Bitcoin (BTC) saw some relevant volatility since early September and most recently following a predicted volatile roadmap by Ali Martinez. If Bitcoin continues to follow his analysis, the leading cryptocurrency could soon reach a new all-time high of $78,000.

The analyst shared what he described as “the best way to mess with everyone’s dreams,” bringing in a chaotic scenario. According to a recent post by Martinez, Bitcoin has already accomplished three out of the four steps, eyeing the breakout.

“I think the best way to mess with everyone’s dreams would be for Bitcoin to drop to $60,000, rebound to $66,000, retrace back to $57,000, and finally break out towards $78,000!”

– Ali Martinez

As of this writing, BTC trades at $62,843, a similar level it was when the analyst posted his roadmap. During this time, Bitcoin dropped to $60,000, rebounded to $64,500, and just retraced back to $58,500.

Bitcoin price bullish case and a road to $78,000

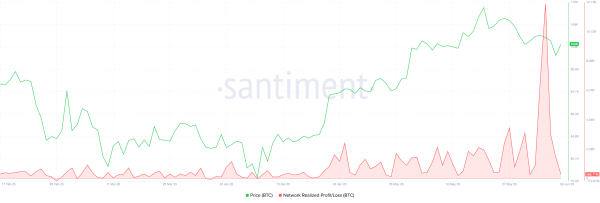

The institutional interest continues to rise for the leading cryptocurrency, fueled by BlackRock (NYSE: BLK), MicroStrategy (NASDAQ: MSTR), and other leaderships from the traditional finance. With that, BTC has become one of the most popular speculative assets in the world, driving speculative demand upwards.

Michael Saylor, from MicroStrategy, revealed today that the company’s end goal is to become a Bitcoin bank, renewing retail’s optimism. In the meantime, the MSTR stock price surged with the news, mirroring the renewed bullish sentiment towards BTC.

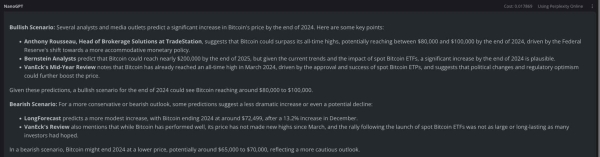

Notably, Finbold asked Perxplexity Online for a Bitcoin price prediction for the end of 2024, based on up-to-date analysts insights. The real-time web scanning artificial intelligence model then set a target between $80,000 to $100,000 and $65,000 to $70,000 in the best and worst case scenarios, respectively.

Bitcoin price bearish case

On the other hand, there are some considerable bearish aspects that could affect Bitcoin’s roadmap to $78,000.

Besides fundamental challenges the coin may face, with increasing mining centralization, recent discoveries suggesting this aspect could be worse than what is seen in the surface, and lack of an organic demand using BTC as money, some analysts identified difficulties in the price chart.

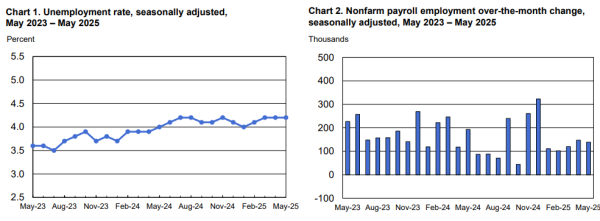

Namely, Alan Santana believes Bitcoin could still crash down to $49,000, while RLinda targets the $52,000 price level. Moreover, US economic data like a rising CPI and PPI inflation create further challenges to the digital commodity.

As things develop, the uncertainties are a direct result of Bitcoin’s price volatility that may or may not lead it to a breakout toward $78,000. Investors and traders must remain cautious and avoid overexposed positions moving forward.