Gold is outperforming Bitcoin and elevated risk assets

![]() Cryptocurrency Oct 24, 2024 Share

Cryptocurrency Oct 24, 2024 Share

The rise of digital currencies such as Bitcoin (BTC) has shone a new light on gold’s role as a store of value. While the two assets have different risk profiles and correlations, many investors are increasingly gravitating toward BTC — mainly on account of its ability to deliver immense returns.

Opinions are split on the matter — whereas financial educator Robert Kiyosaki, for example, recommends holding both, precious metal analyst Peter Spina deemed the digital asset’s role as ‘digital gold’ an utter failure.

Both investments have seen significant price action throughout 2024. At press time, BTC is trading at $66,640 — year-to-date (YTD) gains stand at 57.88%, although trading has been choppy since late September. The cryptocurrency has frequently and unsuccessfully been testing the psychologically important price point of $70,000.

Picks for you

Crypto trader instantly loses $450,000 in minutes 1 hour ago Forget gold and silver; This metal is set for highest close of the year 3 hours ago Orbs’ Liquidity Hub comes to QuickSwap 3 hours ago Here’s the 'hidden factor' driving Silver prices higher 18 hours ago  BTC price YTD chart. Source: Finbold

BTC price YTD chart. Source: Finbold

In contrast, gold, which is up 32.69% YTD, has had much smoother price action — the gleaming metal is in a historic two-year bull run, and this clear uptrend is set to deliver record returns in 2024.

Gold YTD price chart. Source: TradingView

Gold YTD price chart. Source: TradingView

That’s a pretty significant discrepancy in returns — however, one strategist has highlighted how the tide might be turning in favor of the commodity.

Key ratio points to gold’s superior momentum compared to BTC

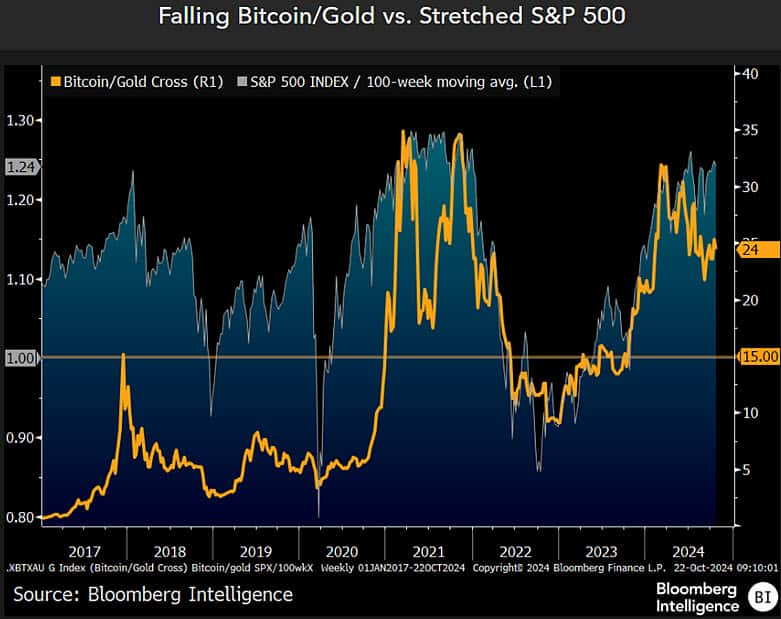

Taking the price of BTC and dividing it by the price of one ounce of gold gives us the gold-to-bitcoin ratio. It’s an elegant tool — offering a simple way to measure the performance of the two assets.

If the ratio is increasing, the virtual asset is outperforming the precious metal — if it decreases, the opposite is taking place. And the ratio has, in fact, been decreasing since March, as shown in a chart shared by senior Commodity strategist Mike McGlone in an X post.

Chart detailing the gold-to-bitcoin ratio from 2017 to 2024. Source: Bloomberg Intelligence

Chart detailing the gold-to-bitcoin ratio from 2017 to 2024. Source: Bloomberg Intelligence

The highest instances of the ratio were two peaks in 2021, reaching a level of 37 amidst strong performance from the S&P 500. A recent, though smaller high of 34 in March of 2024 has been followed by a significant decrease in the ratio.

At the time of publication, one BTC is worth approximately 24 ounces of gold — with the cryptocurrency struggling to break out to the upside while gold is setting new all-time highs, the ratio looks set to decrease even further.

The key difference this time, as pointed out by McGlone, is that the strong performance of the S&P 500 has failed to correlate with an equally strong showing for the digital currency. Per the analyst, this could spell headwinds for risk assets going forward.

While there is a case to be made in favor of the cryptocurrency’s superior returns, the fact that the gap is closing, along with Bitcoin’s higher volatility, means that gold’s role as a safe haven asset won’t be disrupted any time soon.