Bitget Exchange CEO Gracy Chen has highlighted key developments in the Czech Republic’s approach to Bitcoin.

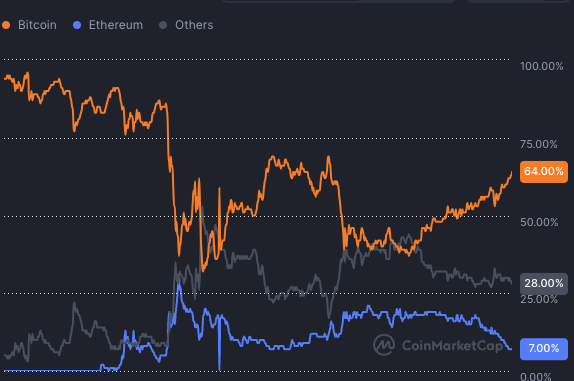

Chen noted that if the Czech National Bank proceeds with its proposal to allocate 5% of its €140 billion foreign reserves into Bitcoin, the country could become the world’s third-largest Bitcoin (BTC) holder, surpassing nations such as the United Kingdom, Germany, and Ukraine.

She also emphasized the new capital gains tax exemption for BTC, which has been in place for over three years, incentivizing long-term adoption.

This is solid great news! 🎉🚀 The Czech National Bank Governor first proposed adding Bitcoin to the country’s foreign exchange reserves on January 7, 2025, and just yesterday, the Czech President signed a new law exempting Bitcoin sales from capital gains tax if held for over…

— Gracy Chen @Bitget (@GracyBitget) February 7, 2025

Unlike many European nations, the Czech Republic is not bound by European Central Bank policies, potentially influencing other countries to follow its lead.

You might also like: ‘Stop thinking like a trader, start thinking like a bank’: EMCD CEO on crypto’s future

Czech Republic’s Bitcoin reserve

The CNB’s Governor, Aleš Michl, has proposed investing up to 5% of the bank’s reserves in Bitcoin to diversify assets. He believes that such an investment could enhance the profitability of the bank’s reserves.

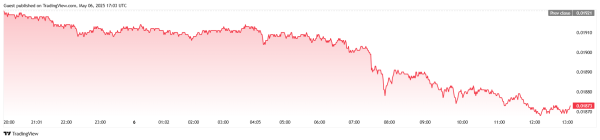

However, the proposal has drawn criticism due to Bitcoin’s high volatility and associated risks. Critics argue that central banks should prioritize liquidity, stability, and capital preservation over speculative investments.

In addition to the proposed reserve allocation, the Czech Republic has enacted a law exempting Bitcoin from capital gains tax if held for more than three years. This legislation, signed by President Petr Pavel, aims to encourage long-term investment in cryptocurrencies and aligns the country’s crypto regulations with the European Union’s Markets in Crypto-Assets framework.

You might also like: BlackRock boosts stake in Strategy stock to 5% amid Bitcoin push

Source