A recent analysis by a CryptoQuant analyst, presented on the QuickTake platform, sheds light on the critical indicators influencing Bitcoin’s current market stance. The report titled “Bitcoin Market Recovery Phase: Have We Reached a Bullish Normalcy or Is There Still Potential for a Decline?” provides a nuanced look at the factors that could dictate Bitcoin’s short-term future.

The analysis focuses primarily on the Market Value to Realized Value (MVRV) Ratio, which measures the disparity between Bitcoin’s market price and the realized price of Bitcoin holders, specifically targeting short-term holders.

Observations suggest that Bitcoin has consistently stayed above the average cost basis of these short-term holders, a bullish signal that typically encourages further capital inflows from new and existing investors. This aspect of holding above the cost basis is vital as it underscores a potential sustained bullish market sentiment, necessary for attracting ongoing investment.

Have We Reached a Bullish Normalcy or Is There Still Potential for a Decline?

“Historical #Bitcoin price cycles, based on holder behavior logic, emphasize the importance of price stabilization and a bullish market sentiment above the average cost basis of short-term investors.”… pic.twitter.com/BPUe240fR9

— CryptoQuant.com (@cryptoquant_com) July 22, 2024

Analyzing Holder Profitability and Market Sentiments

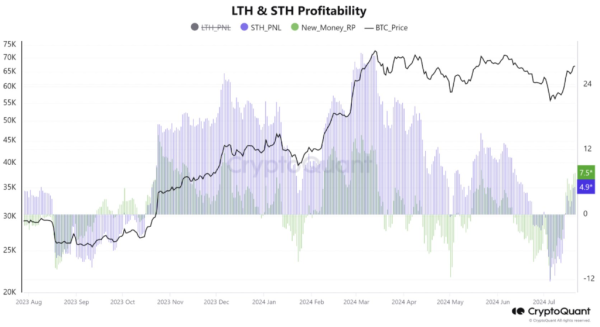

The report delves deeper into the profitability of holders, distinguishing between short-term holders (less than six months) and very new market entrants (less than one month).

The data illustrates that holders within these time frames are seeing average profits of 5% and 7.5%, respectively. Such profitability metrics are crucial as they reflect the recent entrants’ confidence and satisfaction with their investment decisions, potentially influencing their future market actions.

Furthermore, the Spent Output Profit Ratio (SOPR) metric, which assesses the profit or loss status of transacted Bitcoin, indicates a predominantly profitable disposition for most Bitcoins being moved. This trend points towards a recovering market where the majority of transactions are profitable, further reinforcing the notion of a positive market phase.

The implications of these metrics extend beyond mere numbers. They serve as a barometer for underlying market dynamics, influencing strategic investment decisions. Historical data on Bitcoin’s price cycles suggest that stability above the average cost basis is pivotal for maintaining a bullish atmosphere. It is in these phases that Bitcoin has historically seen sustained growth and increased investor participation.

The current market conditions, as outlined by the CryptoQuant analysis, pose the crucial question of whether Bitcoin can maintain this recovery trajectory. Investors are advised to exercise caution and avoid rash decisions. The potential for price stabilization remains contingent on continuous investor confidence and the absence of large-scale liquidity exits at break even points.