Synopsis

The entities that sponsored it, CIC Digital and Fight Fight Fight, earn fees from the so-called liquidity they send to the platform to support trading of the memecoin, Tarun Chitra, CEO of Gauntlet, said in an interview.

Donald Trump’s namesake memecoin has likely generated at least $11.4 million in fees for entities linked to the president since its launch just before his second inauguration, according to an analysis by the crypto risk modeling firm Gauntlet.

The crypto world was caught by surprise when the “official” Trump memecoin was released late on Jan. 17 by the former crypto skeptic turned supporter. The ensuing exuberance swelled the market value of the token to more than $14 billion, spurring speculation that it could potentially earn billions for Trump, while also raising concern about conflicts of interest.

The memecoin was initially launched through the decentralized finance exchange Meteora on the Solana blockchain. The entities that sponsored it, CIC Digital LLC and Fight Fight Fight LLC, earn fees from the so-called liquidity they send to the platform to support trading of the memecoin, Tarun Chitra, the co-founder and chief executive of Gauntlet, said in an interview. Memecoins are a type of cryptocurrency that are typically unlinked to any underlying business and are highly speculative for investors while potentially wildly lucrative for founders.

Crypto Tracker

Crypto Tracker![]() TOP COIN SETSBTC 50 :: ETH 50-5.78% BuyCrypto Blue Chip – 5-5.95% BuyWeb3 Tracker-11.64% BuyDeFi Tracker-16.16% BuyNFT & Metaverse Tracker-19.93% BuyTOP COINS (₹) XRP264 (0.8%)BuyTether87 (0.21%)BuyBitcoin8,760,138 (-0.44%)BuyEthereum265,613 (-2.94%)BuySolana19,559 (-3.55%)BuyDeFi exchanges use algorithms to determine asset prices and facilitate trades without the market makers that serve as intermediaries on conventional exchanges. Platform users trade assets, in this case Trump memecoins held in liquidity pools. This allows traders to swap tokens directly from their wallets. As an incentive, users earn a fee for providing liquidity to different pools. Gauntlet tracked all the fees collected from the Trump token’s liquidity pools on Meteora. The majority of the liquidity is being provided by the Trump-linked entities. Smart contracts, or automated software programs, record all the trades and fees.

TOP COIN SETSBTC 50 :: ETH 50-5.78% BuyCrypto Blue Chip – 5-5.95% BuyWeb3 Tracker-11.64% BuyDeFi Tracker-16.16% BuyNFT & Metaverse Tracker-19.93% BuyTOP COINS (₹) XRP264 (0.8%)BuyTether87 (0.21%)BuyBitcoin8,760,138 (-0.44%)BuyEthereum265,613 (-2.94%)BuySolana19,559 (-3.55%)BuyDeFi exchanges use algorithms to determine asset prices and facilitate trades without the market makers that serve as intermediaries on conventional exchanges. Platform users trade assets, in this case Trump memecoins held in liquidity pools. This allows traders to swap tokens directly from their wallets. As an incentive, users earn a fee for providing liquidity to different pools. Gauntlet tracked all the fees collected from the Trump token’s liquidity pools on Meteora. The majority of the liquidity is being provided by the Trump-linked entities. Smart contracts, or automated software programs, record all the trades and fees.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

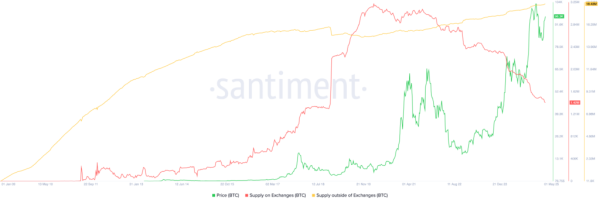

View Details »An 80% share of the virtual asset is owned by CIC Digital and Fight Fight Fight LLC — whose name echoes the words Trump mouthed after a bullet grazed his ear while campaigning last year. Their holdings will be unlocked over a three-year period. According to the site, 200 million tokens immediately became available, a supply that will grow to 1 billion over three years.![]()

A request for comment sent to the email address on the Trump memecoin’s website wasn’t returned.

The Trump token’s debut was likely one of the more successful individual memecoin launches ever, Chitra said.

Pump.fun, which is a platform that allows anyone to create their own memecoins, collected about $16 million in daily fees at its peak. Hundreds of memecoins are launched daily on Pump.fun.

Trump’s token has “basically generated fees on the order of what the best day of memecoins was,” said Chitra. “For Pump.fun, there were many memecoins that were earning fees versus here it’s just one coin.”

To be sure, the actual fee revenue is likely much higher because millions of the Trump tokens were also soon sent to exchanges such as Binance and OKX. With less transparency around centralized exchanges, it’s more difficult to calculate the profits made from trading on those exchanges.

The token’s price has been highly volatile since the launch, and is down about 60% from a high at $73.40 reached Jan. 19, according to data compile by CoinGecko.