Synopsis

During the session, Saketh stressed that although many traders concentrate on perfecting strategies, it’s psychological resilience and discipline that distinguish successful traders from those who struggle. He noted that 93% of traders fail to last more than two years in the market, often due to emotional decision-making rather than flawed strategies.

In a recent live stream, hosted in collaboration with Delta Exchange, trading expert Saketh Ramakrishna shared crucial insights on why trading psychology often outweighs the importance of strategy in the volatile world of crypto trading. While strategies and techniques can be learned, it’s a trader’s mindset that ultimately determines long-term success.

During the session, Saketh emphasised that while many traders focus on mastering strategies, it’s the psychological resilience and discipline that truly set apart successful traders from those who struggle in the market. He highlighted that 93% of traders fail to survive in the market beyond two years, often due to emotional decisions rather than poor strategy.

Watch Live Stream Full Video Here

Long-Term Focus is Key

According to Saketh, adopting a long-term mindset is essential for anyone serious about crypto trading. Too many traders enter the market looking for quick profits, which can lead to high-risk decisions and, often, significant losses. Instead, Saketh advised traders to focus on preserving capital and staying in the market for the long term.

Crypto Tracker![]() TOP COIN SETSAI Tracker20.84% BuyNFT & Metaverse Tracker14.97% BuyDeFi Tracker14.28% BuySmart Contract Tracker8.19% BuyBTC 50 :: ETH 505.59% BuyTOP COINS (₹) Solana13,465 (3.31%)BuyBNB51,211 (2.34%)BuyBitcoin5,557,393 (2.17%)BuyEthereum225,210 (1.82%)BuyTether84 (-0.03%)Buy

TOP COIN SETSAI Tracker20.84% BuyNFT & Metaverse Tracker14.97% BuyDeFi Tracker14.28% BuySmart Contract Tracker8.19% BuyBTC 50 :: ETH 505.59% BuyTOP COINS (₹) Solana13,465 (3.31%)BuyBNB51,211 (2.34%)BuyBitcoin5,557,393 (2.17%)BuyEthereum225,210 (1.82%)BuyTether84 (-0.03%)Buy

“In trading, your goal isn’t to make fast money. The goal is to stay in the market for the long run,” he explained during the live session. This long-term focus allows traders to navigate through market volatility, avoiding reckless decisions driven by greed or fear.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

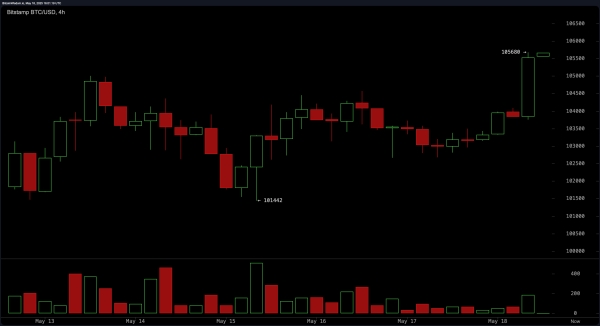

Mindset Over Strategy![]()

Saketh argued that while strategies are important, they won’t lead to success without the right mindset. Emotional reactions to market fluctuations, such as panic selling or overleveraging in moments of excitement, often cause traders to deviate from their strategies, leading to losses.

“You can learn any strategy, but without the right mindset, it won’t matter. Even the best strategies won’t save you if you don’t have psychological resilience,” Saketh said. He stressed that profits should be seen as a byproduct of a disciplined trading process, rather than the primary goal.

Capital Preservation Above All

A recurring theme in Saketh’s talk was the importance of capital preservation. In the highly leveraged world of crypto, traders often fall into the trap of using excessive leverage, which can quickly deplete their accounts. Saketh advised traders to prioritize capital preservation, ensuring that they can stay in the market and recover from losses.

“If you misuse leverage, you can lose everything. But if you trade with the aim of preserving capital, you can stick in the market for the long term,” he noted.

Discipline and Sticking to the Plan

One of the biggest mistakes traders make, according to Saketh, is abandoning their trading plan in moments of emotional stress. He underscored the importance of having a clear plan for entry, exit, and stop-losses and—most importantly—sticking to that plan, even when market conditions tempt you to act otherwise.

“Trading without a plan is like walking into a minefield. You need to know when to exit and where your stop-losses are. The hardest part is sticking to your plan,” Saketh advised during the live stream.

“Trading psychology is the foundation. Master that, and the profits will follow as a byproduct, not the primary goal,” he concluded.

Watch Live Stream Full Video Here(Note: This article is for educational purposes only)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)