Bitcoin ($BTC) is reportedly inching closer to its all-time high price levels. Nonetheless, as per a CryptoQuant analyst going by “caueconomy,” the retail demand of Bitcoin has decreased by -19.34% during the recent thirty days, denoting the cautious behavior of investors. The crypto analyst discussed the present status of Bitcoin’s retail demand in an exclusive report.

Retail Demand Remains Low Despite Bitcoin Nearing ATH

“This signals that despite the new all-time highs, the on-chain structure is not “stretched,” which favors further uptrends.” – By @caueconomy

Full post 👇https://t.co/NMrkGTgCPO pic.twitter.com/8N9Vy1zpGo

— CryptoQuant.com (@cryptoquant_com) January 23, 2025

Bitcoin Records -19.34% Dip in Retail Demand Irrespective of Approaching ATH Price Levels

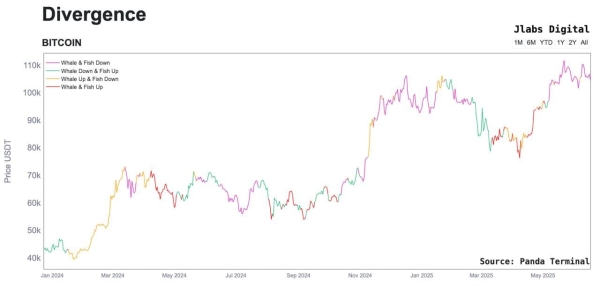

The CryptoQuant analyst asserted that the recent 30 days have seen a massive plunge in Bitcoin’s retail demand. In this respect, a sheer -19.34% dip took place in the retail demand for the top crypto asset. This signifies that the minor investors are quite cautious irrespective of the noteworthy price spikes. The historical statistics point out that Bitcoin’s huge price volatility has often had a considerable impact on the on-chain activity.

The data reveals that the institutional and retail Bitcoin investors have most of the time responded to the market dynamics. Nonetheless, the present trend bucks the respective pattern. After a peak concerning retail demand that occurred in December, a steady decline has taken place in activity. Hence, amid the price upsurge to ATH levels, this diminishing activity is surprising.

On-Chain Structure Remains Far From ‘Stretched,’ Highlighting Room for Bitcoin’s Growth

Irrespective of the slowdown in Bitcoin’s demand across the retail market, the market onlookers deem the present market structure as healthy. Based on the market data, the on-chain activity of Bitcoin is not “stretched” up till now. This indicates that the key crypto asset still has the opportunity to witness a bullish signal. Thus, the long-term investors can anticipate a notable advancement in the future. Contrarily, while Bitcoin market is momentarily facing a slump in retail demand, the institutional players are pushing the price upward. This highlights the steady growth in Bitcoin adoption, often counterbalancing retail market’s fluctuations.

According to the CryptoQuant analyst, the declining retail activity could also underscore opportunities for those entering the market lately. While small investors display reluctance in market participation, the analysts consider that such a phase often leads to persistent uptrends. Overall, the retail sector’s engagement in Bitcoin market will play a key role in determining the growth sustainability.