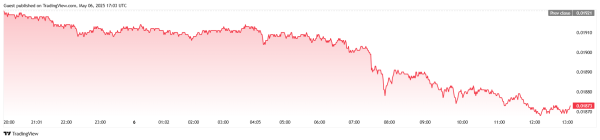

Bitcoin (BTC) rose above $97,000 last week, but fell to $94,000 after being rejected from the $98,000 resistance.

Analysts reported that the decline in BTC was due to macroeconomic uncertainty and the FED’s announcement of its interest rate decision for May.

While analysts warn that the price could drop further in the short term, one analyst has identified key support levels for BTC at $92,500 and $89,000.

Speaking to Coindesk, FxPro analyst Alex Kuptsikevich noted that the market has returned to a key resistance zone that served as support from December to February, with the next downside targets being $92,500 and $89,000.

According to Kuptsikevich, a break below $90,000 would wreak havoc on both technical and psychological levels and could push the price below the 200-day moving average.

“We are back at a key resistance area that served as support from December to February.

The next downside targets are $92,500 and $89,000.

A break below $90,000 would be technically and psychologically damaging and would take us below the 200-day moving average.”

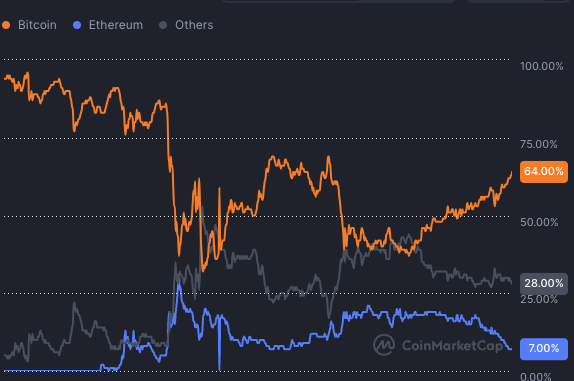

Despite the decline, Bitcoin ETF net inflows reached $1.81 billion last week, indicating continued investor interest.

On Wednesday, May 7, the FED is expected to announce its interest rate decision for May. Then FED Chair Jerome Powell will make statements. While the FED is expected to keep interest rates steady tomorrow, Bitcoin and altcoin investors are closely following the FED decision and Powell’s statements. As investors expect more clarity on the economic outlook and future interest rate cuts.

*This is not investment advice.