IBIT surpasses major competitors in year-to-date inflows as investor confidence grows.

Key Takeaways

- BlackRock’s iShares Bitcoin Trust saw a significant influx of $329 million despite a dip in Bitcoin prices.

- The fund has surpassed Vanguard’s Total Stock Market ETF in terms of year-to-date inflows.

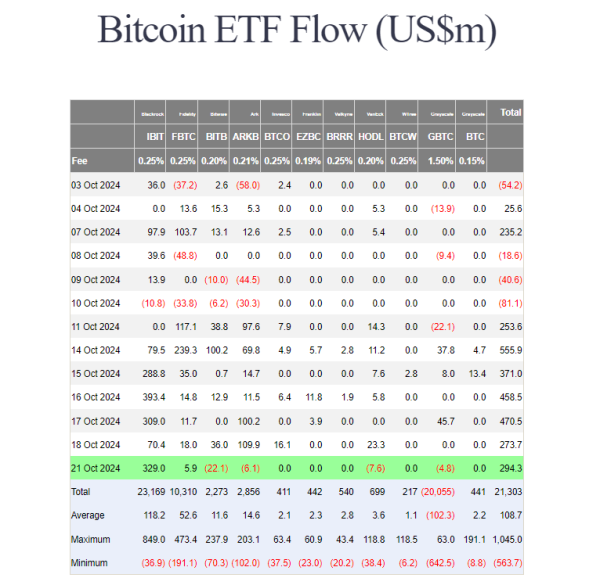

BlackRock’s iShares Bitcoin Trust (IBIT) recorded around $329 million in new investments on Monday, even as Bitcoin’s value fell below $67,000. With the fund’s strong performance, US spot Bitcoin ETFs have successfully extended their winning streak to seven consecutive days with net buying exceeding $2.5 billion, according to Farside Investors data.

US spot Bitcoin ETF Flows on October 21

US spot Bitcoin ETF Flows on October 21

Fidelity’s Bitcoin Fund (FBTC) also reported gains of approximately $6 million on Monday. In contrast, competing ETFs from Bitwise, ARK Invest/21Shares, VanEck, and Grayscale (GBTC) experienced redemptions, totaling over $40 million. The remaining ETFs saw no inflows.

BlackRock’s IBIT remains a popular choice for investors seeking exposure to Bitcoin. Over $1 billion worth of net capital went into the fund last week, accounting for half of US spot Bitcoin ETF inflows.

According to Bloomberg ETF analyst Eric Balchunas, IBIT has now surpassed Vanguard’s Total Stock Market ETF in year-to-date inflows, ranking third overall less than ten months after its launch.

Author: Eric Balchunas

Author: Eric Balchunas

As of October 18, IBIT’s Bitcoin holdings were valued at $26.5 billion, according to updated data from BlackRock.

Despite recent price fluctuations, the sustained interest in Bitcoin ETFs suggests robust institutional engagement, although upcoming US elections and global tensions could impact market stability.

Bitcoin peaked at $69,500 on Monday before retreating below $67,000. It is currently trading at around $67,400, down around 2% in the last 24 hours, per CoinGecko.