- Bitcoin miner revenue dropped to $34 million, marking the lowest since April 2024.

- Whale behaviour is mixed as small holders sell and mid-sized wallets accumulate.

- A bull flag signals that a breakout above $109,000 could push Bitcoin to $146,000 or higher.

Bitcoin miners are experiencing their profits at all-time lows. According to CryptoQuant, miners generated just $34 million daily in June, the lowest level since April. This fall is accompanied by a 50% cut in transaction fees and a 15% decrease in the price of Bitcoin. The two metrics have a significant impact on miner profitability.

Bitcoin miners just saw their worst payday in a year.

Daily revenue slipped to $34 million in June, the lowest since April.

Falling fees and Bitcoin’s price drop are crushing margins. pic.twitter.com/TXdN06CU1F

— CryptoQuant.com (@cryptoquant_com) June 26, 2025

According to the chart provided by CryptoQuant, the revenue parameters resemble those of July 2022. This steep drop has brought about concerns about the sustainability of mining because the costs of operations have been increasing. The mining companies will now be compelled to sell reserves or pause operations to cut losses.

The weakening profitability happens when Bitcoin faces difficulties cracking the resistance of $108,000. While network fundamentals remain strong, miner capitulation could introduce short-term selling pressure if miners offload coins to cover costs.

Mixed Whale Behavior Hints at Market Uncertainty

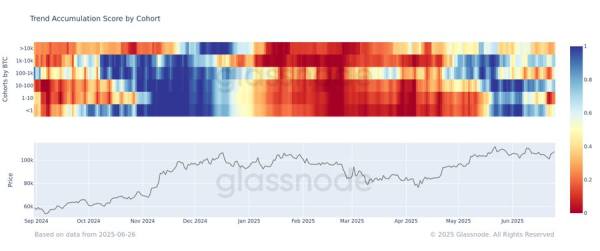

Glassnode data shows a divided picture among Bitcoin holders. The smaller whales with 1-10 BTC actively redistribute them, whereas bigger investors with 10-100 BTC have begun accumulating them. This variance speaks of inconsistency in the approach of the whales.

Source: Glassnode

Source: Glassnode

The Accumulation Trend Score rose by 0.25 to 0.57, indicating that medium-sized investors have become interested again. However, without broader whale cohesion, price direction remains uncertain in the near term.

Bitcoin has been structurally bullish despite the miner stress and contrary whale signals, according to analysts. Consolidation within $102,000 and $108,000 has created a bull flag, a technical formation that leads to great breakouts..

Market analyst Cas Abbe said in a post on X that there was a likelihood of a breakout like the possible 2020 cycle, where Bitcoin rallied approximately threefold in three months. He compares the two periods, indicating a MACD crossover, a range breakout, and a slight correction- patterns followed by the final major rally Bitcoin had.

Source:X

Source:X

Abbè targets a move to $150,000- $180,000 prior to a blow-off top towards the later part of the cycle. He dismisses the claims of supercycle and again reminds everyone that Bitcoin is still in a normal 4-year cycle. His position intensifies anticipation in deep setbacks after making new highs, as it has always been in the market.

If the MACD indicator sustains bullish momentum, Bitcoin could climb 50%–80% by October. That projection aligns with Abbè’s side-by-side chart analysis comparing the 2020 and 2025 patterns. Both periods share nearly identical setups, giving weight to the forecast.