Synopsis

Bitcoin’s recent decline coincides with market uncertainty after President Donald Trump’s tariff announcement. The U.S. plans 25% tariffs on Canadian and Mexican imports and 10% on Chinese goods, fueling volatility in traditional and crypto markets. This policy shift has heightened investor concerns, leading to fluctuations across financial sectors as uncertainty grips global trade and economic stability.

Bitcoin (BTC) experienced a decline, trading below $103,000 on Saturday, February 1, 2025, amid global market volatility spurred by recent U.S. tariff announcements. As of 10:16 am IST, Bitcoin was priced at $102,441, marking a 1.7% decrease over the past 24 hours.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, saw a 2.4% increase, trading at $3,302 during the same period.

Other major altcoins displayed mixed performances. XRP experienced a slight decline, while Solana (SOL) and Stellar (XLM) also saw decreases. Conversely, BNB, Dogecoin (DOGE), and Cardano (ADA) registered gains.

Crypto Tracker

Crypto Tracker![]() TOP COIN SETSDeFi Tracker4.53% BuyWeb3 Tracker2.46% BuyCrypto Blue Chip – 5-2.76% BuySmart Contract Tracker-3.14% BuyNFT & Metaverse Tracker-9.19% BuyTOP COINS (₹) Ethereum286,069 (1.94%)BuyTether87 (0.05%)BuyXRP264 (-1.16%)BuySolana20,158 (-1.82%)BuyBitcoin8,880,571 (-1.85%)BuyThe recent downturn in Bitcoin’s price aligns with heightened market uncertainty following President Donald Trump’s announcement of impending tariffs. The U.S. plans to impose 25% tariffs on imports from Canada and Mexico, as well as 10% on Chinese goods. This policy move has contributed to increased volatility in both traditional and cryptocurrency markets.

TOP COIN SETSDeFi Tracker4.53% BuyWeb3 Tracker2.46% BuyCrypto Blue Chip – 5-2.76% BuySmart Contract Tracker-3.14% BuyNFT & Metaverse Tracker-9.19% BuyTOP COINS (₹) Ethereum286,069 (1.94%)BuyTether87 (0.05%)BuyXRP264 (-1.16%)BuySolana20,158 (-1.82%)BuyBitcoin8,880,571 (-1.85%)BuyThe recent downturn in Bitcoin’s price aligns with heightened market uncertainty following President Donald Trump’s announcement of impending tariffs. The U.S. plans to impose 25% tariffs on imports from Canada and Mexico, as well as 10% on Chinese goods. This policy move has contributed to increased volatility in both traditional and cryptocurrency markets.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

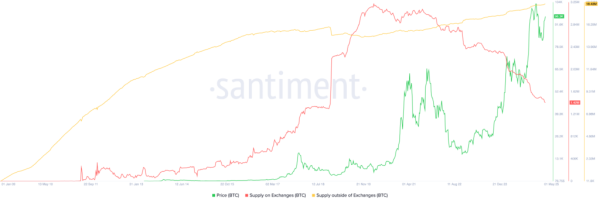

View Details »Despite these developments, some analysts believe that Bitcoin’s stability amidst global economic shifts may indicate its growing acceptance as a mainstream asset. However, concerns persist about the potential impact of ongoing geopolitical tensions and economic policies on the cryptocurrency market.![]()

Also Read: Mudrex survey reveals overwhelming call for crypto tax reforms ahead of Union Budget 2025

On the regulatory side, the European Central Bank president suggested that Bitcoin was unlikely to enter central bank reserves anytime soon, despite the growing global buzz around adopting the digital currency, partly sparked by Donald Trump’s policies.

Also Read: The relevance of global cryptocurrency trends with American political movements

The global cryptocurrency market capitalization has decreased by 1.02% over the past 24 hours, standing at approximately $3.52 trillion. Stablecoins now account for 90.6% of the total 24-hour crypto market volume, totaling $111.81 billion.

Also Read: Eric Trump’s tax-free proposal: What It means for global crypto market

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)