As Bitcoin temporarily surpasses the $100,000 mark, bullish momentum is back in the market. Will BTC continue its ascent to $106,888?

The release of the US CPI data has fueled momentum in the crypto market, with Bitcoin briefly breaking above the $100,000 mark. The BTC price rally reached a 24-hour high of $100,860, surpassing the previous level of $99,514, signaling renewed market optimism.

Bitcoin Price Analysis

Notably, the ongoing Bitcoin price rally follows the bullish setup predicted in our last BTC price analysis. At press time, Bitcoin’s price remains at $99,717 as it retests the broken resistance level.

Bitcoin Price Chart

The bullish resurgence has merged the 50, 100, and 200 EMA lines in the 4-hour chart. This is in preparation for a bullish alignment.

Furthermore, the RSI line is now fluctuating near the overbought boundary line. This reflects a surge in bullish momentum and increases the chances of an upside continuation.

Institutional Support Drives Market Momentum

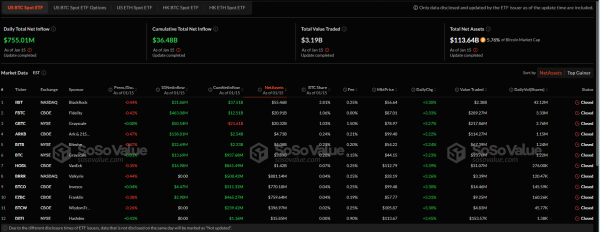

With the massive recovery in Bitcoin’s market price, institutional support is back in the game. On January 15, the daily net inflow of the 12 U.S. spot Bitcoin ETFs stood at $755.01 million.

Bitcoin ETFs

Bitcoin ETFs

Fidelity led the charge, with an inflow of $463 million, followed by ARK Invest’s ARKB ETF, which accumulated $138 million. Notably, Grayscale Bitcoin Trust secured $50.54 million.

Several other issuers also reported positive flows yesterday with no outflow. In addition, three ETFs had zero net flow, while the remaining six showed positive inflows, indicating broad-based confidence among funds.

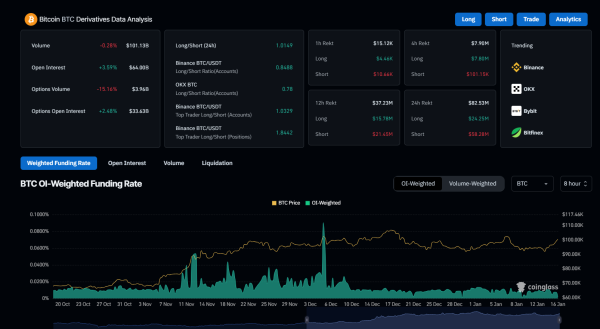

Rising Speculation in the Derivatives Market

With growing bullish demand, speculation in the derivatives market is on the rise. Bitcoin open interest has increased to $64 billion, with a 24-hour surge of 3.59%. This signals heightened activity in the derivatives space.

Bitcoin Derivatives

Bitcoin Derivatives

Consequently, the long-to-short ratio now reflects a greater number of bullish positions, with a ratio of 1.0149. However, the funding rate has dipped slightly to 0.0016%, indicating a minor pullback in sentiment, which is worth monitoring.

Over the past 24 hours, Bitcoin liquidations totaled $82.53 million, with short positions contributing $58.28 million. Bulls experienced liquidations of $24.25 million, further highlighting the dominance of bullish traders.

BTC Price Targets

Based on the price action levels, the recovery run will likely continue with a post-retest reversal. Traders are eyeing the next move above $102,000.

From there, buyers could challenge the supply zone near $102,557. Beyond that, the next key price target is $106,888, which may occur ahead of the Trump swearing-in ceremony.

On the downside, the crucial support level is the 20 EMA line at $97,129. A drop below this support could attract sellers into the market.