Perplexity AI predicts Microsoft stock price amid Bitcoin investing proposal

![]() Stocks Oct 25, 2024 Share

Stocks Oct 25, 2024 Share

Microsoft (NASDAQ: MSFT) shareholders will vote on a Bitcoin (BTC) investment proposal on December 10. The company’s board has positioned against it, fueling speculations with the growing controversy.

Finbold turned to Perplexity AI for real-time analysts’ insights on Microsoft stock price prediction related to the voting issue. Essentially, Perplexity Online is an artificial intelligence model that can scan the web for up-to-date analyses, competing with OpenAI’s ChatGPT.

The model has already provided an Nvidia stock price prediction and analyzed McDonald’s recent E. coli outbreak, leveraging its capacities.

Picks for you

Tesla stock price prediction if Kamala Harris wins Presidency 3 mins ago Top 3 most shorted stocks in the S&P 500 Index 1 hour ago Commodity strategist pinpoints levels where silver's fate hangs in the balance 2 hours ago If I could Invest $1,000 in any Bitcoin ETF, it would be this one 2 hours ago

Meanwhile, MSFT stock opened the U.S. market trading at $430.98, already up from Thursday’s closing at $425.10

Microsoft (NASDAQ: MSFT) five-day price chart. Source: Finbold

Microsoft (NASDAQ: MSFT) five-day price chart. Source: Finbold

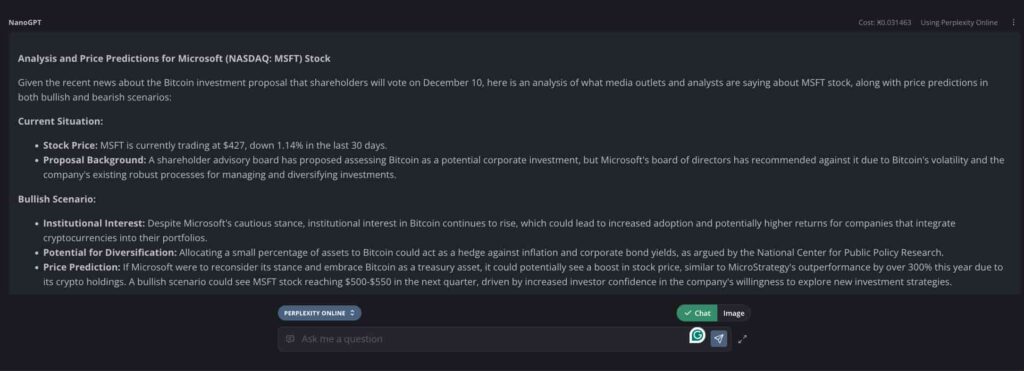

Perplexity AI price prediction and analysis on Microsoft (MSFT) stock

Perplexity AI disclosed consulting four sources to provide the requested analysis, including CryptoSlate‘s reporting on Microsoft shareholders’ Bitcoin investment proposal.

In summary, a shareholder advisory board has proposed assessing Bitcoin as a potential corporate investment. Still, Microsoft’s board of directors has recommended against it due to Bitcoin’s volatility and the company’s existing robust processes for managing and diversifying investments.

Perplexity AI insights: Bullish price prediction for Microsoft stock

Overall, Perplexity AI predicts that approval of the Bitcoin proposal would be bullish for Microsoft’s stock price, mentioning MicroStrategy’s performance. Analysts’ insights gathered by artificial intelligence point to institutional interest and potential for diversification as core catalysts for the approval.

Notably, BlackRock (NYSE: BLK) is Microsoft’s largest shareholder, with over 5% of all shares, and is a recent Bitcoin supporter. The financial giant could influence other shareholders’ decisions despite the board’s cautious stance, considering BlackRock likely influenced Bitcoin ETFs’ approval.

All things considered, Perplexity AI predicts MSFT stock could trade between $500 and $550 by this year’s end after voting.

“If Microsoft were to reconsider its stance and embrace Bitcoin as a treasury asset, it could potentially see a boost in stock price, similar to MicroStrategy’s outperformance by over 300% this year due to its crypto holdings. A bullish scenario could see MSFT stock reaching $500-$550 in the next quarter, driven by increased investor confidence in the company’s willingness to explore new investment strategies.”

– Perplexity Online AI

Perplexity AI on Microsoft (MSFT) stock bullish price prediction. Source: NanoGPT / Finbold

Perplexity AI on Microsoft (MSFT) stock bullish price prediction. Source: NanoGPT / Finbold

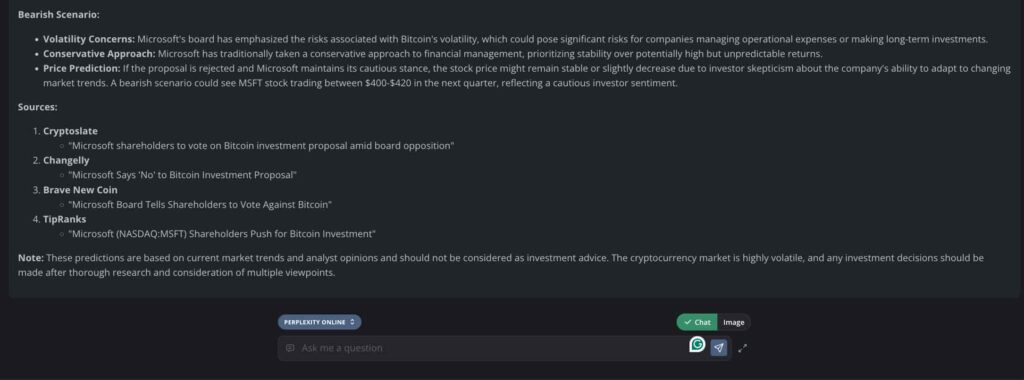

The bearish scenario

On the other hand, Perplexity AI highlighted the risks associated with Bitcoin’s volatility, which was shared by Microsoft’s board. The company is known for a more traditional and conservative approach to financial management, making a counterpoint to the approval.

A victory from the opposing wing to adding Bitcoin to the company’s treasury could frustrate the market’s expectations, analysts argued. In this scenario, Perplexity targets a range between $400 to $420 per share by the end of 2024 for MSFT.

“If the proposal is rejected and Microsoft maintains its cautious stance, the stock price might remain stable or slightly decrease due to investor skepticism about the company’s ability to adapt to changing market trends. A bearish scenario could see MSFT stock trading between $400-$420 in the next quarter, reflecting a cautious investor sentiment.”

– Perplexity Online AI

Perplexity AI on Microsoft (MSFT) stock bearish price prediction. Source: NanoGPT / Finbold

Perplexity AI on Microsoft (MSFT) stock bearish price prediction. Source: NanoGPT / Finbold

Additionally, Citi has lowered its Microsoft stock price targets in a recent forecast ahead of Q3 earnings, as Finbold reported.

Nevertheless, the AI explained that this analysis is based on current market trends and analyst opinions. Traders and investors must access different insights to make better decisions and understand how things can change in stock speculation.