Anonymous whale opens $425M bet on Bitcoin

![]() Cryptocurrency Jun 11, 2025 Share

Cryptocurrency Jun 11, 2025 Share

A mystery whale has deployed nearly $30 million over three days to build a massive leveraged Bitcoin (BTC) position, according to data from Lookonchain.

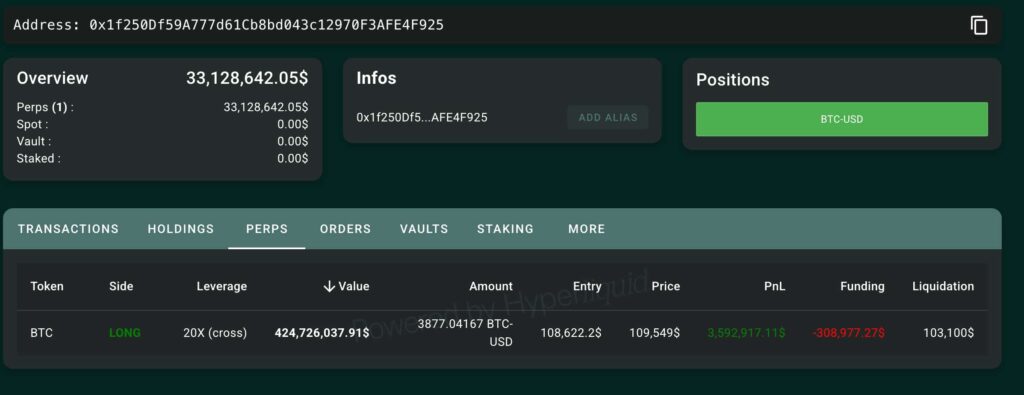

The trader, identified by wallet address “0x1f25…”, created a new wallet and initially deposited 10M USDC to Hyperliquid, opening a 20x leveraged long position on Bitcoin. They then added another 2.35M USDC yesterday, followed by another 10M USDC today.

At press time, the position stood at 3,877 BTC ($424.7M) with an entry price of $108,622 and a liquidation price of $103,100. The trader is currently showing unrealized gains of $3.59M.

“0x1f25…” wallet. Source: Hypurrscan.io

“0x1f25…” wallet. Source: Hypurrscan.io

Bitcoin bulls target $150,000 after breaking key resistance

The whale’s aggressive positioning comes as Bitcoin surged past the $110,000 mark, with analysts suggesting the next potential target could be $150,000 if technical indicators continue to align.

Prominent crypto analyst TradingShot observed that Bitcoin’s current rally has invalidated several short-term bearish patterns and broken through a critical resistance zone. The analyst noted that Bitcoin recently rebounded at the lower high trendline of a three-year ascending channel, with this price structure appearing thrice in Bitcoin’s ongoing ‘channel up’ formation. Each instance triggered at least a 101% gain.

From the April 7 bottom, a 101% rally would put Bitcoin at the $150,000 mark, a clean technical target supported by historical precedent, strong channel support, and renewed breakout momentum.

Analyst Michaël van de Poppe predicted that the current phase is likely a short consolidation period before increased upward momentum. Van de Poppe suggests the ideal buying range sits around $107,000 to $108,000 as BTC prepares for what could be another historic run.

If Bitcoin’s relative strength index (RSI) retests 75 by the end of the month, analyst PlanB suggests the June closing price for BTC would be around $130,000. Meanwhile, investment firm Bernstein maintains a $200,000 price target, calling it a “high-conviction but conservative” forecast.

Institutional demand remains strong, with Strategy (formerly MicroStrategy) (NASDAQ: MSTR) buying over 1000 BTC this week, worth approximately $110.2 million in total. Spot Bitcoin ETFs now manage over $120 billion in assets, highlighting BTC’s transition into a mainstream asset class.

Bitcoin price analysis

At the time of publication, Bitcoin was trading at $109,505, up 0.32% daily and over 3.53% weekly, approaching the key $110,000 resistance level.

Bitcoin 7-day price chart. Source: Finbold.com

Bitcoin 7-day price chart. Source: Finbold.com

A sustained break and hold above $110,000 could pave the way toward $115,000, potentially setting up a new all-time high.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Featured image via Shutterstock