SEC website posts document naming XRP as a strategic asset for U.S.

![]() Cryptocurrency Mar 14, 2025 Share

Cryptocurrency Mar 14, 2025 Share

On Thursday, March 13, the Securities and Exchange Commission (SEC) website published a document titled ‘Comprehensive Proposal: XRP as a Strategic Financial Asset for the U.S.,’ immediately sparking interest and speculation.

In five pages, the document presents a rough outline of how XRP might become a strategic tool in America’s financial arsenal while also proposing the role of several other cryptocurrencies.

XRP as a strategic asset: The why

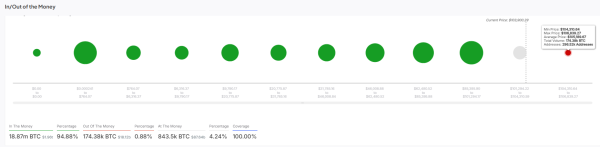

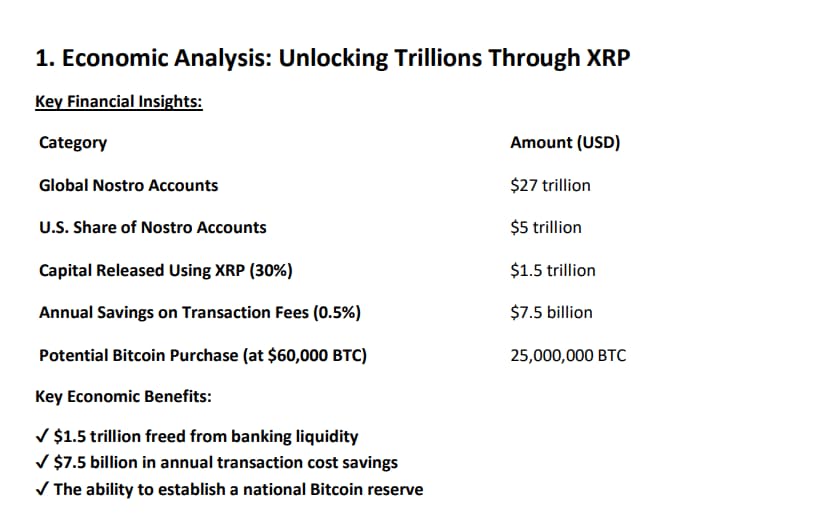

In the first section, the document assumes that a government-level adoption of the token could release as much as 30% of the U.S.’ $5 trillion share of the global Nostro accounts – $1.5 trillion – and provide $7.5 billion in annual savings on transaction fees.

Picks for you

Gold surpasses $3,000 for the first time — What’s next for the commodity? 57 mins ago Silo brings its V2 protocol to Sonic 1 hour ago Tonkeeper Pro now supports USDT TRC20 tokens with no TRX required 2 hours ago Number of XRP addresses hits an all-time high 3 hours ago

Furthermore, despite the ‘comprehensive proposal’ being centered on XRP, it acknowledges the role of Bitcoin (BTC) as the strategic reserve asset. Thus, it proposes directing the savings towards BTC acquisition.

The text states that the potential purchase could amount to 25 million Bitcoins and assumes an average purchase price of $60,000.

Math indicates that the $1.5 million in savings from the U.S. Nostro accounts would be used, though the proposal does not address the fact that such an amount would be approximately 20% greater than the total BTC supply or that such buying activity would cause significant price fluctuations.

Still, the implication can also be read as ‘the U.S. could buy as many as 25 million BTC with the newly available cash,’ not as ‘the plan is for the U.S. to buy 25 million.’

A Nostro account is a domestic bank account held in another country and denominated in that country’s currency.

The overview of the strategic XRP benefits. Source: Maximilian Staudinger via the SEC

The overview of the strategic XRP benefits. Source: Maximilian Staudinger via the SEC

XRP as a strategic asset: The how

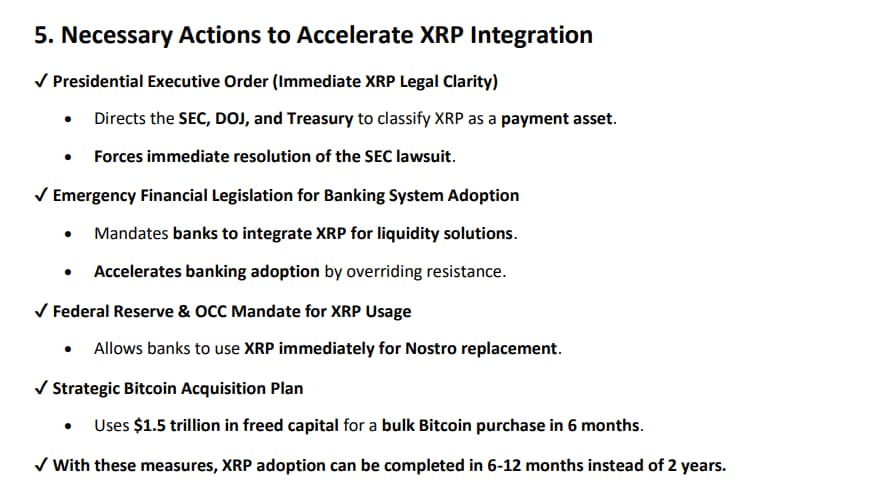

After establishing the basic balance, the document proposes that the SEC declare XRP a payment network instead of a security and that the Department of Justice (DoJ) lift the bank ban in sections two, five, and six.

