A large cryptocurrency whale has deposited 750 Bitcoin (BTC), worth approximately $47.9 million, into Binance, one of the world’s largest cryptocurrency exchanges. This deposit, made about 30 minutes ago, is widely interpreted as a profit-taking move, as whales often offload large amounts of BTC on exchanges when preparing to sell. The timing of this move suggests that the whale is capitalizing on current market conditions, possibly eyeing short-term price fluctuations.

This smart whale deposited 750 $BTC ($47.9M) to Binance for profit ~30 minutes ago.

Note that the whale’s recent moves were accumulating 1,115 $BTC ($65.1M) from #Binance in early September at an average price of only $58,382! 👇

Current holding: 3,083 $BTC ($196.9M).

Estimated… https://t.co/MPzAXyEGJh pic.twitter.com/fZfQEQvA1W— Spot On Chain (@spotonchain) September 24, 2024

This whale’s latest transaction follows a series of notable accumulations. In early September, the same whale acquired 1,115 BTC from Binance at an average price of $58,382 per coin, totaling $65.1 million. This suggests the whale has been strategically buying Bitcoin at favorable price points, likely during periods of market consolidation. The accumulation phase reflects a typical whale strategy—buying large amounts of BTC when prices are relatively lower and waiting for the market to rise before making profit-driven moves.

Massive Bitcoin Holdings and Substantial Profit Gains

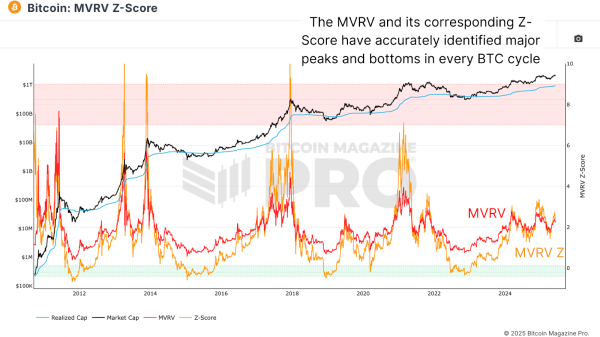

According to Spot on Chain, the whale currently holds 3,083 BTC, valued at a staggering $196.9 million. Over the recent trading period, this whale has achieved an estimated total profit of $80.5 million, translating into a 44% return on investment. This sizable profit suggests careful timing and a shrewd understanding of market cycles, allowing the whale to capitalize on both dips and rallies in the Bitcoin market.

Such large movements from whales can have significant effects on the broader market. Whale deposits on exchanges like Binance are often followed by sharp market movements, as traders and investors anticipate possible sell-offs. The deposit of 750 BTC could indicate that the whale is looking to take profits, which may influence Bitcoin’s price in the short term. With BTC hovering around a critical resistance level, this whale’s move might trigger volatility, as other traders look to front-run the potential sale or respond to the influx of supply on the exchange.

This activity highlights the ongoing importance of whale movements in shaping cryptocurrency market trends. When large-scale investors like this whale make bold moves, it can spark reactions from smaller investors and traders, leading to potential price swings across the market.