Key Points:

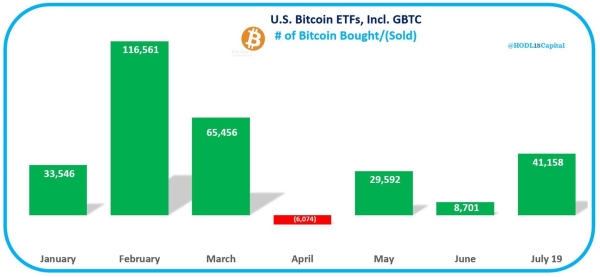

- Bitcoin ETF inflow surged in July with 41,158 BTC bought and the dominance of BlackRock’s IBIT.

- Despite sell-offs and repayments, Bitcoin remains strong, with miners adding 4,500 BTC this month.

As of July 21, Bitcoin ETF purchases in the U.S. have reached 41,158 coins, according to HODL15Capital.

Read more: Fidelity Leads Bitcoin ETF Inflow With $141 Million

Record Bitcoin ETF Inflows in July

July has seen a dramatic surge in Bitcoin ETF inflows, with billions of dollars pouring into funds. BlackRock’s iShares Bitcoin Trust (IBIT) experienced a substantial $116.2 million influx on July 19, marking ten consecutive days of inflows, as reported by Farside Investors.

In June, Bitcoin faced pressure when Germany’s government offloaded 50,000 BTC from a 2020 police seizure, causing a temporary market downturn. Additionally, the defunct Mt. Gox exchange is set to repay $9 billion in BTC to creditors. However, the potential market impact may be softened if creditors decide to retain their holdings rather than selling.

Bullish Miner Sentiment and Future Price Expectations

Despite these challenges, investor sentiment remains strong. U.S. Bitcoin ETF inflows have demonstrated recovery. The cryptocurrency’s appeal is shown by its sovereign nature and decentralized network, which contrasts with the faltering faith in fiat currencies and central banks.

Crypto analytics firm IntoTheBlock reports that miners have significantly increased their Bitcoin holdings throughout July, adding 4,500 BTC, valued at $300 million.

In January, Bitcoin marked a milestone with its first U.S.-based cryptocurrency offering, and despite Ethereum’s slower launch, Bitcoin has surged to an all-time high of $73,000. Looking forward, BlackRock anticipates that active ETFs could reach $4 trillion in assets by 2030 and aims to expand its market presence, with $26 billion currently under management out of $720 billion in U.S. ETFs this year.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |