Story Highlights

-

Economic growth in G-7 countries boosts investor confidence in riskier assets like Bitcoin.

-

Expected interest rate cuts from the Fed could increase Bitcoin demand.

-

Stable U.S. stock market conditions indicate potential for a Bitcoin bull run.

Bitcoin’s price dropped sharply, hitting a low not seen in four months at around $53,500, marking a decline of over 9.3%. Despite Germany’s significant Bitcoin sales and fears surrounding Mt. Gox’s liquidation, macroeconomic factors and ongoing risk appetite in traditional markets hint at a robust recovery.

However, the broader outlook for Bitcoin suggests that once these specific supply pressures are resolved, the market could rebound strongly. Meanwhile, here are some of the key reasons why Bitcoin could begin its bull run soon.

Economic Growth in G-7 Countries

The G-7, a group of the world’s leading economies, is currently in a phase of economic growth. This growth, combined with high interest rates, is encouraging investors to put more money into riskier assets like Bitcoin and stocks.

The OECD’s leading indicator, which predicts short-term economic trends, has surpassed 100, indicating strong and accelerating growth.

Interest Rate Cuts To Boost Bitcoin

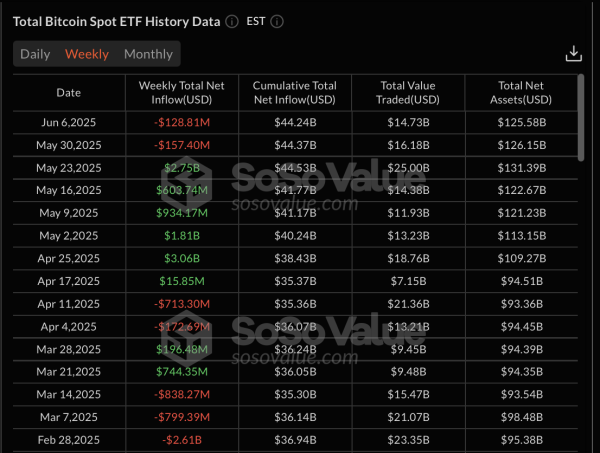

The U.S. Bureau of Labor Statistics will soon release its June consumer price index (CPI) report. This report is expected to show a 3.1% increase over the past year, down from May’s 3.3% rise.

This decrease suggests progress toward the Federal Reserve’s 2% inflation target, which could lead to lower borrowing costs by the end of the year. Historically, lower interest rates have increased demand for Bitcoin, as seen earlier this year when lower-than-expected CPI reports boosted Bitcoin ETF investments.

Tech Positivity To Support Bitcoin

Wall Street’s current optimism in the technology sector is another positive sign for Bitcoin. The ratio between the tech-heavy Nasdaq index and the broader S&P 500 has reached record highs, reflecting strong investor confidence.

Bitcoin has historically rallied during periods when tech stocks perform well, tying its success to the tech market’s growth.

Concerns about a potential U.S. stock market bubble seem unfounded. According to TS Lombard, U.S. margin debt is growing slower than equity market cap, indicating that market performance is not mainly driven by borrowed money. Investor positions in both S&P 500 and Nasdaq futures are also close to neutral, suggesting stability.