Short squeeze alert for two highly shorted cryptocurrencies

![]() Cryptocurrency Oct 4, 2024 Share

Cryptocurrency Oct 4, 2024 Share

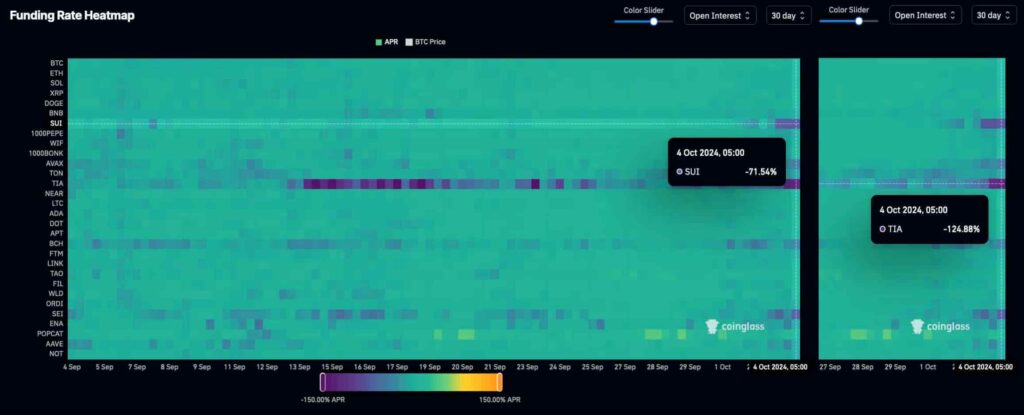

As October started, the cryptocurrency market faced a significant crash, increasing the bearish sentiment and attracting highly capitalized short-sellers. Some cryptocurrencies now risk suffering a short squeeze as imbalances appear in the market’s open interest, dominated by short positions.

In particular, Sui (SUI) and Celestia (TIA) stand out with remarkably high negative funding rates, according to data from CoinGlass. On October 4, SUI and TIA short-sellers were paying 71.54% and 124.88% APR to long position holders, respectively.

These funding rates were the most asymmetric among the 30 cryptocurrencies with the highest open interest in the market.

Picks for you

Sell signal: Ethereum long-term investors offload massive ETH positions 3 hours ago Bitcoin pattern in 'full motion' sets BTC price for the end of 2024 4 hours ago You can now legally bet on U.S. presidential election 6 hours ago SHIB price rockets 10% as Shiba Inu adds $1 billion in a day 7 hours ago

Essentially, funding rates can increase or shrink due to imbalances between open shorts and longs, interfering in the dynamics. Highly shorted markets will punish short-sellers with a higher cost to keep their positions open, potentially causing a short squeeze.

Funding Rate Heatmap of SUI and TIA. Source: CoinGlass / Finbold

Funding Rate Heatmap of SUI and TIA. Source: CoinGlass / Finbold

Sui (SUI) short squeeze alert

First, Sui reached an all-time high open interest of $502.28 million on October 2, trading at $1.85. This was caused mainly by a surge in short positions, evidenced by SUI’s funding rates suddenly becoming highly negative.

The trend continued, and on October 4, the token reached a record negative funding rate at the $1.69 price. In its current state, Sui could soon suffer a short squeeze if its demand experiences an unexpected rise.

Notably, the last time SUI saw such an imbalance, weighted by its total open interest, prices increased significantly in August.

SUI OI-Weighted Funding Rate and SUI Futures Open Interest. Source: CoinGlass / Finbold

SUI OI-Weighted Funding Rate and SUI Futures Open Interest. Source: CoinGlass / Finbold

Interestingly, the imbalance showed up one day after Sui unlocked over $100 million in vested tokens, as Finbold previously warned. The event raised concerns about Sui venture capitalists (VCs) using retail’s interest as an “easy exit liquidity.”

Early VC investors getting easy exit liquidity. https://t.co/rwyMnr8JID

— ₳ Ben (@benohanlon) September 30, 2024

Celestia (TIA) extreme negative funding rates

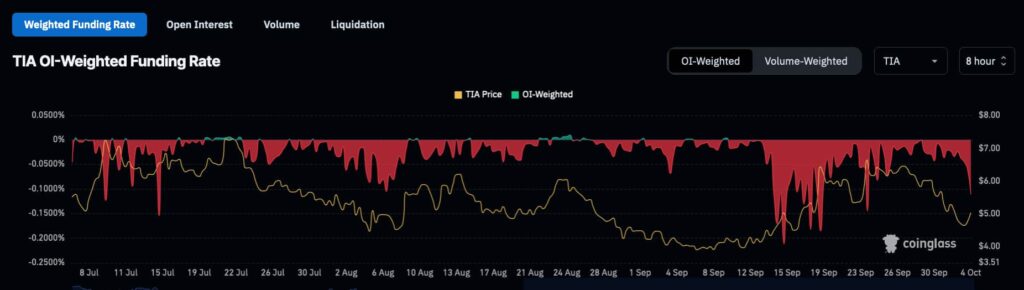

Second, Celestia presents the highest imbalance in the market, with a nearly -125% funding rate by press time. This, however, appears to be a normal state for its native token, TIA, according to the cryptocurrency’s historical funding rate.

Moreover, despite having the highest negative rate, Celestia had far worse short-selling imbalances in the past when weighted by OI. Similarly to SUI, its chart evidences how negative funding rate spikes usually preceded short squeezes, followed by price increases.

TIA OI-Weighted Funding Rate. Source: CoinGlass / Finbold

TIA OI-Weighted Funding Rate. Source: CoinGlass / Finbold

While increased short-selling and high negative funding rates can potentially cause short squeezes and price surges, traders should remain cautious. This is because short positions usually increase when assets are overbought or a bearish sentiment dominates the market.

SUI, for example, recently surged by over 100% in a short time frame, suggesting an overbought cryptocurrency. TIA, on the other hand, is clearly dominated by short-sellers amid an ongoing bearish perception since July.

Therefore, these projects could not suffer a short squeeze unless further data suggests otherwise and the sentiment shifts. Traders can open and close positions at any time, re-evaluating according to the market’s dynamics.