Bitcoin had a rough Wednesday, starting the day above $62,000 but quickly slipping to a daily low of $60,541. The market turbulence didn’t stop there, as over $40 million in bitcoin long positions were wiped out. Across the broader crypto space, both long and short positions saw liquidations totaling $169.45 million in the past 24 hours.

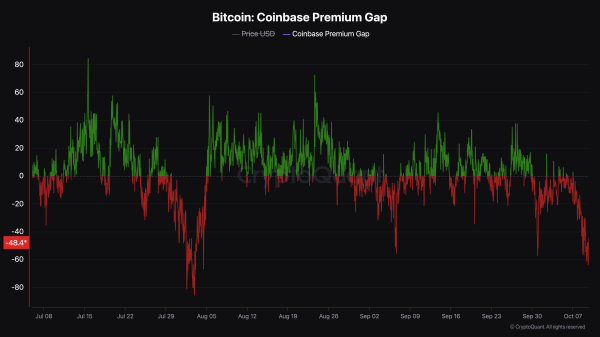

$40M Bitcoin Longs Liquidated as Coinbase Premium Gap Hits -$48.4

By 7:35 p.m. Eastern Time on Wednesday, the overall cryptocurrency market was valued at $2.13 trillion, marking a slight 1% drop over the day. Bitcoin (BTC) slid almost 2%, while ethereum (ETH) dipped by about 1%.

Market analyst Maartunn, sharing data from cryptoquant.com, provided a key insight, noting the day before that “the Coinbase Premium has fallen to -$41, signaling strong selling pressure from U.S. institutions.”

By Wednesday, Cryptoquant’s data showed the Coinbase Premium Gap had widened further to -$48.4. This metric, the Coinbase Premium, tracks the price difference of bitcoin between Coinbase Pro (USD pair) and Binance (USDT pair).

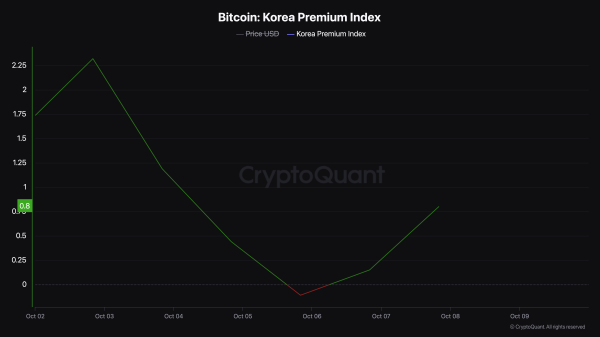

A higher premium indicates active buying on Coinbase, while a lower one could signal selling or low activity. Cryptoquant data also highlights that in South Korea, the premium turned negative again over the past week.

This isn’t the first time a discount appeared. It happened twice in September, hitting a 1.15% markdown on Sept. 25. On Oct. 5, another dip occurred, though this time it only dropped by 0.11%. Right now, there’s a slight premium of 0.8%, staying under the 1% mark.

These shifting premiums and market trends reveal the delicate dance between institutional investors and the broader digital asset environment. As prices continue to waver, global sentiment and ongoing uncertainty keep shaping the crypto market.

What do you think about bitcoin’s price wavering on Wednesday and the Coinbase Premium Gap sinking? Share your thoughts and opinions about this subject in the comments section below.