Robert Kiyosaki blasts Bitcoin sellers after market crash

![]() Cryptocurrency Mar 5, 2025 Share

Cryptocurrency Mar 5, 2025 Share

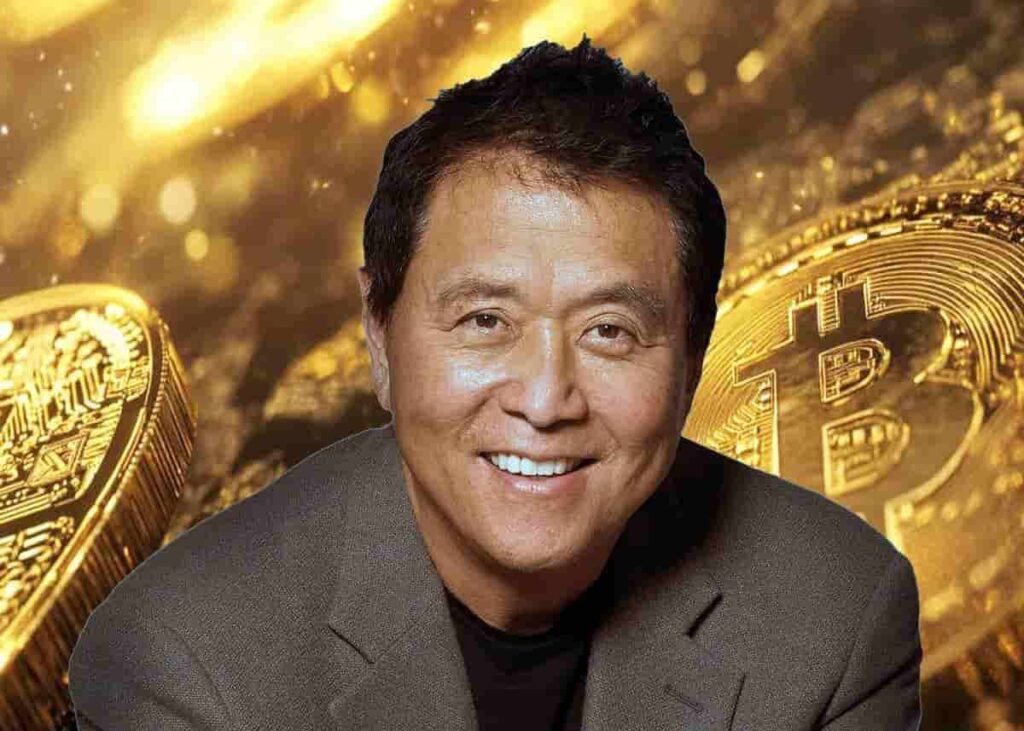

During Bitcoin’s (BTC) rally above $90,000 on Tuesday night and Wednesday morning, the prominent investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, took to X to berate investors who sold their cryptocurrency during the preceding downturn:

People who sold BITCOIN in the last crash are LOSERS.

Kiyosaki, who simultaneously revealed that he purchased more BTC during the downturn, cited Donald Trump’s presidency as the main argument for why selling was the wrong call.

Picks for you

DeepSeek AI says Cardano (ADA) will hit this target by March 31,2025 9 hours ago 2 overbought cryptocurrencies to avoid buying now 10 hours ago Analyst says XRP 'is ready for an all-time high' if it holds above key levels 12 hours ago If you invested $1,000 in Bitcoin when Trump took office, you’d now have this much 12 hours ago

The famous author explained that Bitcoin’s price is bound to enjoy a major rally as soon as the federal government begins buying the coin ‘to help solve America’s financial insanity.’ He, thus, concluded that those who used the price drop to buy more would be proven as ‘winners,’ and those who sold as ‘losers.’

People who sold BITCOIN in the last crash are LOSERS.

Don’t they know who the President of the United States is?

President Trump….the right President at the right time….understands the power of BITCOIN.

When he begins buying BITCOIN to help solve America’s financial…

— Robert Kiyosaki (@theRealKiyosaki) March 5, 2025

President Donald Trump and the strategic Bitcoin reserve

President Trump promised a strategic BTC reserve – and sometimes a broader strategic crypto reserve – during his campaign and has been teasing it with a mix of announcements and preliminary orders since his inauguration.

Though several of these generated strong reactions in the cryptocurrency market – the Sunday, March 2, and Monday, March 3 rally being the most recent example – there is no strong indication that the U.S. will begin stockpiling coins and tokens in the near future.

Indeed, Senator Cynthia Lummis – a long-standing proponent of a Bitcoin reserve – revealed in late February that the federal government is unlikely to begin purchasing BTC in the near future and forecasted that individual states would first set up the reserves.

According to the Senator, as of early 2025, there is not enough support in Congress for a discussion to truly take place or enough knowledgeable politicians for a legislative push to succeed.

Why Kiyosaki’s advice may be sound despite abrasive tone

Despite the uncertain situation regarding President Trump and the strategic Bitcoin reserve, Kiyosaki may be right that buying during the downturn would have been wiser than selling.

Still, the earnestness of his advice can be doubted as he has historically engaged in behaviour that could be interpreted as sacrificing his followers to boost his portfolio, althout it is somewhat difficult to read unsavory intent into a statement that amounts to ‘buying low and selling high is better than buying high and selling low.’

Though future is never certain in the cryptocurrency market, historical performance does hint – as many traders and analysts have been maintaining – that BTC is yet to find its cycle high.

Why the Bitcoin bull market is likely not over despite high volatility

Previous bull markets peaked approximately 12 to 18 months after a halving – the most recent one took place in April 2024 – meaning Bitcoin is likely to plateau later in 2025, indicating that buying remains the right call.

Still, a lack of confidence is abundantly clear in March 2025, and digital assets have been swinging wildly in recent trading.

BTC one-week price chart. Source: Finbold

BTC one-week price chart. Source: Finbold

Bitcoin itself plunged to lows below $78,000 on February 28, soared almost to $95,000 on March 2, collapsed under $83,000 on March 4, rallied above $90,000 in the small hours of March 5, and finally landed to its press time price of $88,226.