Crypto market wipes $600m in a week, 2nd largest outflow in history

![]() Cryptocurrency Sep 9, 2024 Share

Cryptocurrency Sep 9, 2024 Share

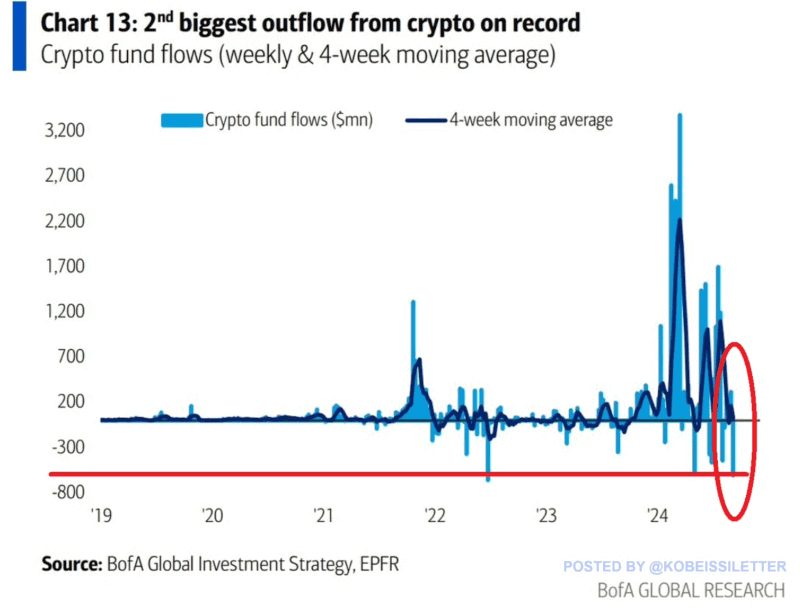

As the new week begins on a more positive note for many assets in the cryptocurrency industry, the past week has marked the second-largest negative weekly flow from the sector since its inception, recording a whopping $600 million in crypto fund outflows.

Specifically, crypto fund flows have witnessed the second-most massive weekly decline ever, with the largest outflow taking place during the bear market in late 2022, according to recent data shared by markets analytics platform The Kobeissi Letter in an X post on September 7.

Crypto fund flows. Source: The Kobeissi Letter

Crypto fund flows. Source: The Kobeissi Letter

Indeed, following several weeks of consistent drains, the outflows in the last week reached $600 million, second only to the $700 million from late 2022, the year in which the crypto industry suffered a crippling bear market and investors, businesses, and consumers around the world lost nearly $2 trillion.

Picks for you

Asa Hutchinson's net worth revealed: How rich is the former Arkansas governor? 3 hours ago Ro Khanna’s net worth revealed: How rich is the US Representative for California? 6 hours ago GRVT teams up with leading industry makers and secures over $3 billion in monthly volume 6 hours ago Bernstein analysts predict Bitcoin price if Kamala Harris wins election 6 hours ago

On the other hand, in the first quarter of 2024, crypto funds regularly experienced inflows, culminating in as much as $3.3 billion. Notably, the analysts ascribed the recent losses to the declining risk appetite in crypto “despite expectations that the Fed will cut rates this month.”

Market cap and Bitcoin follow

At the same time, the crypto sector lost $80 billion in its total market capitalization the past week, during which declined from $2.02 trillion on September 2 to $1.94 trillion on September 8, according to the most recent CoinMarketCap data retrieved by Finbold.

Total crypto market cap 1-month chart. Source: CoinMarketCap

Total crypto market cap 1-month chart. Source: CoinMarketCap

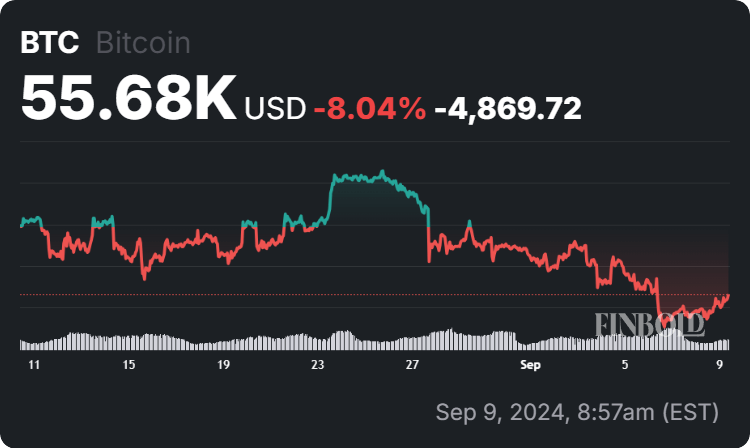

Meanwhile, the crypto’s representative and the largest asset in the sector by market cap, Bitcoin (BTC), was at press time trading at the price of $55,680, reflecting a 1.76% increase on the day, a loss of 5.23% across the week, and an 8.04% drop in the past month.

Bitcoin price 30-day chart. Source: Finbold

Bitcoin price 30-day chart. Source: Finbold

Ultimately, the major crypto fund outflows, combined with the declining market cap and Bitcoin price, could signal a bear market, although other upcoming events, including the Consumer Price Index (CPI) inflation data, the Producer Price Index (PPI) report, and others, are yet to exercise their influence.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.