AI predicts Bitcoin price for March 1, 2025

![]() Cryptocurrency Feb 17, 2025 Share

Cryptocurrency Feb 17, 2025 Share

Bitcoin (BTC) remains consolidated in a tight trading range between $94,000 and $100,000, struggling to establish clear momentum amid lingering market uncertainty.

At press time, BTC is trading at $96,907, posting a modest 0.16% gain. However, investor sentiment remains fragile, with U.S. spot Bitcoin ETFs recording a $430 million net outflow last week, marking a decline in institutional demand and adding pressure to BTC’s price action.

Bitcoin one-day price chart. Source: Finbold

Bitcoin one-day price chart. Source: Finbold

Finbold AI predicts Bitcoin price target for March 1

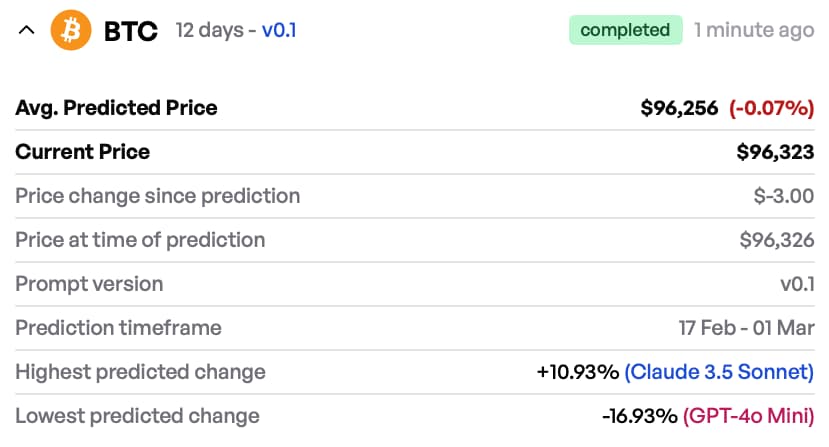

As Bitcoin struggles to break free from its current range, Finbold’s AI-powered prediction tool has provided an updated outlook for its trajectory leading up to March 1, 2025. Factoring in technical indicators and market data, the model forecasts an average BTC price of $96,256 for the start of next month, a 0.07% decline from its current level of $96,323.

Picks for you

XRP whales load up on 60 million tokens — is $3.3 next? 1 hour ago Monster insider trading alert for TRUMP meme coin 3 hours ago Sam Altman net worth revealed: How rich is the CEO of OpenAI? 5 hours ago Dave Portnoy loses over $5M on Javier Milei backed-Libra 7 hours ago  Finbold AI Bitcoin price prediction. Source: Finbold

Finbold AI Bitcoin price prediction. Source: Finbold

Despite this near-flat projection, AI models remain sharply divided on Bitcoin’s next move. The most optimistic outlook, generated by Claude 3.5 Sonnet, foresees a 10.93% rally, suggesting BTC could test $106,800 in the coming weeks.

Conversely, GPT-4o Mini presents a bearish case, predicting a 16.93% drop, which could see Bitcoin fall as low as $80,000—a scenario likely tied to macroeconomic headwinds or increased selling pressure.

Analysts’ take on BTC price

While AI models paint a mixed picture for Bitcoin’s trajectory, technical analysts are closely monitoring BTC’s price action within a well-defined range, with resistance at $106,800 and support near $91,700.

Bitcoin price analysis chart. Source: CrypNuevo/X

Bitcoin price analysis chart. Source: CrypNuevo/X

BTC is struggling to reclaim its mid-range level at $99,048, which aligns with the 50-day Exponential Moving Average (EMA)—a key resistance zone that has already rejected multiple attempts of a breakout

A decisive move above this level could validate the optimistic price projection, according to CrypNuevo.

On the downside, Bitcoin’s current price of $96,227 leaves it vulnerable to a pullback. A breakdown below $91,764 would strengthen the bearish outlook predicted by GPT-4o Mini, opening the door for a potential drop toward $90,000 and lower.

Beyond technicals, macroeconomic factors are also in focus. The upcoming Federal Reserve minutes and jobless claims data could add volatility, with traders closely watching for any shifts in monetary policy. Persistent inflation concerns have already pushed back expectations of interest rate cuts, a factor that could influence risk appetite in the crypto market.

Featured image via Shutterstock