Bitcoin (BTC) price’s recent journey has been a bumpy one, with its value seeing a pullback to around $93.5K. This brings into focus the critical $91K level, which serves as the average cost basis for short-term holders.

BTC Price Takes a Hit

Currently, Bitcoin‘s ability to sustain above this price is crucial for maintaining the bullish sentiment that pervades the market. Should this level hold, it might restore confidence among investors, potentially setting the stage for a recovery.

However, those who bought in at or above $100K are now facing unrealized losses. The decision of this group to hold or sell will be pivotal. If they choose to offload their holdings, we could see increased selling pressure, which might drive prices down even further.

Conversely, their decision to hold could help stabilize the market, allowing Bitcoin to consolidate and perhaps climb back. The resilience of the $91K support level is under scrutiny. If this support holds, it could reinforce investor confidence, possibly initiating a recovery phase.

BTC price support and resistance | Source: CryptoQuant

BTC price support and resistance | Source: CryptoQuant

Currently, BTC continues to range as it trades above $96K following that fall. But if it fails, BTC could find itself testing the next significant support at the Realized Price level, which is progressively lower, indicating potential spots for renewed buying activity based on historical behavior.

A breach below $91K would likely lead to further corrections, testing lower supports at around $70K as shown by historical realized prices. This could test the market’s strength and the resolve of long-term holders, possibly leading to a bearish phase.

BTC price’s future movements hinged significantly on its ability to hold at the $91K level. A successful hold could lead to market stabilization and a gradual recovery towards levels above $100K.

However, failing this test could trigger a sharper decline, challenging the conviction of long-term holders and setting a bearish tone for the market.

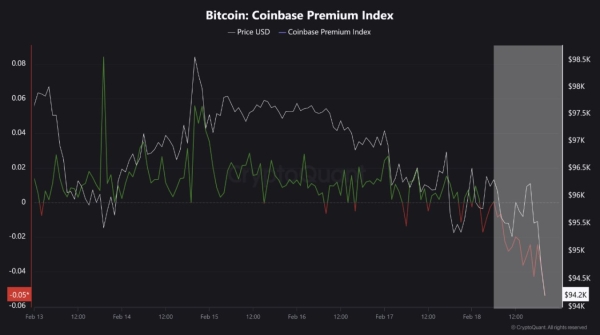

Bitcoin Coinbase Premium Index

Further assessment of the Coinbase Premium Index, which gauges the price difference between Bitcoin on Coinbase and its price on Binance, took a nosedive right after U.S. markets opened, an indication of volatility.

This sudden drop, from a near-zero to -0.05, mirrored a shift in trading behavior, suggesting that traders on Coinbase were offloading Bitcoin at lower prices compared to Binance.

As the index fell, so did BTC price, tumbling from $96,000 to about $94,200. This suggested that demand for BTC and other cryptos was low potentially due to the fall in prices in the broader market.

Bitcoin Coinbase Price Index | Source: CryptoQuant

Bitcoin Coinbase Price Index | Source: CryptoQuant

This negative premium is a red flag, hinting that investor sentiment on Coinbase has turned bearish, likely influencing the wider market. If this trend persists, Bitcoin could face further declines as confidence wanes.

However, if the premium swings back to positive, it might indicate easing selling pressure, potentially stabilizing or even boosting Bitcoin’s price.

This index could offer key insights into market sentiment and upcoming BTC price movements. It could make it a critical indicator for traders monitoring inter-exchange dynamics.