Andrew Tate’s top 3 investments for the end of 2024

![]() Cryptocurrency Jul 15, 2024 Share

Cryptocurrency Jul 15, 2024 Share

Former kickboxer and social media personality Andrew Tate’s recent activities and commentary have increasingly focused on the financial world.

Notably, Tate has shown a keen interest in investments in the crypto and traditional finance sectors, preferring products that seem to align with his strategic financial goals and risk appetite.

In this regard, the following are some investment products that Tate has shown an inclination toward.

Picks for you

How rich is New Mexico's junior senator: Ben Ray Lujan's net worth revealed 3 hours ago Bitcoin shoots up on Trump assassination attempt 4 hours ago How rich is Cody Conrod? Clix’s net worth revealed 4 hours ago How rich is Alaska's senator: Dan Sullivan's net worth revealed 5 hours ago

Daddy Tate

Tate has embraced the meme cryptocurrency movement through his involvement with the Daddy Tate (DADDY) coin. The DADDY project uses a humorous and provocative marketing strategy, emphasizing a rebellious, anti-establishment stand.

Although impacted by general market volatility, Tate has been central to DADDY’s gains, with the coin’s market cap reaching around $135 million at some point.

Indeed, on-chain data indicated that Tate’s wallet received 40% of the DADDY supply. While wallets directly linked to Tate have not sold any DADDY tokens since their issuance on June 9, other wallets appear to have purchased 30% of the token’s supply before it was widely promoted on social media.

2/ On June 9th at 21:24 UTC, @DaddyTateCTO sent 40% of the $DADDY supply to @Cobratate.

Andrew Tate later bought and burnt $10k worth of tokens

This is verifiable on-chain:https://t.co/05HfS1Idyg

— Bubblemaps (@bubblemaps) June 12, 2024

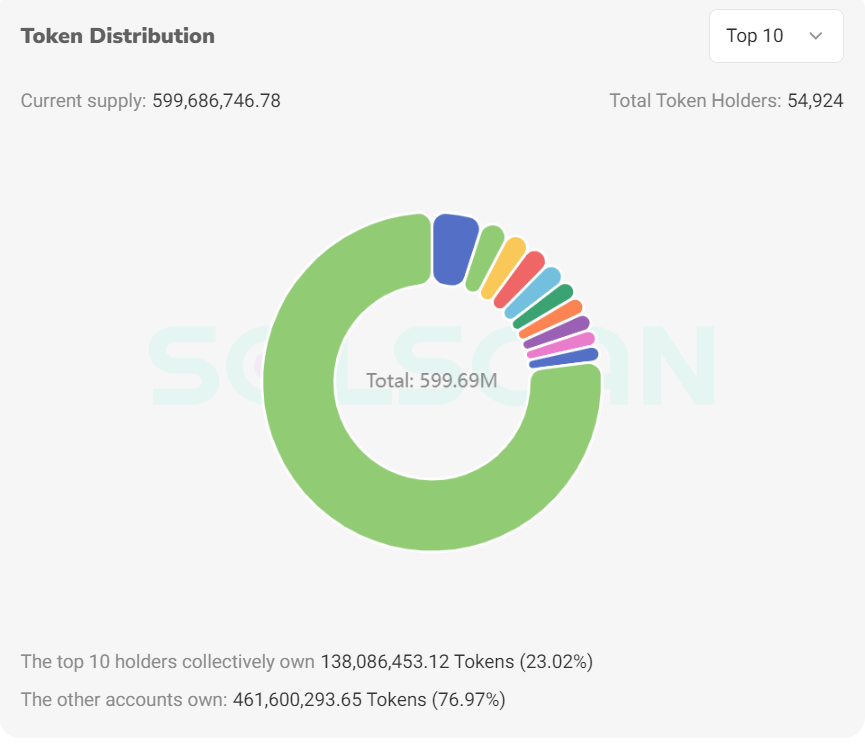

Despite facing accusations of insider trading, data indicates that a majority of the token’s supply is concentrated in a few wallets. For instance, the top ten holders of DADDY account for 23.02% of the token’s supply.

DADDY token supply distribution. Source: Solscan

DADDY token supply distribution. Source: Solscan

Tate has consistently promoted the token as a new alternative, foreseeing significant growth to reach a $1 billion market cap. The token has risen about 20% in the last 24 hours.

Bitcoin

In May this year, Tate expressed dissatisfaction with the fiat money system, pushing him to consider Bitcoin (BTC). He noted that he plans to invest a large amount of money in Bitcoin.

Tate has voiced his frustration with banks and what he terms their associated scams, declaring his intention to prove his investment in Bitcoin. This aligns with Bitcoin’s tenets of addressing the shortcomings of the traditional finance sector.

I know I’m not supposed to do this in chaotic times but I’m about to leave fiat completely and ape over 100M into btc.

And I’ll even prove I did it.

I’m done with the banks.

I’m done with their money.

Done with the scams.

Then I’m going boating.

— Andrew Tate (@Cobratate) May 15, 2024

However, Tate’s preference for Bitcoin has also landed him in trouble. Romanian authorities have seized assets such as Bitcoin from Tate. At one point, he was accused of promoting Bitcoin as a form of tax avoidance. His bet will likely pay off, considering that Bitcoin gained over 43% in 2024.

GameStop

The social media personality has also been involved in the meme stock frenzy, with GameStop (NYSE: GME) being his preferred target. Tate claimed he participated in the downfall of hedge funds by investing $6 million in GameStop.

According to him, these decisions could reap rewards if investors boldly select products to invest in. At the same time, Tate committed to holding 2,148.22 GME shares indefinitely, regardless of the stock’s performance. Despite his bullish stance, Tate has claimed he has lost significant amounts in GME. However, GME has gained almost 58% year-to-date to trade at $26 by press time.

100k GME @ 46.55

2148.22 Shares@SECGov @BarackObama @JoeBiden @Madonna

HAHAHAHAHAHAHAHAHAHAHA. 🙌💎

— Andrew Tate (@Cobratate) June 7, 2024

Overall, it remains challenging to determine Andrew Tate’s investment strategy based on the various sectors he is involved in. However, it is clear that he is interested in diversifying his investments across popular assets among retail investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.