On July 8, Katie Stockton, founder and managing partner of Fairlead Strategies, appeared on CNBC’s “Squawk Box” to share her insights on Bitcoin’s recent volatility and broader market trends. In her conversation with co-host Joe Kernen, Stockton provided a detailed analysis of the current state of the cryptocurrency market and the technical indicators that investors should watch.

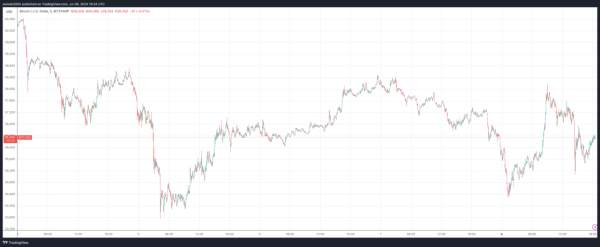

Katie Stockton began by addressing Bitcoin’s recent decline, noting that the cryptocurrency had fallen below $55,000 for the first time since February.

Source: TradingView

Source: TradingView

Stockton explained that this drop followed the announcement from Mt. Gox that it had begun making repayments nearly a decade after collapsing into bankruptcy. Stockton emphasized that Bitcoin’s price movement often serves as an indicator for other risk assets, highlighting its recent high correlation with the NASDAQ 100.

Katie Stockton noted that while the NASDAQ has continued to perform well, Bitcoin has broken some critical support levels. Stockton identified $60,000 as a key support level for Bitcoin, and its breach suggests further corrective price action. Stockton predicted that the next support level for Bitcoin is around $51,500, indicating potential further downside while still maintaining a long-term uptrend.

Stockton emphasized her belief in maintaining a small percentage of a portfolio in Bitcoin, regardless of short-term price action. Stockton views Bitcoin as a long-term investment with significant upside potential, akin to a call option. Stockton mentioned that if Bitcoin were to fall into the $40,000 range, it could indicate a structural issue from a technical perspective, potentially jeopardizing its long-term uptrend.

When discussing broader market trends, Stockton observed that the S&P 500 and the NASDAQ are heavily influenced by a few mega-cap stocks, particularly in the technology sector. Stockton pointed out that stocks like Apple, Meta, and Tesla have shown short-term breakouts, contributing to the market’s upward momentum. Stockton explained that this narrow leadership could be concerning, as it indicates limited breadth in the market’s performance.

Katie Stockton expressed skepticism about relying on negative divergences to predict bearish market trends. Stockton argued that while negative divergences might show a less healthy market, they do not necessarily signal the end of an uptrend. Stockton predicted that the second half of the year would likely see more volatility, with the uptrend maintaining itself but experiencing more corrective phases.

In her conversation with Joe Kernen, Stockton addressed the frustration among investors about the narrow, concentrated leadership in the market. Stockton noted that despite these frustrations, there are still numerous opportunities for investment beyond large-cap technology stocks. Stockton highlighted the commodity-related stocks, particularly in energy and materials, as areas showing promising technical setups.

Katie Stockton pointed out that crude oil appears to be pushing out of a long-term triangle formation, suggesting potential strength in energy stocks. Stockton also mentioned that copper has shown signs of downside exhaustion, which could indicate a buying opportunity in related stocks. Stockton emphasized the importance of being on the right side of these trends, regardless of how narrow the market leadership might be.

Stockton and Kernen also reminisced about past market cycles, with Kernen recalling the NASDAQ’s previous milestones. Stockton noted the impressive targets derived from flag patterns in the S&P 500 and the NASDAQ, indicating potential further upside. Stockton underscored the market’s ability to continue its upward trajectory despite past volatility.

Featured Image via Pixabay