The proposal explains that a forced settlement ensuring the status could be imposed if there is no other way forward. It does not, however, address the fact that XRP already benefits from regulatory clarity and that the SEC, in its latest appeal, does not contest the ruling that the token is not a security.

In the proposal, the forcing of adoption is justified by the anticipated economic benefit of the program.

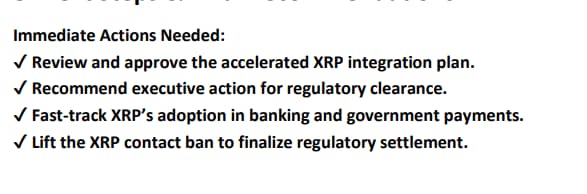

An overview of proposed actions needed to implement the XRP plan. Source: Maximilian Staudinger via the SEC

An overview of proposed actions needed to implement the XRP plan. Source: Maximilian Staudinger via the SEC

XRP as a strategic asset: The when

Segments three and four detail standard and accelerated implementation programs, one assuming a 12 to 24-month process and the other a 6 to 12-month framework.

Though it offers some hints into how each step could be executed – for example, ‘full-scale financial integration’ is accompanied by a comment stating ‘Federal Reserve & O(ffice of the) C(omptroller of the) C(urrency) mandates’ – it does not offer a comprehensive analysis of the execution.

XRP as a strategic asset: The Trump factor

In its seventh segment, the document seeks to clarify the confusion arising from President Donald Trump’s statements about a strategic cryptocurrency reserve.

It is worth remembering that the Republican has, so far, promised a Bitcoin reserve, speculated on a potential ‘America first’ reserve – one that would featured digital assets issued by U.S. companies – evaded the terms reserve describing a stockpile instead, ordered preliminary examinations for such a project, and issued an unenforceable creation order – unenforceable as it lacks a concrete acquisition mechanism.

For all the confusion, President Trump did keep his promise to prevent the Federal government from selling cryptocurrency already in its possession.

The document attempts to resolve the contradictions and uncertainty by proposing a set of specific roles for specific digital assets. Under the framework, Bitcoin would be the reserve asset, XRP would be used for state-level transactions, and Solana (SOL) would have a significant purpose involving ‘high-speed blockchain applications, such as real-time government databases, secure voting mechanisms, and digital identity management.’

Cardano (ADA) was also included as ‘best suited for academic credentialing, smart contracts for government services, and secure infrastructure management.’

Solana and Cardano should be integrated into U.S. digital infrastructure but not included in the reserve strategy. Instead, they enhance efficiency and security for state applications, while XRP remains the key asset for financial transactions.

XRP as a strategic asset: The conclusion

The final segment makes an interesting stylistic choice as it is titled ‘next steps & final recommendations’ but arguably only summarizes or repeats earlier parts of the document.

Summary of immediate actions needed to implement the XRP plan. Source: Maximilian Staudinger via the SEC

Summary of immediate actions needed to implement the XRP plan. Source: Maximilian Staudinger via the SEC

The choice is interesting as it bolsters the document’s appearance as the result of a speculative conversation with ChatGPT or another similar artificial intelligence (AI) platform.

Other pointers include the overall structure, filled with tables and subheadings, but, given the way more recent OpenAI models communicate, the unexpectedly high number of checkmarks as signifiers of bullet points.

Still, despite some circumstantial evidence, it is not known whether and to what extent AI may have been used in writing the five-page ‘Comprehensive Proposal.’

Lastly, the document’s author appears obscure despite being known by name: Maximilian Staudinger. It is noteworthy that anyone can submit a comment or a proposal to the SEC, and such files are frequently found on the regulator’s website.

Online records of individuals with the name exist but are mostly confined to LinkedIn profiles of people in Germany and Austria, with some other socials pointing to Canada.

The only interesting result – though not confirming anything – is that an X account of the same name replied on March 3 to a Peter Schiff post explaining that the economist understands the logic behind a Bitcoin reserve but not behind an XRP reserve.

"XRP as a national reserve enables fast, low-cost transactions, global acceptance & independence from central banks. It diversifies reserves, protects against fiat risks & leverages secure blockchain tech. Regulations are inevitable—early adoption ensures strategic advantages."

— Maximilian Staudinger (@MaxStau) March 3, 2025

Though brief and vague, the reply is somewhat reminiscent of some of the points raised in the ‘comprehensive proposal,’ as it states, for example, that ‘XRP as a national reserve enables fast, low-cost transactions, global acceptance & independence from central banks.’

Featured image via Shutterstock