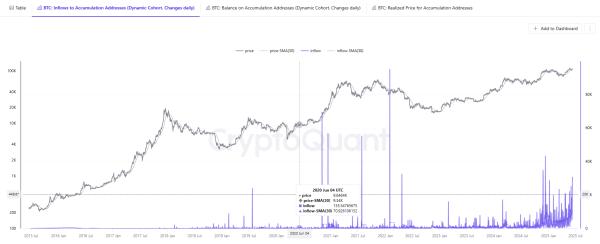

Inflows of Bitcoin into accumulation wallets continue, with no pressure to capitulate or take profits. Buying from wallets with over 10 BTC reached their highest levels in the year to date.

Bitcoin accumulation addresses saw rapid inflows in the past few days, despite the price spike. Over 30K BTC were bought up and sent to addresses that were extremely conservative about moving their coins.

In total, accumulation addresses absorbed $3.3B, or 30,754 BTC. Currently, accumulation and even occasional buying are absorbing all newly mined coins, while also drawing down the reserves of OTC desks and exchanges.

The recent wave of buying continued even at prices above $109,000. Bitcoin is still in accumulation mode, though sinking slightly to $104,578. Accumulation is happening while anticipating a larger rally in 2025, with $120,000 the next target.

Accumulation addresses are relatively old, and have an average accumulation price of $64,000. However, newer accumulation addresses are also added, even near peak prices. Based on CryptoQuant data, over 2.91M BTC are now held in accumulation addresses with different ages.

In 2025, inflows to accumulation addresses exhibited a higher baseline, with more regular stacking. There is also a growth trend in buying more Bitcoin, as inflows reached peak levels for the year to date.

Bitcoin accumulation wallets had higher baseline activity in 2025, recently reaching peak inflows for the year to date. | Source: CryptoQuant

Bitcoin accumulation wallets had higher baseline activity in 2025, recently reaching peak inflows for the year to date. | Source: CryptoQuant

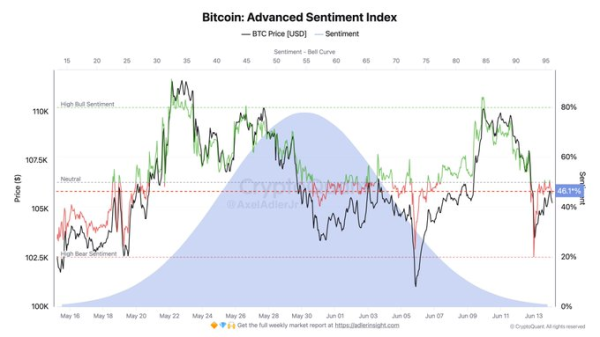

The recent data confirms the trend where despite the near-peak valuations, whales are not taking profits. BTC spot markets still show long-term confidence, despite the short-term volatility with derivative trading. The crypto fear and greed index switched to 51 points, signaling a neutral attitude, down from the recent levels of extreme greed. However, spot accumulation can continue under different market conditions.

BTC accumulation boosted by the treasury narrative

The recent Bitcoin buying is a mix of anonymous whales and high-profile corporate buyers. Previous trends showed retail was hardly active above $90,000 per BTC, with most of the accumulation coming from whales and other large-scale wallets holding between 100 and 1,000 BTC. Corporate buyers and funds can also afford to keep absorbing Bitcoin even near peak prices.

Treasuries already contain 3.41M BTC, with active buying from some of the high-profile holders in the past week. Even smaller corporate buyers have taken up to 5,000 BTC off the market in a single day.

In the past month, 20 companies added Bitcoin to their public balances, with more announcements and plans to finance Bitcoin acquisitions with debt or equity.

The idea of a Bitcoin strategic reserve is also brought back to crypto projects. Recently, the Polkadot community raised a proposal to build a tBTC reserve, buying and holding wrapped coins for the long term.

Part of the Bitcoin accumulation may also be due to DeFi protocols and other types of collateral wallets. As Bitcoin becomes more valuable, on-chain activity is slower, while some protocols are offering a way to tap the Bitcoin value without selling.

Solana is also becoming one of the venues for wrapped Bitcoin. A total of 4,726 BTC is now held on Solana in the form of tBTC, with 75% growth for the whole of 2025. Additionally, Bitcoin staking and other DeFi protocols are holding up coins with no intention to sell.