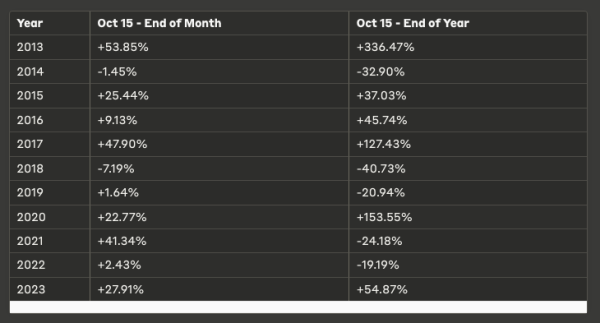

Pseudonymous crypto analyst Aylo recently shared his thoughts on Bitcoin’s historical performance from mid-October onward, highlighting intriguing patterns for both short-term and medium-term holders. Aylo pointed out that Bitcoin has shown positive returns between October 15 and the end of the month in nine out of the last eleven years, making it an appealing period for short-term investors. According to Aylo, this historical pattern should give speculators additional confidence, especially given Bitcoin’s typically favorable outcomes during this period.

Aylo also discussed the potential for medium-term investors holding Bitcoin from October 15 until the year’s end, though the results are more mixed in this case. He noted that only six out of the last eleven years saw Bitcoin post positive returns over this timeframe, while five years recorded negative outcomes. However, Aylo emphasized the remarkable post-halving performances, where Bitcoin gained +45.74% and +153.55% in the two years following previous halving events. He further highlighted that these periods also coincided with U.S. election years, which could add a layer of bullishness to the current cycle.

The detailed table Aylo shared in his analysis reinforces these observations, showing Bitcoin’s returns from both October 15 to month-end and October 15 to year-end between 2013 and 2023. According to Aylo, these historical trends could inform investors’ decisions, as history often holds weight in the investment community. He believes that short-term buyers and medium-term holders are currently in a strong moment cyclically for positive returns, based on these historical data points.

Source: X

Source: X

Aylo also drew attention to macroeconomic factors that could further support Bitcoin’s bullish trajectory. He noted that we are currently post the first non-recessionary rate cut, with additional cuts expected later in the quarter. According to Aylo, this adds another layer of confluence, giving investors more reason to adopt a bullish bias toward Bitcoin in the near future.

While Aylo acknowledged that historical data doesn’t guarantee future outcomes, he underscored its importance for many investors when making decisions. In his view, the current combination of historical patterns and favorable macroeconomic conditions provides significant optimism for Bitcoin bulls, offering what he described as “hopium” for those with a bullish outlook.