Why Bitcoin could hit $100,000 today

![]() Cryptocurrency Nov 25, 2024 Share

Cryptocurrency Nov 25, 2024 Share

Bitcoin (BTC) could be back on track to hit the $100,000 record high, with technical indicators supporting this push.

This comes as market euphoria surrounding the maiden cryptocurrency’s six-figure milestone appeared to falter when the asset pulled back just below the $99,000 mark.

Now, Bitcoin’s super trend indicator, meant to identify potential reversals and trend directions, has flipped bullish on the asset’s one-hour chart, hinting at a possible rally toward $100,000, according to an outlook shared by trading expert Ali Martinez in an X post on November 25.

Picks for you

‘Rich Dad’ R. Kiyosaki sets bold 2025 Bitcoin price target using AI 32 mins ago Ethereum’s next move: Key levels to watch as ETH reclaims $3,250 support 17 hours ago Crypto trader turns $3.3k into $2.5 million in 3 hours 18 hours ago AI predicts Stellar Lumens (XLM) price for year-end 19 hours ago

Adding to the bullish sentiment, Martinez noted that Bitcoin’s Relative Strength Index (RSI) has also broken above its descending resistance line. The momentum indicator now points toward a strengthening uptrend, which, if sustained, could push the asset to its record high today, November 25.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Regarding Bitcoin’s RSI, pseudonymous crypto analyst el_crypto_prof noted in an X post on November 25 that the indicator has crossed above 70 on the monthly time frame, a threshold historically linked to explosive price action and the lead-up to “final blow-off tops” in crypto markets.

The RSI has consistently preceded sharp rallies, as observed in previous cycles, 2013, 2016, and 2020.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

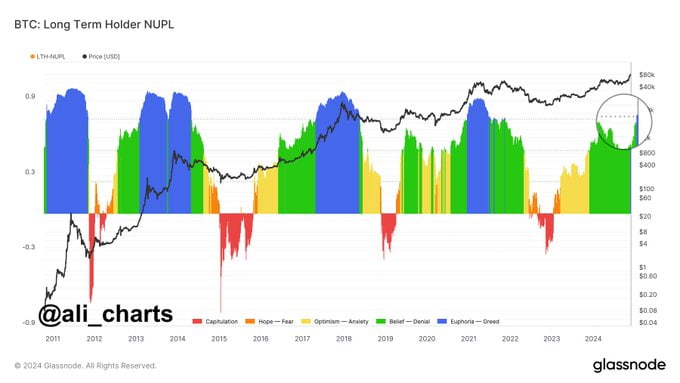

Bitcoin long-term holders turning greedy

Long-term Bitcoin holders further support a possible push toward the $100,000 mark. According to data shared by on-chain analyst Martinez, this class of investors is exhibiting increased greed—a behavior historically linked to market tops.

Previous cycles suggest it takes 8–11 months from such sentiment shifts for Bitcoin to peak. If the trend holds, the technical expert noted that investors could expect a potential market top between June and September 2025.

Bitcoin long-term holders NUPL. Source: Glassnode/Ali_charts

Bitcoin long-term holders NUPL. Source: Glassnode/Ali_charts

This positive outlook comes as Bitcoin attempts to recover after dropping to as low as $95,700 in the last 24 hours.

Investors anticipate this as the last dip before the asset resumes the upward momentum triggered by Donald Trump’s election, who is expected to implement crypto-friendly policies.

Meanwhile, the crypto market seems to be at a standstill regarding Bitcoin’s next direction after reaching $100,000. Some players maintain that if BTC follows historical patterns, the asset will likely surge to $135,000 by December 2024. On the other hand, some see this rally as a peak that could lead to a sharp correction.

Although technical indicators mostly point to sustained upside momentum, some analysts, such as David Lawant, head of research at crypto prime broker FalconX, foresee notable selling pressure on the asset.

“I’m seeing an increasing skew to the sell side as we near the $100,000 mark. <…> This suggests we may experience consolidation around this level in the near term before a sustained breakthrough above it,” he said.

Bitcoin price analysis

Bitcoin was trading at $98,865 by press time, gaining about 0.87% in the last 24 hours. On the weekly chart, BTC is up over 7%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

All factors considered, technical indicators highly favor Bitcoin hitting the $100,000 psychological mark. However, bulls need to make more effort to minimize prolonged tussles with bears below this level.

Featured image via Shutterstock