Bitcoin price is set to ‘crash and produce one major low’

![]() Cryptocurrency Sep 25, 2024 Share

Cryptocurrency Sep 25, 2024 Share

Although Bitcoin (BTC) is solidifying its position above the $60,000 support zone, a cryptocurrency analyst has warned that the maiden digital asset is headed for a significant downturn.

Particularly, Bitcoin is likely to crash and form a major low in the coming months, a period that will possibly be marked by high volatility if it continues to trade below $70,000, Alan Santana noted in a TradingView post on September 25.

Santana highlighted the technical challenges Bitcoin has faced since reaching an all-time high of $74,000 in March 2024. In early March, a powerful bearish signal emerged, with the highest daily bearish volume seen in years on March 5, foreshadowing the market’s downward trajectory.

Picks for you

Crypto trader turns $1.3k into $3.4 million in 15 days 7 hours ago Here's what Bitcoin needs before 'Uptober' can start 7 hours ago Silver is in one of its ‘hottest bull markets of all time’ 10 hours ago Warren Buffett just dumped $860 million of this stock 11 hours ago

Since then, Bitcoin has been unable to recover, producing a series of lower highs until it ultimately crashed in early August. Santana pointed out that this downward trend remains intact, leaving little room for optimism unless key levels are reclaimed.

The descending triangle formed on Bitcoin’s chart is a crucial pattern contributing to Santana’s bearish stance. This formation, often pointing to further downside, has intensified concerns of a breakout to lower levels. According to Santana, the potential severity of the decline shows Bitcoin possibly falling as low as the $30,000 range.

Bitcoin price analysis chart. Source: TradingView/Alan Santana

Bitcoin price analysis chart. Source: TradingView/Alan Santana

Bitcoin’s price levels to watch

Despite the bearish outlook, Santana suggested that two scenarios could shift Bitcoin into bullish territory. The first would be a breakout above $71,000, invalidating much of the current downward momentum. The second would involve Bitcoin producing a new low with reduced selling volume and oversold indicators, signaling that a bottom may be near. In either case, Santana stressed that Bitcoin will need to show clearer signs of reversal before any optimism can take hold.

The expert added that Bitcoin would likely produce one major low before beginning any meaningful recovery, with crash timelines set for September or November 2024, depending on market conditions.

“We continue 100% bearish on Bitcoin as long as it trades below $70,000/$71,000 on the weekly/monthly close.<…> Bitcoin is set to crash and produce one major low. It can happen now, September 2024, or later in November 2024,” Santana noted.

Meanwhile, while Santana foresees a possible downturn, the expert believes an opportunity might be opening in the altcoin market. As reported by Finbold, Santana noted that small-cap altcoins have turned bullish since they have already hit their bottom, unlike Bitcoin.

Bitcoin’s critical support zone

In an X post on September 25, crypto trading expert Ali Martinez noted that Bitcoin is currently at a critical juncture with the asset facing potential price movement in both directions.

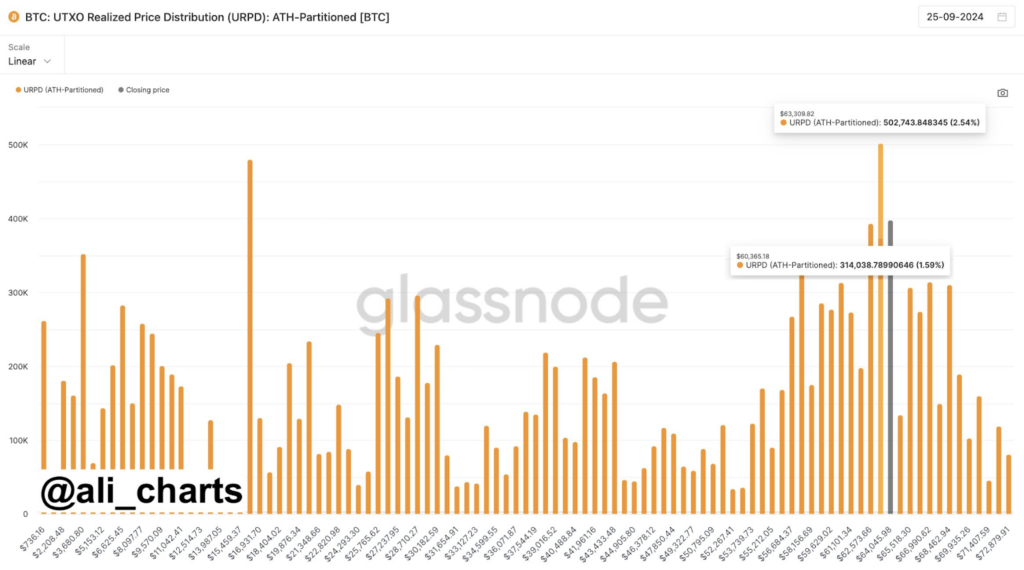

Martinez stated that data indicates Bitcoin’s most critical support zone is at $63,300 since it marks the level where the largest accumulation of realized transactions occurred. At this level, over 500,000 BTC were transacted. Therefore, if Bitcoin maintains this key support, the asset could target $65,500.

Bitcoin realized price distribution chart. Source: Glassnode

Bitcoin realized price distribution chart. Source: Glassnode

However, a failure to hold $63,300 may result in a downward move toward $60,365, where approximately 314,000 BTC were transacted, marking the next potential support level.

Bitcoin price analysis

Bitcoin was trading at $63,650 at press time, reflecting gains of about 0.7% in the last 24 hours. Over the past seven days, BTC is up almost 7%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Overall, Bitcoin is showing a strong bullish trend as it sits above both the 50-day SMA ($59,657) and the 200-day SMA ($61,683). This indicates positive momentum in both the short and long term. Therefore, as long as the crypto sustains the price above these values, there is room for further growth.