Synopsis

Cryptocurrency prices declined on Wednesday, with Bitcoin, Ethereum, and Solana leading the drop, as investors awaited the U.S. consumer price index report. The data could influence future Federal Reserve policy moves, adding to current market volatility.

The cryptocurrency market saw a decline on Wednesday, dragged by Bitcoin, Ethereum, and Solana, as investors awaited the US consumer price index report for policy cues.

As of 1:30 pm IST, Bitcoin was down 0.9% at $56,706, while Ethereum dropped 0.92% to $2,341. Other major cryptocurrencies also saw declines: BNB fell 1.2%, Solana dropped 1.9%, XRP slipped 1%, Dogecoin fell 2.75%, Shiba Inu dropped 1.65%, and Polkadot lost 2.6%.

The U.S. Labor Department’s consumer price index report for August, due later today. Although the Federal Reserve has shifted its attention to employment over inflation, the data could provide clues about future policy moves.

Crypto Tracker![]() TOP COIN SETSWeb3 Tracker5.72% BuyAI Tracker3.62% BuySmart Contract Tracker-2.08% BuyCrypto Blue Chip – 5-3.22% BuyBTC 50 :: ETH 50-3.95% BuyTOP COINS (₹) Tether84 (0.06%)BuyBitcoin4,741,409 (-1.0%)BuyEthereum195,273 (-1.05%)BuyBNB42,927 (-1.32%)BuySolana11,043 (-2.32%)BuyWhile the Fed is widely anticipated to cut interest rates next week, the size of the cut remains uncertain, especially after Friday’s mixed labor report. Markets are currently pricing in a 65% chance of a 25 basis point rate cut, and a 35% chance for a 50 basis point cut, according to the CME FedWatch tool.

TOP COIN SETSWeb3 Tracker5.72% BuyAI Tracker3.62% BuySmart Contract Tracker-2.08% BuyCrypto Blue Chip – 5-3.22% BuyBTC 50 :: ETH 50-3.95% BuyTOP COINS (₹) Tether84 (0.06%)BuyBitcoin4,741,409 (-1.0%)BuyEthereum195,273 (-1.05%)BuyBNB42,927 (-1.32%)BuySolana11,043 (-2.32%)BuyWhile the Fed is widely anticipated to cut interest rates next week, the size of the cut remains uncertain, especially after Friday’s mixed labor report. Markets are currently pricing in a 65% chance of a 25 basis point rate cut, and a 35% chance for a 50 basis point cut, according to the CME FedWatch tool.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »“Market volatility is likely with U.S. CPI data. If inflation is lower than expected, we could see a short-term rally. The Fear & Greed Index is at 37, showing fear, but it’s better than last week’s extreme fear,” said CoinSwitch Markets Desk.![]()

The CoinDCX Research Team added, “The market saw an uptick yesterday but dipped today after the Kamala-Trump debate ended without any cryptocurrency discussion. This caused Trump’s winning chances on Polymarket to drop from 51% to 49%. While the market looks positive on higher time frames, the open CME gap at $53,000 is a concern. Today’s CPI data will be critical in setting the direction.”

The global crypto market cap fell by 9.6% to $1.99 trillion, with total market volume decreasing 7.7% to $63.12 billion. Stablecoins accounted for $57.87 billion of this volume, or 91.69%, according to .

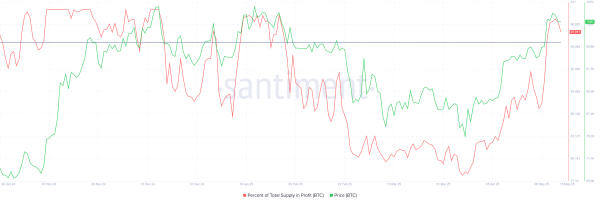

In the last 24 hours, Bitcoin’s market cap dropped to $1.118 trillion. Bitcoin’s dominance now stands at 56.02%. BTC volume in the same period fell 8.5% to $30.9 billion.

“Bitcoin is consolidating around $57,000, showing resilience. Its 30-day average funding rate for perpetual futures has turned negative, and ETFs have stopped a series of outflows, signaling renewed confidence. Bitcoin needs to break past the key $57,800 resistance to maintain momentum,” said Vikram Subburaj, CEO of Giottus.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

“To know even one life has breathed easier because you have lived. This is to have succeeded.” – Ralph Waldo Emerson

For the full poem, click here