Massive sell-off alert amid a $111 million unlock, inflates ALT supply by 42%

![]() Cryptocurrency Jul 20, 2024 Share

Cryptocurrency Jul 20, 2024 Share

Cryptocurrencies often unlock tokens previously locked within the protocol or in vesting contracts, inflating the supply and creating selling pressure. Monitoring and understanding these economic dynamics can give investors a relevant edge in the market, positioning accordingly.

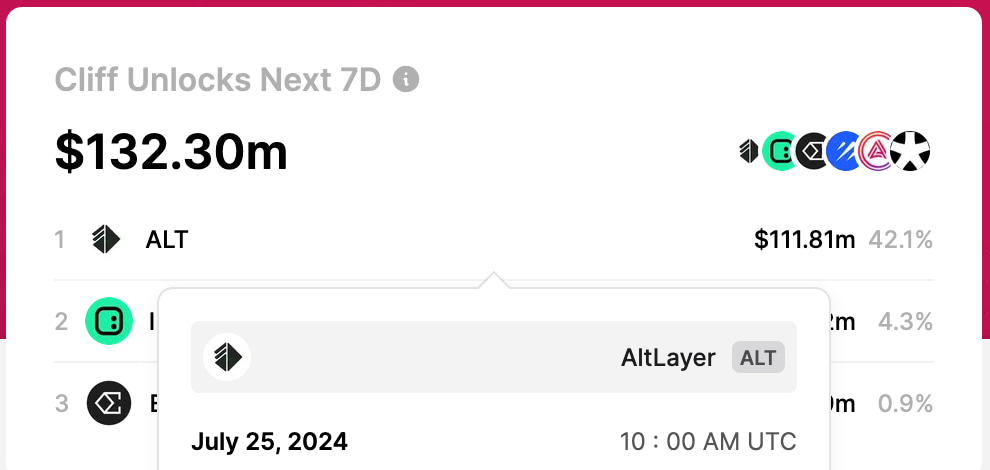

On July 25, AltLayer (ALT) will unlock 684.21 million ALT worth $111.81 million when Finbold retrieved this data. According to TokenUnlocksApp, this event will increase AltLayer’s supply by 42.1%, generating massive inflation that may impact its value.

Interestingly, ALT’s unlock represents 84.5% of the total cliff unlocks in the next seven days for all the space. This contrasts with AltLayer’s ranking in 258 by market capitalization, highlighting how relevant this incoming unlock is to the project.

Picks for you

2 cryptocurrencies to reach $100 billion market cap in August 49 mins ago Solana or MultiversX? We asked ChatGPT-4o which is the best investment for this bull market cycle 2 hours ago Brazil to strengthen relations with China through 'Belt and Road Initiative' 4 hours ago Buckle up: These 4 indicators suggest recession is closing in 4 hours ago  Cliff Unlocks Next 7D. Source: TokenUnlocksApp

Cliff Unlocks Next 7D. Source: TokenUnlocksApp

AltLayer’s unlock distribution

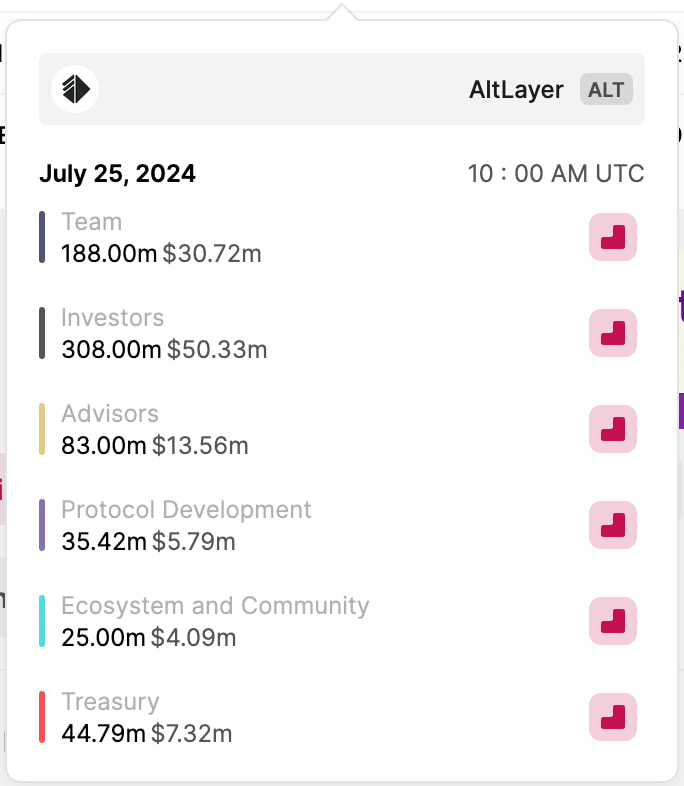

In this context, private funding round investors will receive 45% of this current distribution, unlocking 308 million ALT. This amount currently has a nominal value of $50.33 million and will likely impact the token’s price.

Moreover, the team will receive 188 million ALT for general spending, 35.42 million for protocol development, and 44.79 million tokens for the project’s treasury. The ecosystem and community will get the smallest share, receiving 25 million ALT worth $4.09 million.

AltLayer (ALT) unlock distribution. Source: TokenUnlocksApp

AltLayer (ALT) unlock distribution. Source: TokenUnlocksApp

Conclusion and economic impacts

In conclusion, the impending unlock of 684.21 million ALT tokens represents a significant event in the market, with potentially far-reaching consequences for AltLayer and its investors.

The massive 42.1% increase in supply could create substantial selling pressure, potentially impacting ALT’s value. Investors and market observers should closely monitor this event, as it may provide valuable insights into market dynamics and token economics.

Furthermore, the disproportionate size of this unlock compared to AltLayer’s market capitalization further emphasizes its importance. As the crypto landscape continues to evolve, understanding and anticipating such events becomes crucial for making informed investment decisions.

Ultimately, the market’s response to this unlock will serve as a litmus test for AltLayer’s long-term viability and investor confidence in the project.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.