Bitcoin at risk as investors interest is ‘worse than bear market’ lows

![]() Cryptocurrency Sep 29, 2024 Share

Cryptocurrency Sep 29, 2024 Share

Investors anticipating a possible continuation of Bitcoin’s (BTC) rally to reclaim the $70,000 level might have to wait longer as the general market sentiment is not fully bullish.

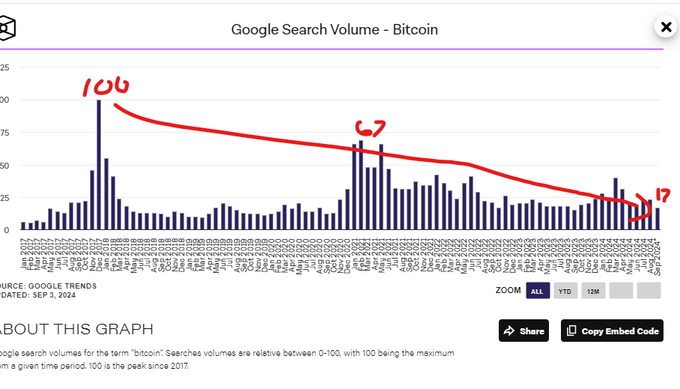

Specifically, Bitcoin is facing dwindling interest from investors, with search volumes reflecting levels lower than those seen during the most challenging bear markets, according to data shared by Alex Becker.

Google search volume for Bitcoin. Source: Alex Becker

Google search volume for Bitcoin. Source: Alex Becker

An analysis of search trends indicates that while the crypto community perceives increasing bullish sentiment, the broader market remains largely disengaged. Looking at metrics such as YouTube and Google search data, crypto interest remains at what Becker termed “worse than bear market” levels.

Picks for you

Beware: Cryptocurrencies to unlock $300 million supply this week 20 mins ago Bitcoin price must clear this level before a ‘solid run up to $100,000’ 18 hours ago Expert explains how he turned $40,000 into $10 million last cycle 18 hours ago This metric hints at gold’s ‘major top’ in Q4 2024 22 hours ago

“It may seem like everyone is too bullish right now. You need to step back. On YT and Google crypto interest is still at “worse than bear market” lows,” he said.

The data indicated that the search volume dropped from its peak in 2020, when it hit the maximum search interest score of 100, to just 17, a contrast showing the scale of investor disinterest.

Becker emphasized that roughly 85% of the retail crowd has left the market, meaning that most investors are bearish and have completely abandoned tracking crypto trends. He added that for Bitcoin and the broader crypto space to regain significant traction, current online engagement must increase by at least 3.5 times.

Additionally, Becker suggested that this disengagement signifies that while a vocal minority remains bullish, the majority is bearish, rendering Bitcoin and other cryptocurrencies irrelevant.

Bitcoin’s all-time high to wait longer

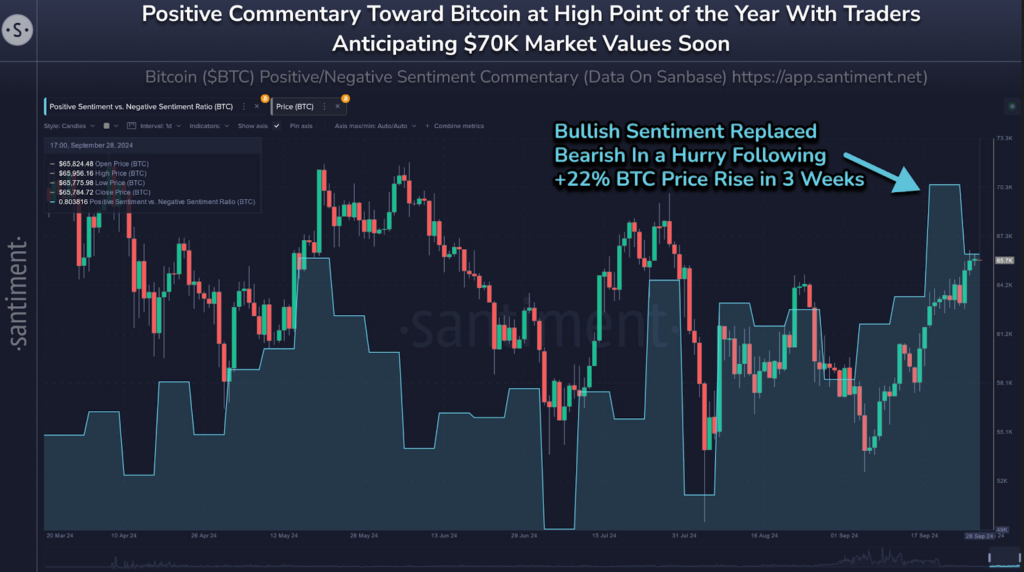

The sentiment around the digital asset also hints at what awaits Bitcoin based on market interest, as indicated by data shared by crypto analysis platform Santiment in an X post on September 29.

