Two second-layer Ethereum tokens to avoid amid massive unlocks

![]() Cryptocurrency Sep 14, 2024 Share

Cryptocurrency Sep 14, 2024 Share

The Ethereum (ETH) ecosystem comprises dozens of second-layer blockchains (L2s), each regularly unlocking millions of dollars of their native tokens. These massive unlocks create significant selling pressure, potentially leading to price loss over time as private investors dump on retail.

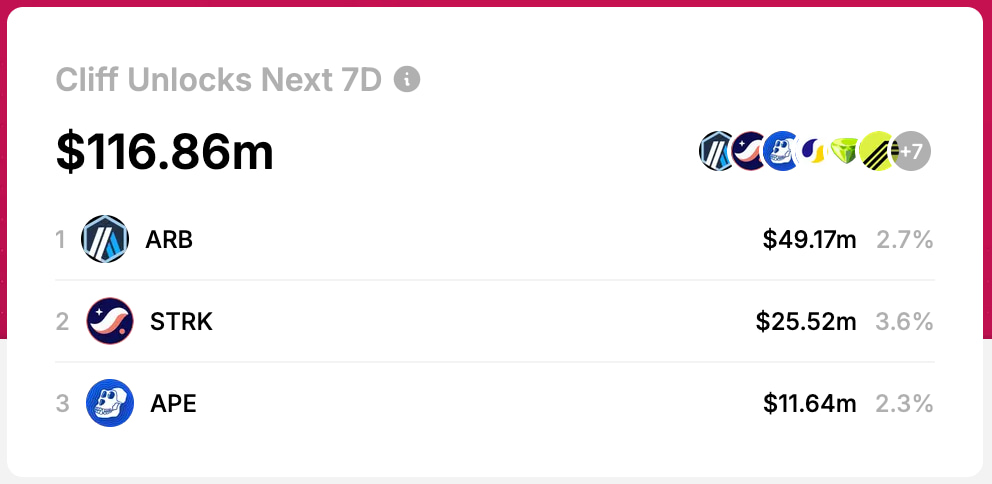

This week, two popular Ethereum L2s will unlock nearly $100 million worth of tokens, according to retrieved data from TokenUnlocksApp.

In particular, Arbitrum (ARB) and Starknet (STRK) will be responsible for $74.69 million of the $116.86 million released from 13 cryptocurrencies in the seven days starting September 14. These events will represent a circulating supply inflation of 2.7% and 3.6% for ARB and STRK, respectively.

Picks for you

OpenAI’s o1 predicts Gold price for the end of 2024 15 mins ago Gold or Bitcoin? Robert Kiyosaki puts an end to the debate 4 hours ago Crypto millionaire loses over $40 million with this trade 5 hours ago Revealed – Here's the S&P 500 best trading strategy since launch 20 hours ago

Essentially, Arbitrum leads the charge, unlocking 92.65 million ARB on September 16, worth $49.17 million, by press time. Meanwhile, Starknet follows closely with a 64 million STRK unlock on September 15, worth $25.52 million.

Cliff Unlocks Next 7D. Source: TokenUnlocksApp / Finbold

Cliff Unlocks Next 7D. Source: TokenUnlocksApp / Finbold

The Ethereum layer-2 scaling debate and controversy

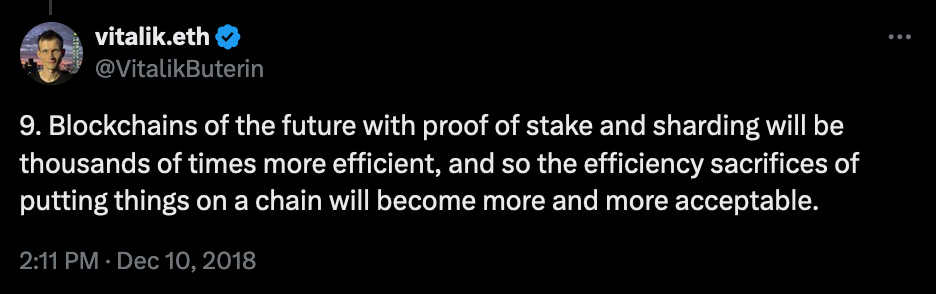

In 2018, Vitalik Buterin, Ethereum’s creator, forecasted the future of cryptocurrencies would be based on proof of stake and sharding.

“Blockchains of the future with proof of stake and sharding will be thousands of times more efficient, and so the efficiency sacrifices of putting things on a chain will become more and more acceptable.”

– Vitalik Buterin

Vitalik Buterin’s post, as quoted. Source: X / Finbold

Vitalik Buterin’s post, as quoted. Source: X / Finbold

However, the Ethereum core development pivoted from half of this vision to scaling the blockchain in layers. This happened after years of trying to implement the sharding technology and failing to find a working solution.

Interestingly, other blockchains like MultiversX (EGLD) have successfully implemented all three types of sharding. This chain was called the “technological Holy Grail of crypto” by Justin Bons, as Finbold reported.

Bons, founder and CIO of Europe’s oldest cryptocurrency fund, recently appeared to criticize Ethereum’s layer-2 scaling model in a debate hosted by Laura Shin at Unchained. In summary, he explained that Ethereum’s second layers are essentially centralized and parasitic systems against ETH with their tokens.

ETH Is Down Bad, While Layer 2s Are Ripping. Are L2s Parasitic to Ethereum?

💥 @Justin_Bons and @RyanBerckmans dive into a fierce debate:

🔥 Can Ethereum scale without losing to L2s?

🔻 Does the blockchain trilemma not exist anymore?

📉 Is Ethereum’s L1 stuck in the past?

👊 ETH… pic.twitter.com/6uNY5fIWWe— Laura Shin (@laurashin) September 10, 2024

Arbitrum (ARB) recurrent unlocks and inflation

As defended by Justin Bons in the debate, Ethereum L2s have conflicting financial interests, given their tokenomics. Notably, vesting contracts unlock early private allocations from VCs who must sell these tokens at a higher price, a dynamic Justin Bons described as “predatory.”

In this context, Finbold has reported some of Arbitrum’s monthly unlocks with their respective nominal values, showing a consistent monthly loss.

For example, the same 92.65 million ARB unlocked in June was worth $85.37 million, as reported. In July, Arbitrum’s unlock had a nominal value of $65 million, resulting in 42% and 24% losses to date, respectively.

In closing, investors and traders must closely follow ongoing token unlocks to avoid buying other players’ exit strategies. As the selling pressure increases, these dumps can directly impact the long-term price performance of these cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.