Bitcoin has struggled to achieve new all-time highs, having failed multiple times over the last five months when it hit $73,750.

A recent analysis by the intelligence platform IntoTheBlock points fingers at the distribution of Bitcoin holders as a major hindrance. The “In/Out of the Money” analysis provides insight into the price levels at which Bitcoin holders are positioned, offering a clear view of where selling pressure is emanating from.

7M Addresses Holding Bitcoin at Loss, Looking for Breakeven

Notably, the analysis reveals that approximately seven million addresses are holding Bitcoin at a loss, with purchase prices ranging from $61,700 to $70,500. These holders are likely waiting for a breakeven point, which could trigger significant selling activity. This tier of investors forms the largest red circle in the image below.

Essentially, this $61,700 to $70,500 range represents a strong resistance level, as many of these holders may sell their Bitcoin once the price nears their acquisition cost to break even, causing significant selling pressure.

Per IntoTheBlock, Bitcoin will require substantial momentum to overcome this trend and achieve a breakthrough.

In contrast, around 2.53 million addresses are currently in the “At the Money” range, having acquired Bitcoin between $56,504 and $59,798. This range is also critical, as it represents a potential swing zone where holders are neither profitable nor at a loss. Any price movement in this range could trigger substantial buying or selling actions.

Bitcoin vs. Other Assets

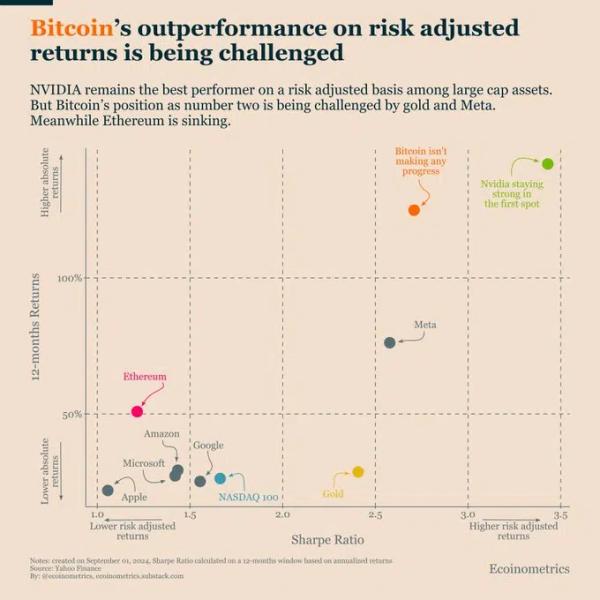

Bitcoin’s performance in risk-adjusted returns has also been under scrutiny. A recent chart by Ecoinometrics compares Bitcoin’s Sharpe Ratio with that of other large-cap assets over the past twelve months. Although Bitcoin maintains a Sharpe Ratio above 2.0, its performance has lagged behind assets like NVIDIA.

<span style=font weight 400>BTC Risk Adjusted Returns Ecoinometrics<span>

<span style=font weight 400>BTC Risk Adjusted Returns Ecoinometrics<span>

NVIDIA, with a Sharpe Ratio above 3.5, and Meta, with returns approaching 100%, have outpaced Bitcoin, challenging its position in the market. Additionally, Gold, with a Sharpe Ratio slightly below 2.5, is closing in on Bitcoin, highlighting the increased competition among these assets.

A Crucial Month for Bitcoin

As September progresses, investors are keeping a close eye on Bitcoin, waiting to see if it will defy its historical trend of struggling during this month. Typically, September has been a tough period for Bitcoin, with the cryptocurrency averaging a loss of 4.78%.

However, factors such as the reduced selling pressure from the German government, which sold 50,000 BTC earlier this year, and the strong retention by long-term holders may offer some stabilization.

Furthermore, renewed optimism surrounding Bitcoin ETFs suggests a potential positive inflow in September, contrasting the slight negative flow observed in August.