A Bitcoin analyst on the Thinking Crypto podcast suggested recent Bitcoin price dips were a strategic move by whales positioning for a bull run. The analyst analyzed BTC’s chart patterns and compared them to historical trends, highlighting how Ethereum and other altcoins have behaved in recent months as they prepared for sustained rallies.

Bitcoin hit a new all-time high in March, just weeks before the latest halving event. However, the flagship crypto has since consolidated, retracing over 30% in the past six months. While many retail traders panicked about BTC’s behavior, the renowned analyst explained how Bitcoin whales controlled the trend, taking advantage of a downward channel and setting the market up for a sustained bull run.

Read also: Bitcoin Price Stable Despite Market Fluctuations, Hash Rate Soars

Bitcoin’s Behavior is Consistent

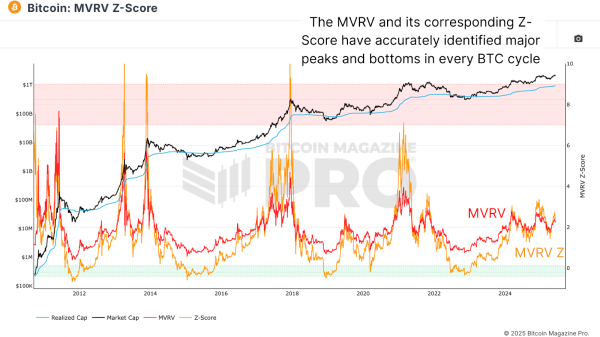

The analyst pointed out the consistency of Bitcoin’s historical price patterns. According to him, the crypto market’s notable rallies usually happen within the years following the Bitcoin halving. Hence, the current market condition is consistent with Bitcoin’s traditional behavior.

Read also: Bitcoin Whales Signal Bullish Trend: $5.6 Million Options Bet Fuels Price Rally

Ethereum’s Parity with Bitcoin: A Bullish Sign

The analyst also used the ETH/BTC chart to support his opinion on market consistency by showing how the pair repeated the type of pullbacks it experienced every cycle before the parabolic bull run. More crucially, he highlighted Ethereum is achieving parity with Bitcoin, signaling the likelihood of the type of rally seen when the crypto market moves in tandem during notable uptrends.

BTC to $150,000 Before FOMO

As a prediction, the analyst believes Bitcoin can go as high as $150,000 in the current bull cycle. However, he thinks crypto traders need to pay attention to the Fear Of Missing Out (FOMO) the market would generate after the rally begins. According to him, a consequential FOMO can cause BTC to rally up to $250,000.

From an expert trader’s perspective, the analyst explained how investors can track the Bitcoin market after reaching a realistic price target of around $120,000 and follow up with stop-losses and a close observation as the FOMO kicks in. He emphasized that the FOMO volume is unsustainable and could disappear quickly.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.