Synopsis

Weak US manufacturing data pushed global equities lower on Thursday. The data raised doubts about the US economy and dimmed the widespread optimism about potential Federal Reserve interest rate cuts in September.

Major cryptocurrencies traded in the red for the fourth straight day on Friday as a slump in global equity sell-off drove investors towards less risky assets.

Global equities turned lower on Thursday amid weak US manufacturing data, which raised doubts about the US economy and countered optimism about potential Federal Reserve interest rate cuts.

Geopolitical tensions also weighed on sentiment after the Israeli military said on Thursday that Mohammed Deif, the head of Hamas’ military wing, was killed in an Israeli airstrike in Gaza, following the death of the group’s political leader, Ismail Haniyeh, in Tehran on Wednesday.

Crypto Tracker![]() TOP COIN SETSBTC 50 :: ETH 50-1.67% BuyCrypto Blue Chip – 5-5.00% BuySmart Contract Tracker-5.47% BuyNFT & Metaverse Tracker-8.81% BuyWeb3 Tracker-11.22% BuyTOP COINS (₹) BNB47,755 (0.08%)BuyTether84 (-0.05%)BuyBitcoin5,390,240 (-0.17%)BuyEthereum263,988 (-0.86%)BuySolana13,622 (-3.78%)BuyThese developments have added pressure to crude oil prices, which have risen over 2% in the last three days. Crude oil prices are crucial for global inflation.

TOP COIN SETSBTC 50 :: ETH 50-1.67% BuyCrypto Blue Chip – 5-5.00% BuySmart Contract Tracker-5.47% BuyNFT & Metaverse Tracker-8.81% BuyWeb3 Tracker-11.22% BuyTOP COINS (₹) BNB47,755 (0.08%)BuyTether84 (-0.05%)BuyBitcoin5,390,240 (-0.17%)BuyEthereum263,988 (-0.86%)BuySolana13,622 (-3.78%)BuyThese developments have added pressure to crude oil prices, which have risen over 2% in the last three days. Crude oil prices are crucial for global inflation.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »At 11:56 PM IST, Bitcoin (BTC) was trading 0.55% lower at $63,867, while Ethereum was down 1.15% at $3,131. Earlier in the day, BTC touched a low of $62,249. Meanwhile, the global cryptocurrency market cap dropped by 0.8% to around $2.29 trillion in the last 24 hours.

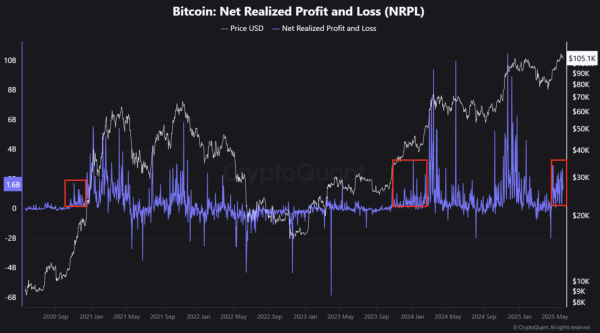

“This sharp downturn is primarily attributed to heightened selling pressure and market volatility as traders responded to the rapid price surge,” said CoinSwitch Markets Desk.

“Adding to the volatility, the crypto markets are experiencing turbulence due to escalating geopolitical risks, particularly in Eastern Europe and the Middle East. Investors are reacting to potential disruptions that could impact global financial stability, leading to increased fluctuations in crypto asset prices,” CoinSwitch added.

However, some analysts see this slide in major crypto tokens as a short-term pullback.

“This price action represents a short-term pullback similar to previous instances when the market turns green, often followed by significant upward moves,” said Edul Patel, CEO of Mudrex.

Other crypto tokens such as Solana, XRP, Dogecoin, Avalanche, Shiba Inu, Bitcoin Cash, Polkadot, NEAR Protocol, and Chainlink also declined 3-8%.

(Disclaimer: Recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of the Economic Times)