4 billion XRP tokens released by Ripple in a year

![]() Cryptocurrency Mar 5, 2025 Share

Cryptocurrency Mar 5, 2025 Share

Ripple Labs, the issuer and biggest holder of XRP, has been maintaining a system of gradual releases for additional tokens into circulation for years.

This approach, further developed with an escrow system in 2017, has ensured the digital asset has remained slightly inflationary through its existence.

Specifically, on the first day of each month, the company unlocks 1 billion XRP, making 20-30% (200-300 million tokens) available for trading to raise additional funds for its operations while re-locking the rest.

Picks for you

DeepSeek AI says Cardano (ADA) will hit this target by March 31,2025 3 hours ago 2 overbought cryptocurrencies to avoid buying now 4 hours ago Robert Kiyosaki blasts Bitcoin sellers after market crash 5 hours ago Analyst says XRP 'is ready for an all-time high' if it holds above key levels 6 hours ago

In March 2025, the proportion may be changing somewhat, as Finbold reported that Ripple might be preparing to sell as much as $795 million worth of the cryptocurrency. Simultaneously, the circulating supply of XRP has been increasing at a heightened pace.

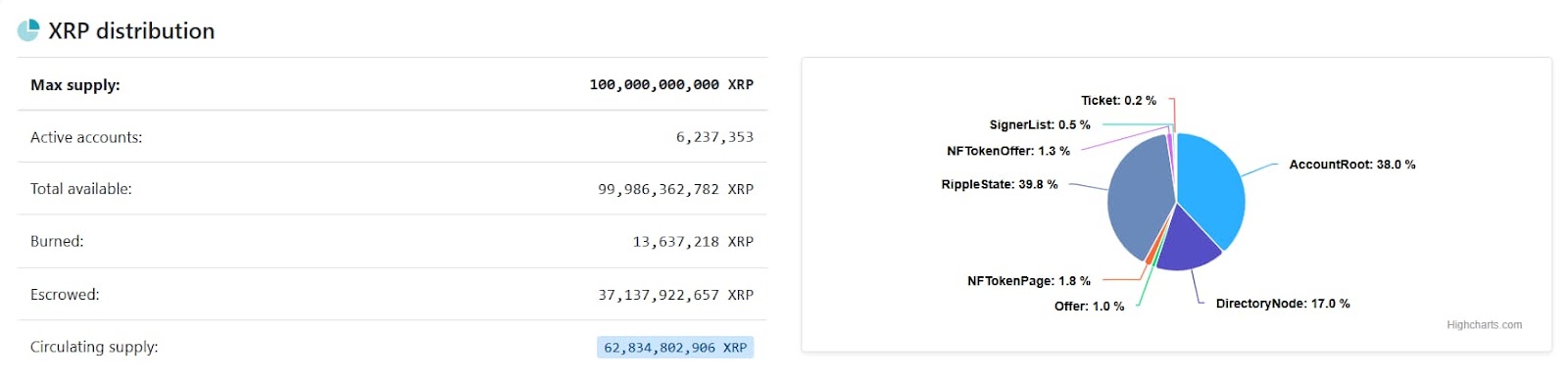

There were 56.5 billion tokens in circulation at the start of 2023 and 58.6 billion at the start of 2024, per the data Finbold retrieved using the Wayback Machine, indicating a 2 billion annual increase. At press time on March 5, 2025, the number increased to 62.8 billion, hinting at an unlock acceleration to 4 billion per year, according to the information retrieved from XRPscan.

XRP distribution on March 5, 2025. Source: XRPscan.

XRP distribution on March 5, 2025. Source: XRPscan.

In total, the number of XRP in circulation rose from the 20 billion initially available in 2012 by nearly 43 billion, and 37 billion remain escrowed, demonstrating that the current system is likely to remain stable for years.

Is XRP inflation the token’s main price driver?

Monthly unlocks of 200–300 million XRP (~$500–700M at $2.46) could increase selling pressure, but they’ve not been major price drivers. Instead, the SEC’s lawsuit against Ripple, ongoing since 2020, has been the primary suppressant.

In general, the cryptocurrency has become fairly susceptible to external factors as evidenced both by the rally in the aftermath of Donald Trump’s re-election – and the expected shift in the U.S. policy towards the industry – and the subsequent struggles.

Despite the hopes for the current administration, the relative lack of progress in terms of creating a strategic cryptocurrency reserve has ensured that XRP failed to sustain its upward momentum and recent highs and is 15.48% year-to-date (YTD) at its press time price of $2.46.

XRP YTD price chart. Source: Finbold

XRP YTD price chart. Source: Finbold

Still, in early March, a powerful rally is possible as the SEC has been on something of a case-dropping spree, leading many traders to hope the fight against Ripple is nearing its end. Simultaneously, President Trump resparked the discussion about a strategic cryptocurrency reserve on Sunday, March 2, leading to a short-lived but powerful rally.

Featured image via Shutterstock