Synopsis

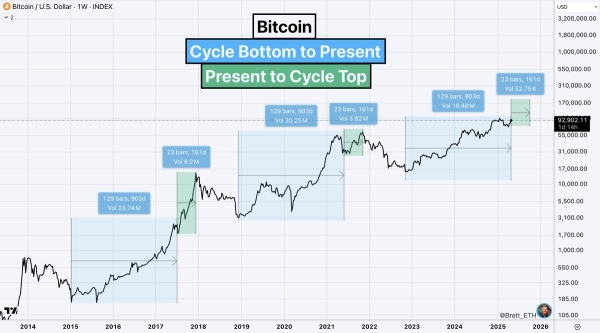

Bitcoin traded at $96,749, up 0.45%, while Ethereum dipped 0.4% to $2,699. BTC held key support at $95,000, facing resistance at $98,000. Altcoins showed mixed trends, with XRP gaining 3% on ETF news. Analysts predict short-term consolidation amid macroeconomic concerns. BTC dominance stood at 59.89%, with trading volumes declining.

Bitcoin (BTC) and other major cryptocurrencies traded mixed on Friday, February 14. BTC, XRP, Solana, Cardano, Stellar, and Dogecoin gained up to 3.7%, while Ethereum, BNB, Tron, Sui, Chainlink, and Avalanche declined, falling as much as 5%.

As of 12:05 pm IST, Bitcoin was up 0.45% at $96,749, while Ethereum dipped 0.4% to $2,699. The global cryptocurrency market cap remained steady at approximately $3.2 trillion, inching up 0.02% in the past 24 hours.

Edul Patel, CEO and co-founder of Mudrex, said, “Bitcoin is holding above $96,700 after finding support near $95,000. Higher-than-expected CPI and PPI data have raised inflation concerns, reducing the likelihood of a Federal Reserve rate cut in the first half of the year. However, BTC has shown resilience at key support levels. To maintain bullish momentum, it must break past the $98,000 resistance.”

Crypto Tracker![]() TOP COIN SETSNFT & Metaverse Tracker8.62% BuyAI Tracker8.23% BuySmart Contract Tracker5.70% BuyCrypto Blue Chip – 52.93% BuyBTC 50 :: ETH 501.64% BuyTOP COINS (₹) XRP222 (4.83%)BuyBitcoin8,420,087 (0.86%)BuyEthereum234,792 (0.79%)BuyTether87 (-0.02%)BuyBNB57,952 (-5.65%)BuyVikram Subburaj, CEO of Giottus, noted. “Altcoins had a mixed session, with Ethereum, BNB, and Tron posting modest declines. Meanwhile, XRP gained 3% after Nasdaq filed with the SEC to list a CoinShares-backed XRP ETF. As Bitcoin consolidates, altcoins are expected to regain momentum gradually.”

TOP COIN SETSNFT & Metaverse Tracker8.62% BuyAI Tracker8.23% BuySmart Contract Tracker5.70% BuyCrypto Blue Chip – 52.93% BuyBTC 50 :: ETH 501.64% BuyTOP COINS (₹) XRP222 (4.83%)BuyBitcoin8,420,087 (0.86%)BuyEthereum234,792 (0.79%)BuyTether87 (-0.02%)BuyBNB57,952 (-5.65%)BuyVikram Subburaj, CEO of Giottus, noted. “Altcoins had a mixed session, with Ethereum, BNB, and Tron posting modest declines. Meanwhile, XRP gained 3% after Nasdaq filed with the SEC to list a CoinShares-backed XRP ETF. As Bitcoin consolidates, altcoins are expected to regain momentum gradually.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »CoinSwitch Markets Desk, said, “With BTC trading around the 96500 USD mark for the 13th day in a row, it has become difficult for the bears to breach through this support and at the same time there are continuous lower highs forming in BTC – signalling towards a short term downtrend.”![]()

Also Read: The impact of macroeconomic factors on the crypto market in 2025

In the last 24 hours, Bitcoin’s market cap rose to $1.916 trillion. Bitcoin’s dominance now stands at 59.89%. BTC volume in the same period fell 28.3% to $34.86 billion. Meanwhile, stablecoins accounted for $94.33 billion of this volume, or 92.29%, according to .

Tech view by Sathvik Vishwanath, Co-Founder & CEO, Unocoin

Currently, BTC trades around $ 96,600. Escape over $ 100,000 could move prices towards 31 January maximum $ 106,012. However, the relative force index (RSI) at 44 signaries carries the momentum and gliding average convergence (MACD) shows the bear crossover, indicating a potential disadvantage. If the BTC closes below $ 94,000, it can further reduce and test psychological support of $ 90,000.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)