner.”

– CRYPTOMOJO_TA

BTC price analysis

As things developed, Bitcoin successfully bounced from a key support the trader was monitoring and must hold above $57,200 to keep the momentum for a potential reversal. According to CRYPTOMOJO_TA, the first resistance is at $59,500, followed by two other key levels worth watching.

One is between $60,000 and $61,000, making an important psychological level, while the other positions itself between $62,900 and $64,500. Moreover, the updated analysis highlights a bullish divergence in the four-hour chart that could sustain a rally for two days.

Nevertheless, September has historically been a losing month for Bitcoin, the victim of the “September Effect,” as Finbold reported. Other prominent analysts are still showing a slightly bearish bias right now, while millionaire investors were seeing massively accumulating BTC.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.