The recent Bitcoin (BTC) price rally above $56k has raised expectations of further crypto rebound in the coming days. Bitcoin’s daily Relative Strength Index (RSI) has been forming a bullish divergence amid the rising demand from whale investors.

Furthermore, the US spot Bitcoin ETFs posted a net cash inflows of about $28 million on Monday, led by Fidelity’s FBTC. Additionally, on-chain data shows the overall supply of stablecoins on centralized exchanges increased by about $300 million in the past 24 hours.

Short Squeeze Impact on Bitcoin Price

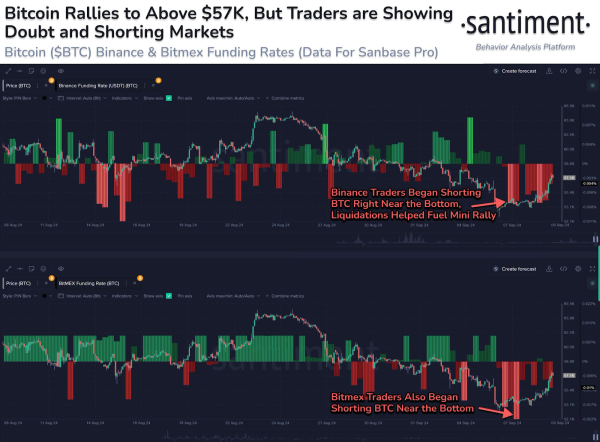

According to market data provided by Santiment, the possibility of a Bitcoin short squeeze in the near term has significantly increased based on the heightened short funding rates. Ideally, an increase in short position in crypto exchanges leads to their forced liquidation, which attracts whale traders to long the instrument and vice versa.

As a result, Santiment believes the chances of further Bitcoin pumping in the coming days are higher until the funding rate on major exchanges turns long.

Midterm BTC Price Targets

we simply can’t be friends if you think the greatest bull flag in $BTC history is going to break down pic.twitter.com/KpUMmrcw2p

— Satoshi Flipper (@SatoshiFlipper) September 9, 2024

Ahead of tomorrow’s US CPI data, which will heavily determine whether the Fed initiates much-awaited interest rate cuts on September 18, Bitcoin price is expected to register heightened. From a technical analysis standpoint, Bitcoin price has been retesting the lower border of a weekly falling channel.

Most importantly, Bitcoin price has been forming a potential reversal pattern characterized by a weekly head and shoulders (H&S) pattern coupled with a bullish divergence on the RSI.

As a result, Bitcoin price could easily pump towards the support level around $59k before retracting towards $50k.