2 cryptocurrencies to reach $100 billion market cap in August

![]() Cryptocurrency Jul 20, 2024 Share

Cryptocurrency Jul 20, 2024 Share

The cryptocurrency market experienced a notable surge in the second half of July, led by a powerful rally in Bitcoin (BTC). This bullish trend was driven by significant events, including the German government’s completion of a $3.5 billion Bitcoin selloff and the defunct Mt. Gox exchange successfully repaying 65% of its creditors, reducing supply pressure.

Renewed investor confidence was evident as significant investments flowed into Bitcoin Exchange Traded Funds (ETFs), highlighting strong market sentiment.

Amid this positive environment, several altcoins are on the brink of reaching significant milestones, with some assets nearing the $100 billion market cap threshold and poised for potential rallies.

Picks for you

Solana or MultiversX? We asked ChatGPT-4o which is the best investment for this bull market cycle 6 hours ago Brazil to strengthen relations with China through 'Belt and Road Initiative' 8 hours ago Buckle up: These 4 indicators suggest recession is closing in 8 hours ago Massive sell-off alert amid a $111 million unlock, inflates ALT supply by 42% 9 hours ago

Finbold has identified two cryptocurrencies, BNB Chain (BNB) and Solana (SOL), that are likely to surpass this mark by the end of August.

BNB Chain (BNB)

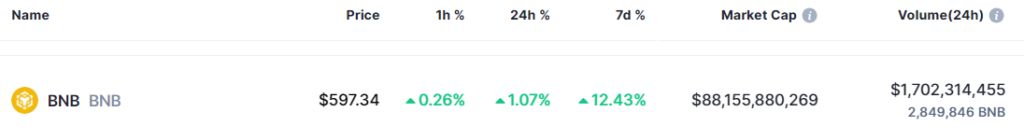

BNB, the native token of Binance, priced at $597 with a market cap of $88 billion, shows strong potential to reach a $100 billion market cap by the end of August.

Technical indicators are displaying bullish patterns, suggesting increased buying pressure and a positive outlook. BNB has recently surpassed key resistance levels, including the 200-day EMA, indicating further price appreciation.

BNB market cap. Source: CoinMarketCap

BNB market cap. Source: CoinMarketCap

With increased trading volume and a significant market recovery, BNB is positioned well for growth. If it can break through resistance levels at $610, $633, and $675, reaching a price of approximately $680, a $100 billion market cap is achievable by the end of August.

Fundamentally, Binance’s recent court approval to invest customer fiat funds in US Treasury Bills has boosted market confidence.

This, coupled with Binance’s compliance with regulatory requirements and resolution of legal issues, has alleviated investor concerns.

The approval has led to a notable price recovery, pushing BNB toward the $600 level. With the continuation of bullish technical trends and positive market sentiment, BNB is on a strong path to achieving a $100 billion market cap by the end of August.

Solana (SOL)

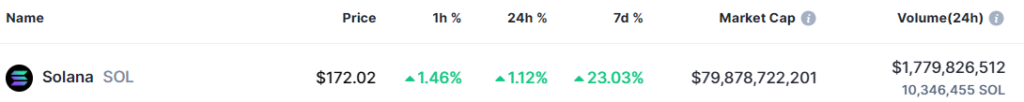

Currently, the fifth-largest cryptocurrency, priced at $172 with a market cap of $79 billion, Solana has shown strong bullish resilience, breaking above its bearish trendline.

The key $175 resistance level is within reach, and surpassing it could propel SOL to higher levels such as $188 and $205. This potential for upward movement is supported by a significant increase in trading volume and positive technical indicators, signaling strong buying pressure.

Solana market cap. Source: CoinMarketCap

Solana market cap. Source: CoinMarketCap

Moreover, Solana’s fundamentals are robust. The Total Value Locked (TVL) in its DeFi projects has reached $5 billion, and the market cap for stablecoins on its blockchain stands at $3.268 billion, reflecting growing investor confidence and adoption.

Additionally, SOL’s price surge has positively impacted its meme coin ecosystem, with an average increase of 12.4%.

These combined factors, technical strength, increased trading volume, rising DeFi activity, and growth in the meme coin ecosystem create a favorable environment for Solana to potentially reach a $100 billion market cap by the end of August.

As Bitcoin’s rally uplifts the entire market, these altcoins stand to benefit significantly. The strong technical indicators, increased trading volumes, and positive market sentiment surrounding BNB and Solana highlight their potential for growth.

With favorable conditions and rising investor confidence, BNB and Solana are well-positioned to hit the $100 billion market cap mark, setting the stage for a dynamic second half of the year in the cryptocurrency market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk