Bitcoin just collapsed to $80,000, wiping out over $200 billion from the crypto market in one of the worst single-day crashes over the past year, according to data from CoinGecko.

Ether also crashed, tumbling below $2,000 to trade at $1,992, a level we haven’t seen in over six months. The sudden sell-off came after Donald Trump signed an Executive Order on Thursday, officially launching the Strategic Bitcoin Reserve—a decision you’d expect would boost prices, not tank them.

Source: Jai Hamid/TradingView

Source: Jai Hamid/TradingView

Friday’s White House Crypto Summit was set to be the big event, but Trump threw a curveball by announcing the reserve ahead of schedule. Traders were betting on a bullish rally, but instead, Bitcoin dropped from $90,000 to $85,000 within minutes of the announcement.

The market reaction was brutal, with options traders unwinding long positions, volatility spiking, and put contracts gaining demand as traders scrambled to hedge against deeper downsides, per data from Coinglass.

Trump’s Bitcoin Reserve triggers sell-off instead of rally

The Executive Order confirms the US government’s plan to stockpile Bitcoin, but there’s a catch—there’s no new funding for purchases yet. The initial reserves will be built using Bitcoin seized from criminal or civil asset forfeitures, which means no immediate demand pressure.

Scott Bessent, the Treasury Secretary, and Howard Lutnick, the Commerce Secretary, have been given the job of figuring out “budget-neutral” ways to add more Bitcoin to the reserve without costing taxpayers a dime.

That wasn’t what traders wanted to hear. The market was looking for aggressive government buying, not just a relabeling of old holdings. With no

sign of new demand, the sell-off gained momentum.

As trading company QCP explained in its Friday Telegram note, risk reversals in the crypto market flipped, meaning traders started pricing in more downside risk than upside potential, which only made the crash worse.

Recession fears and US debt crisis fuel the fire

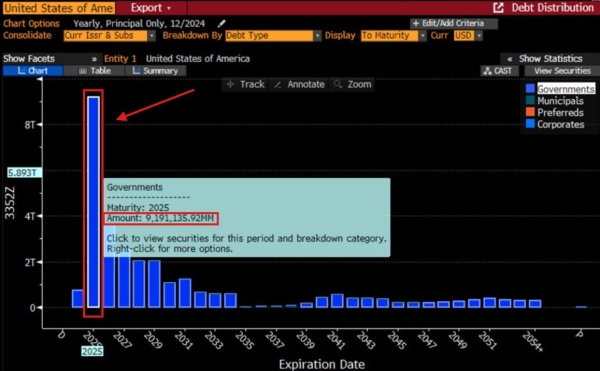

Meanwhile, the broader economic picture is looking worse by the day, and traders are bracing for a recession. The US is staring at a $9.2 trillion debt refinancing problem in 2025, with most of that debt maturing between January and June. The government needs lower interest rates—badly.

The easiest way to get them? A recession.

Over the last two months, the 10-year Treasury yield has dropped by 60 basis points, a sign that markets are pricing in economic trouble.

Elon Musk’s Department of Government Efficiency (DOGE) has been working hard at spending cuts with a target of $2 trillion, but those guys aren’t working fast enough to fix the debt problem.

President Donald Trump has been pushing for lower oil prices to fight inflation, even calling on OPEC to drop prices. But the fastest way to kill inflation? A recession that crushes demand.

That’s why traders are keeping a close eye on the Atlanta Fed, which recently slashed its Q1 2025 GDP growth estimate to -2.8%, according to an analysis from The Kobeissi Letter.

Markets have been expecting the Federal Reserve to cut rates at some point during the first half of 2025, but inflation keeps getting in the way.

Source: Adam Kobeissi X/Twitter

Source: Adam Kobeissi X/Twitter

US consumer expectations for inflation just jumped to 6.0% over the next 12 months, the highest since May 2023. That’s the third straight month of rising inflation expectations—a problem for rate-cut hopes.

Trump doesn’t even care about the stock market anymore. As Cryptopolitan reported on March 6, he said, “I’m not watching the market,” though during his first term, he was obsessed with it. That’s not just an offhand comment—it’s a message. Wall Street is on its own.

Bitcoin braces for $75K as liquidation risks increase

With Bitcoin now at $80,000, traders are already looking at the next danger zone—and it’s ugly. According to Arthur Hayes, the co-founder of BitMEX, things could get a lot worse before they get better.

“An ugly start to the week. Looks like BTC will retest $78K. If it fails, $75K is next in the crosshairs. There are a lot of options open interest at $70K-$75K, and if we get into that range, it will be violent,” Arthur warned in a post on X.

Meanwhile, CryptoQuant data shows that Bitcoin exchange reserves are dropping rapidly, which means there is a potential supply shock—but right now, that doesn’t matter. When the market is in freefall, supply-side fundamentals take a backseat to sheer panic selling.

But while most traders are running for the exits, President Nayib Bukele is buying the dip. El Salvador, which has been steadily accumulating Bitcoin, bought 5 more BTC today—up from its usual 1 BTC daily purchase.

Only thing that’s gonna save these markets now is a rate cut, and the only way we’re gonna get that is through a recession. Buckle up, folks.