Synopsis

Bitcoin fell below $100,000 on January 27, driven by profit-taking after a recent rally. Smaller altcoins like Solana and Dogecoin saw sharper declines. Market sentiment remains mixed, with long-term holders optimistic and technical indicators suggesting indecision. Broader economic factors, including U.S. interest rate decisions, contribute to potential volatility in the coming week.

Bitcoin (BTC), the world’s largest cryptocurrency by market value, fell below the $100,000 mark on Monday, January 27, as traders booked profits following a recent rally. The drop comes shortly after former U.S. President Donald Trump highlighted the digital-assets industry as a crucial driver of innovation in an executive order.

As of 12:09 AM IST, Bitcoin had declined 5.4% to $99,359. Smaller tokens such as Solana, Dogecoin, Sui, and Cardano, which have surged in recent weeks, experienced even sharper declines.

“Bitcoin’s recent price movement highlights the ongoing battle between bulls and bears. While short-term holders exhibit cautious sentiments due to significant liquidations and fluctuating trading volumes, long-term holders remain optimistic and resilient,” said Avinash Shekhar, Co-Founder & CEO of Pi42.

Crypto Tracker

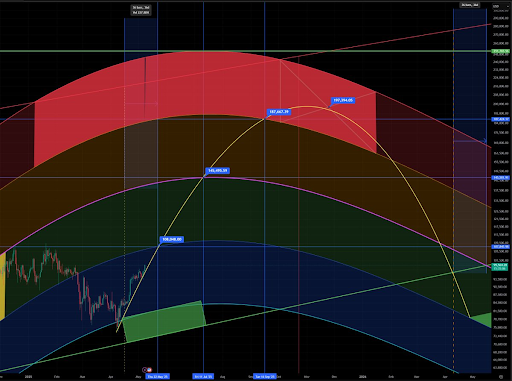

Crypto Tracker![]() TOP COIN SETSBTC 50 :: ETH 50-4.62% BuySmart Contract Tracker-6.58% BuyAI Tracker-7.11% BuyWeb3 Tracker-7.69% BuyDeFi Tracker-10.24% BuyTOP COINS (₹) Tether86 (-0.13%)BuyBitcoin8,510,498 (-5.98%)BuyEthereum264,838 (-8.03%)BuyXRP243 (-10.26%)BuySolana19,520 (-12.64%)BuyRyan Lee, Chief Analyst at Bitget Research, added, “The market sentiment remains mixed. Technical indicators suggest a potential symmetrical triangle formation, reflecting investor indecision. Broader economic factors, including U.S. interest rate decisions and the upcoming FOMC meeting, are contributing to potential volatility in Bitcoin’s price movements this week.”

TOP COIN SETSBTC 50 :: ETH 50-4.62% BuySmart Contract Tracker-6.58% BuyAI Tracker-7.11% BuyWeb3 Tracker-7.69% BuyDeFi Tracker-10.24% BuyTOP COINS (₹) Tether86 (-0.13%)BuyBitcoin8,510,498 (-5.98%)BuyEthereum264,838 (-8.03%)BuyXRP243 (-10.26%)BuySolana19,520 (-12.64%)BuyRyan Lee, Chief Analyst at Bitget Research, added, “The market sentiment remains mixed. Technical indicators suggest a potential symmetrical triangle formation, reflecting investor indecision. Broader economic factors, including U.S. interest rate decisions and the upcoming FOMC meeting, are contributing to potential volatility in Bitcoin’s price movements this week.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Also Read: Union Budget 2025: The perfect moment to explore the VDA opportunity![]()

Meanwhile, Ethereum declined by 6% to $3,144, while other major altcoins also faced losses on Monday. Solana fell 9.9%, XRP 6%, BNB 5%, Dogecoin 9.3%, Cardano 8.2%, Sui 11.6%, Shiba Inu 9%, and Chainlink 8.3%. The global cryptocurrency market capitalization dropped by 5.4% to $3.42 trillion.

“Ethereum is currently trading in a range between $2,900 and $3,500, with technical analysis pointing to a neutral trend. The MACD suggests stability, and holding above the $2,900 support level could pave the way for testing the $3,500 resistance in the near term,” said Ryan Lee.

Also Read: Trump’s crypto venture divides the industry he aims to support

The volume of all stablecoins is now $103.6 billion, which is 89.57% of the total crypto market 24-hour volume, as per data available on .

In the last 24 hours, the market cap of Bitcoin, the world’s largest cryptocurrency, fell to $1.989 trillion. Bitcoin’s dominance is currently 58.12%, according to . BTC volume in the last 24 hours surged 88.2% to $40.88 billion.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)