Synopsis

Bitcoin reached its all-time high of $73,780 in March 2024, right before the halving event occurred. However, despite all expectations of a bull run symmetrical to previous halving events, the world’s largest cryptocurrency has disappointed investors so far registering a 15% fall in the next six months.

Bitcoin reached its all-time high of $73,780 in March 2024, right before the halving event occurred. However, despite all expectations of a bull run symmetrical to previous halving events, the world’s largest cryptocurrency has disappointed investors so far registering a 15% fall in the next six months.

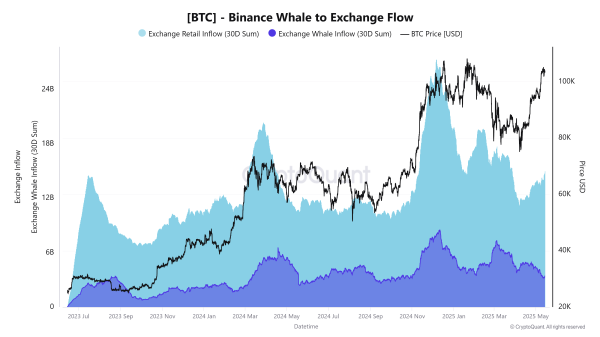

At the time of writing this opinion on September 9, Bitcoin has been unable to sustain its upward momentum and is trading at $55,081. Institutional investors have already provided a sale indicator, and coupled with whales and retail investors booking profits and the upcoming Federal rate cut announcement in September, experts suggest its valuation will slump over 20% in the near future. However, predictions have often worked little to understand the dynamics of the crypto markets in the long-term, but the looming rate cut and the outcome of the US Presidential Election have everything to shape Bitcoin’s future.

As it stands, the $60,000 mark has become the resistance point for Bitcoin in the near future. While BTC’s prior upward momentum has been able to cross the mark a couple of times since the halving event, it has failed to sustain its position, and the resulting movement has forced Bitcoin to seek strength from the support zone at $56,000. The immediate future looks bleak at best, and the Fibonacci Retracement method suggests that it is in a downward spiral and even at the best of scenarios, could probably reach only the $65,000 levels.

Recovery Phase – Halted or Over?

Since August, BTC has majorly remained stagnant between the $55,000 – $62.000 levels and has been unable to achieve any considerable momentum. Experts believe that numerous factors have been at play that have contributed to this stalled momentum. However, one of the major reasons behind this stagnant behaviour has been the market’s developing emphasis on macroeconomic conditions around the world, which has made it more sensitive towards economic factors and global market dynamics. Only this time, the familiarity with the 2022-23 trend seems eerily similar.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker-1.10% BuyNFT & Metaverse Tracker-4.70% BuySmart Contract Tracker-5.38% BuyCrypto Blue Chip – 5-7.03% BuyBTC 50 :: ETH 50-7.94% BuyTOP COINS (₹) Bitcoin4,629,948 (1.43%)BuyEthereum194,937 (1.32%)BuyBNB42,633 (1.05%)BuySolana10,893 (0.3%)BuyTether84 (0.03%)Buy

TOP COIN SETSDeFi Tracker-1.10% BuyNFT & Metaverse Tracker-4.70% BuySmart Contract Tracker-5.38% BuyCrypto Blue Chip – 5-7.03% BuyBTC 50 :: ETH 50-7.94% BuyTOP COINS (₹) Bitcoin4,629,948 (1.43%)BuyEthereum194,937 (1.32%)BuyBNB42,633 (1.05%)BuySolana10,893 (0.3%)BuyTether84 (0.03%)Buy

BTC reached its critical resistance (current support) of $30,000 in April 2023 and subsequently adopted a downtrend that forced it to $26,000 levels in the next few months. However, by the next calendar year, BTC’s upward momentum led it to $48,000 — a bull run that sustained it till its all-time high. With sufficient support following the rate cut announcement and a favourable US Presidential Election, Bitcoin may replicate a similar momentum by 2025 and may create new all-time high levels as well. Different oscillators suggest that Bitcoin’s stay in the overbought zone is reducing, and driven by whales, institutionalised investors and retail investors buying at the dip strategy, it may very well touch the $100,000 mark — just not in the near future.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »![]()

Spot Bitcoin ETFs are being considered critical enablers to BTC’s overall growth in the last couple of months. They have been hugely successful in increasing retail participation — a crucial aspect for sustaining BTC’s bullish momentum beyond 2025. Presently, Bitcoin’s market capitalisation stands at $1.09 trillion, down from $1.44 trillion a few months ago — suggesting the ongoing downtrend. However, as it approaches and accumulates strength from the support zones, the movement may replicate performance from earlier this year.

Surpassing the $100,000 Level

Coupled with the halving event earlier this year, Bitcoin’s future momentum will also require crucial support and favourable scenarios from two significant events — the US Fed rate cut and the US Presidential Election. Even if BTC adopts a bullish momentum based on favourable outcomes in both events, it is improbable that BTC will be able to surpass the $100,000 level soon, even in 2025. However, despite the challenge, it is not impossible. Historical patterns and a supportive environment can propel Bitcoin to cross the $100,000 level in the long term, but numerous aspects linked with macroeconomics, market sentiments and investor behaviour will be crucial to achieving this feat.

Based on historical data, fundamentalists believe that a significant breakout is possible in the mid to long term. If this major breakout is achieved, investors should look forward to BTC breaking its all-time high and establishing new benchmarks where targets lie between $90,000 – $100,000. Sustaining this level will be another discussion, and will require critical support from all stakeholders and initiatives involved. Furthermore, the $100,000 signifies a crucial resistance for the world’s largest cryptocurrency, it’s only possible that the psychology of whales and other institutional investors will look to book profits near that mark. Fundamentalists believe the target lies far north of $100,000 — potentially near $150,000 by the end of 2025. This will require enhanced adoption rates across the world and robust retail participation that displays resilience in the face of market dynamics. Retail investors, however, are required to complete in-depth due diligence before entering the market or risk safeguarding financial interests.

(Attributed to Roshan Aslam, Co- founder & CEO of GoSats.)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)