The platform acknowledged that Bitcoin has witnessed a 22% surge in value, sparking optimism about a possible continuation. However, this wave of bullish sentiment might be counterproductive to the imminent all-time high some in the market are anticipating.

According to the data, Bitcoin’s positive commentary is currently at the highest point of the year, with 1.8 bullish posts for every bearish post. This ratio of bullish-to-bearish sentiment reflects the crowd’s enthusiasm for a swift rally, possibly to the $70,000 level.

Bitcoin positive/negative sentiment. Source: Santiment

Bitcoin positive/negative sentiment. Source: Santiment

As Santiment observed, historically, markets often move opposite to the majority’s expectations. When overly positive sentiment arises, it can signal a potential pullback or stagnation.

Excessive optimism can lead to diminished demand or profit-taking by larger investors, causing short-term downward pressure. While long-term fundamentals are strong, the market may need time to digest gains and reset before the next push higher.

Bitcoin remains in the ‘Greed’ zone

The current market overconfidence is also seen on the crypto Fear & Greed Index, which is currently in the “Greed” zone, with a reading of 63. This sentiment highlights growing investor confidence, a significant shift from recent months of cautious or mixed sentiment.

Crypto Fear & Greed Index. Source: Alternative

Crypto Fear & Greed Index. Source: Alternative

The Fear & Greed Index, which oscillates between extreme fear and extreme greed on a scale of 0 to 100, provides insights into whether market participants are overly bullish or bearish.

However, high greed levels can sometimes indicate overbought conditions and a potential market correction, as emotional exuberance rather than fundamentals may drive prices.

An analysis by Alan Santana supports the possible bearish sentiment. The expert noted that investors should anticipate a potential correction when Bitcoin forms a ‘major low’ in the coming months. In this line, if Bitcoin continues to trade below the $71,000 mark, the crypto will likely drop further, as this level signals sustained bearishness.

However, market analyst CyclesFan, in an X post on September 29, offered a dissenting voice, noting that Bitcoin is destined for a record high in Q4 2024. The expert observed that after enduring a five-month correction, Bitcoin’s price action signals a potential breakout to new all-time highs by Q4 2024.

The correction phase, which ended in August when Bitcoin touched its 12-month moving average, mirrors a similar market structure seen before the bull market peak in 2021.

Bitcoin price analysis chart. Source: Investing.com

Bitcoin price analysis chart. Source: Investing.com

If history repeats, investors anticipate Bitcoin to rally in tandem with the ‘Uptober’ momentum, where the asset tends to perform better in October. To this end, some analysts maintain that if Bitcoin clears $68,000, it is open to claiming the $100,000 record high.

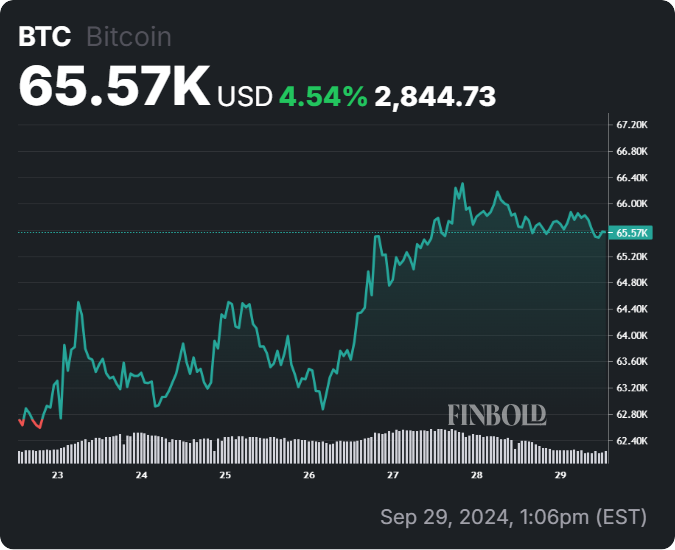

Bitcoin price analysis

As of press time, Bitcoin was trading at $65,570, with daily losses of about 0.3%. On the weekly chart, BTC is up almost 5%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Overall, while Bitcoin has experienced a recent surge and growing bullish sentiment, its path to reclaiming the $70,000 level may face challenges. The first challenge investors need to keep an eye on is the crypto’s ability to maintain its price above $65,000.