Synopsis

I believe the recent 50 basis point interest rate cut by the US Federal Reserve will positively impact the crypto market both in the short and long term because interest rate cuts are aimed at stimulating economic growth by making borrowing cheaper and seeking higher returns in the crypto market.

In an exclusive interview with , Shivam Thakral, CEO of BuyUcoin, highlighted how the upcoming 2024 US presidential election and recent interest rate cuts by the Federal Reserve could reshape the cryptocurrency market. He noted that the 50 basis point rate cut is likely to boost investor interest in cryptocurrencies, while the increasing political influence of younger, pro-crypto voters may lead to significant policy shifts.

With the recent 50 bps interest rate cut by the US Federal Reserve, how do you expect this to impact the crypto market in both the short and long term? Do you anticipate increased investor appetite for riskier assets like cryptocurrencies?

I believe the recent 50 basis point interest rate cut by the US Federal Reserve will positively impact the crypto market both in the short and long term because interest rate cuts are aimed at stimulating economic growth by making borrowing cheaper and seeking higher returns in the crypto market. In the short term, the interest rate cut will attract significant investors’ sentiments and increase liquidity in the financial system. The increased financial liquidity will rise the demand in the market. To earn more profit, investors may opt for different cryptocurrencies.

If we talk in the long term, it will attract institutional investors and prompt regulatory developments. This environment fosters greater market stability and legitimacy, potentially solidifying cryptocurrencies as a mainstream asset class in the long term.

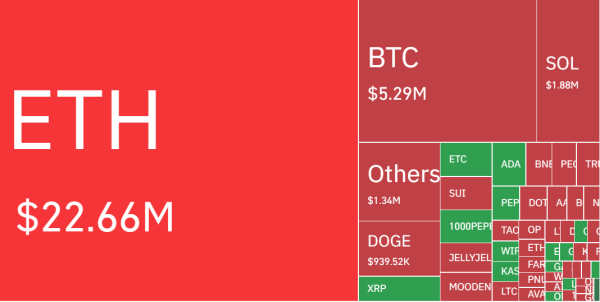

Crypto Tracker![]() TOP COIN SETSSmart Contract Tracker0.31% BuyDeFi Tracker-0.13% BuyCrypto Blue Chip – 5-0.43% BuyWeb3 Tracker-2.00% BuyAI Tracker-4.12% BuyTOP COINS (₹) Tether84 (-0.03%)BuyBitcoin5,613,734 (-1.06%)BuySolana13,865 (-1.59%)BuyEthereum219,084 (-1.71%)BuyBNB49,180 (-1.81%)Buy

TOP COIN SETSSmart Contract Tracker0.31% BuyDeFi Tracker-0.13% BuyCrypto Blue Chip – 5-0.43% BuyWeb3 Tracker-2.00% BuyAI Tracker-4.12% BuyTOP COINS (₹) Tether84 (-0.03%)BuyBitcoin5,613,734 (-1.06%)BuySolana13,865 (-1.59%)BuyEthereum219,084 (-1.71%)BuyBNB49,180 (-1.81%)Buy

Yes, there is an anticipated increase in investor appetite for riskier assets like cryptocurrencies. Historical trends show that rate cuts typically lead to bullish sentiment in crypto markets, driving demand and prices higher

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »![]()

As the 2024 US presidential election approaches, what role do you believe crypto policies will play in the campaigns, especially considering the growing political influence of younger, pro-crypto voters? Could we see significant policy shifts?

As the 2024 U.S. presidential election approaches, cryptocurrency policies are becoming pivotal, especially with younger, pro-crypto voters gaining influence. Candidates like Donald Trump are actively courting this demographic, promising to make the U.S. “the crypto capital of the world” and proposing a national Bitcoin stockpile. In contrast, Kamala Harris and Democrats are working to improve relations with the crypto sector after years of regulatory crackdowns.

The substantial financial contributions from the crypto sector over $119 million this cycle highlights its political significance. As both parties recognize the importance of appealing to younger constituents, we may witness transformative changes in crypto policies that could reshape the landscape of digital assets.

How do you think the collaboration between the RBI, SEBI, and other government bodies will shape India’s crypto market and adoption?

The collaboration between the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and other government bodies will significantly shape India’s cryptocurrency market in a better way. The recent partnership aims to develop a comprehensive crypto policy, with a discussion paper indicating a potential shift from a restrictive to a more inclusive regulatory approach.

SEBI’s openness to regulating private virtual assets contrasts with the RBI’s cautious stance, which emphasizes macroeconomic risks. This collaboration highlights the need for a balanced framework that addresses both regulatory concerns and market growth. Ultimately, this collaboration may foster greater investor confidence and encourage innovation, positioning India as a competitive player in the global crypto landscape.

In the aftermath of the WazirX’s $230 hack, what lessons should the Indian crypto market and exchanges take regarding security and investor protection? How do you think this incident will influence security measures going forward?

After the WazirX hack, which saw over $230 million stolen, the Indian crypto market must prioritize security and investor protection. This incident highlights the necessity for exchanges to adopt advanced security measures, such as regular audits and enhanced multi-factor authentication protocols.

Collaboration among exchanges, regulatory bodies like the RBI and SEBI, and cybersecurity experts is essential to establishing a unified framework for safeguarding user assets. Going forward, we can expect a shift towards greater transparency and compliance with global security standards.

Given the contrasting regulatory approaches of the US and India, how do you envision the global crypto market evolving over the next few years? Could regional differences in policies drive fragmentation, or will they foster localized innovation?

The US and India have very different regulatory frameworks, which will have a big impact on the global cryptocurrency market. Although fragmentation of regulations can lead to uncertainty and encourage companies to look for favorable jurisdictions, it can also encourage localized innovation. In India, ongoing discussions around regulation may result in tailored solutions that address local needs. I believe there is a hope for increased global cooperation on regulatory standards, even though regional disparities may initially split the market.

How do you envision the future of the crypto exchange industry, and what role do you see BuyUcoin playing in it?

The cryptocurrency exchange sector is expected to undergo substantial change in the future due to improved security protocols and more transparent regulations. To safeguard user assets, we place a high priority on strong security procedures, such as advanced encryption and thorough KYC/AML procedures.

Through the implementation of best-in-class security features and the promotion of a user-friendly trading environment, BuyUcoin hopes to spearhead this transformation. Our dedication to openness and adherence to changing laws establishes us as a reliable platform in India. As the market develops, BuyUcoin will concentrate on encouraging blockchain innovation and adoption while making sure that our users have a safe trading environment.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)